Inside The Oil Market’s Jekyll-And-Hyde Moment

By Jake Lloyd-Smith, Bloomberg Markets Live commentator and reporter

The global oil market is having a Jekyll-and-Hyde moment. A mismatch has opened up between what’s happening in crude futures, which have sold off on fears of a slowdown, and the physical side, which still looks pretty solid. That means if macro concerns start to lose their vigor, there’s support for a rebound.

In Robert Louis Stevenson’s classic 19th century novella, Hyde’s the rogue while Jekyll’s the good guy. The twist, of course, is they are one and the same person. In oil, futures have been dragged lower by fears a recession may erode demand; they’ve gone all Hyde. But in the real world, there’s still plenty of competition for prompt barrels showcasing the commodity’s Jekyll.

This dissonance caught the attention of the folk at RBC.

“The financial oil market is dislocating dramatically from an extremely tight spot physical market,” analysts including Helima Croft and Michael Tran said in a note.

“The physical market is pricing in scarcity, while the financial market is pricing in recession.”

That can make for some confusing signals.

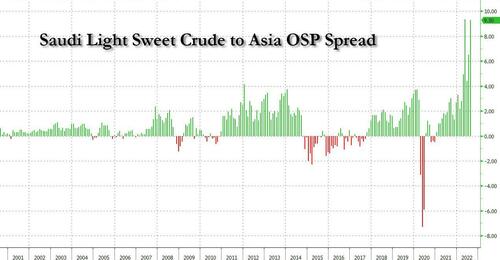

On the one hand, oil kingpin Saudi Arabia just increased next month’s prices for Asia amid signs that underlying demand remains robust, but on the other hand, futures have been in retreat.

And while Brent is on course for a substantial weekly decline, the global benchmark’s prompt spread – that’s the difference between its two nearest contracts – remains firmly backwardated…

…a bullish pattern.

Tyler Durden

Fri, 07/08/2022 – 13:29