Tchir: “Ugh… Last Week Was Frustrating”

By Peter Tchir of Academy Securities

I’m not going to lie, last week was frustrating.

Were commodity prices going down a sign that the economy is on the rocks? Or a sign that inflation is easing and the Fed can take their foot off the brake?

Were lower yields good for stocks, regardless of the reason? Or did the reason matter, as on Friday stocks shook off the ongoing volatility in rates?

The 5-year Treasury closed as low as 2.82% on Tuesday, only to finish the week at 3.13%! That is a lot of volatility for the belly of the curve in the most liquid bond market in the world for the most transparent and largest issuer.

What I found most frustrating was that the market seemed to seesaw between:

Recession risk is real versus the economy is doing okay and a soft landing is on the table.

Recession risk is bad for risky assets versus recession risk keeps rates lower which is good for risky assets.

For a week with only 4 trading days, we seemed to cycle through at least three major themes, which wouldn’t matter so much from a “strategy” point of view if the moves weren’t so big and so violent.

What to Make of it All?

Rather than re-iterate concerns from last week’s You’re So Vain report, I will just encourage you to review that report. Yes, a little lazy on my part, but did I mention that it was a frustrating week? I would also encourage you to check out Academy’s Bloomberg TV appearance from Tuesday as we have had a lot of good feedback on this appearance (it starts at the 28:20 mark and runs for 2 segments).

Since I’m being lazy, am frustrated, and still sitting back trying to figure out what we’ve gotten right and wrong, The Fed Blinked and Cutting Off the Nose to Spite the Face are worth reading as well.

Garbage In, Garbage Out

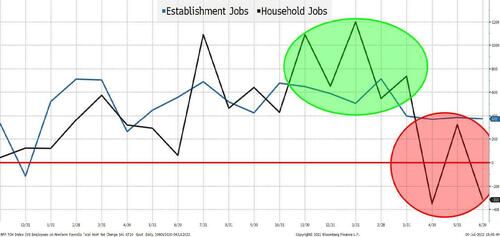

I’m not sure what to make of the following chart:

In this day and age, where marketers know what we want to buy (even before we do), we still wait for a monthly report to tell us how jobs are doing! Strangely (at least to me) there are two parts to the report, an “Establishment Survey” based on data reported by employers and the “Household Survey,” based on phone calls and knocking on people’s doors (that seems so 1970’s). The “Establishment” provided the headline that 372,000 jobs were created! That was good (and as we wrote in our quick take on Friday, there were other compelling parts to the report). But they also determined that 74,000 fewer jobs were created in the prior two months than previously reported. Since roughly 750,000 jobs had been reported, the “correction” is “only” 10%! Not bad for government work, I guess. But it does make me laugh, or at least smile, that we continue to publish data as though it is accurate to the nearest thousand, even when the stated margin for error is large.

But what struck me as “interesting” is that the Household Survey has been materially weaker for a few months now. Maybe it is catching up from when it was stronger? Maybe the Establishment Survey is more accurate this time of year? Maybe we will get a monster Household Survey next time? Maybe, just maybe, the downward revisions and the Household Survey point to the potential that the job market was overstated in this report? (The JOLTS data did deteriorate modestly).

So, as I bang my head against the wall thinking about just this one aspect of the economy, I realize that I’m not banging my head against the wall hard enough!

Regarding the next 5% move in stocks, I am not sure that I can tell you whether more jobs is better or worse for stocks than fewer jobs?

I believe that the economy is weaker than the data. I believe that over the coming weeks, weakness will weigh on markets. Earnings calls (as CEOs are forced to mention the increased uncertainty) will dampen enthusiasm for stocks. The wild gyrations in the Treasury market do not seem conducive to risk taking (though it didn’t stop it from occurring last week).

Having said all that, I still feel like I’m banging my head into a wall because I could be wrong on the direction of the economy, but also because getting the direction of the economy right doesn’t seem to tie into getting markets correct at the moment. Ugh!

Crypto

I did get to participate in a great roundtable on crypto and web 3.0 titled “Build or Burn” and while there was much disagreement on where crypto prices are headed next, there was almost universal agreement that the crypto space needs to become more transparent and more focused on rules of law (including, domicile), etc. Whether this occurs via formal regulation, or the market itself imposes these changes via more scrutiny/discriminating investors remains to be seen, but I think that is the right track. I believe that is particularly true in regard to gaining (or re-engaging) institutional investors in the space.

I guess I’m in the “possible Phoenix” camp, where there is more pain to come in the near-term (despite the recent rise back above $21,000 for bitcoin), but there will be opportunities for a new and better ecosystem (that truly serves its constituency) to emerge. Without a doubt, some of those entities already exist, but for the moment, there still seem to be many poorly managed companies and investors who didn’t spend enough time (or any time) on the fine print!

Bottom Line

Asides from “ugh” I think that yields will creep higher from here as the Fed remains hawkish and commodities will bounce because the sell-off was as much or more about positioning than “fixing” anything. This now leaves me staring at risk assets, where I think that credit will outperform equities. While I cannot fully embrace risk, it seems equally dangerous to bet against it, which brings me back to ugh!

Have a great weekend and let’s hope that next week feels less like a pachinko parlor and more like something that at least attempts to give credence to the efficient market thesis.

Tyler Durden

Sun, 07/10/2022 – 14:30