Global Diesel Shortage To Push Oil Prices Much Higher

By John Kemp, senior market analyst at Reuters

Worsening diesel shortages in the United States and the rest of the world are intensifying upward pressure on petroleum prices and threaten to recreate the conditions that led to the record price spike in 2008.

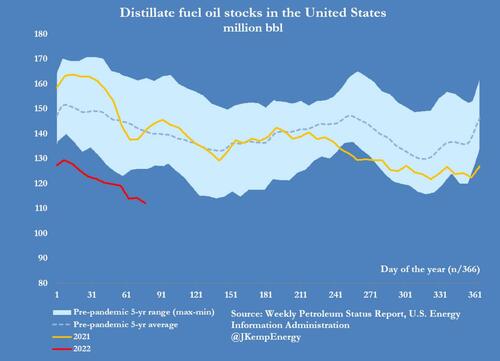

U.S. distillate fuel oil inventories, the category including diesel, fell by 2 million barrels to 112 million barrels last week, according to high-frequency data from the U.S. Energy Information Administration (EIA).

Distillate stocks have declined in 52 of the last 79 weeks by a total of 67 million barrels, and are at the lowest for the time of year since 2014 and before that 2008 (“Weekly petroleum status report”, EIA, March 23).

Distillates have emerged as the tightest part of the oil market: U.S. inventories are 20% below the pre-pandemic five-year average for 2015-2019 compared with deficits of 11% in crude and 1% in gasoline.

If stocks move in line with seasonal patterns over the last ten years, inventories are expected to drop to a low of 104 million barrels before the middle of the year, which would make them as tight as they were in 2008.

In the reasonable worst case scenario, however, stocks could deplete to as little as 93 million barrels, which would be critically low and lead to explosive upward pressure on prices.

Global Shortfall

Similar distillate shortages have emerged in Europe and Asia as the rapid recovery in consumption after the pandemic has outrun increased output of crude oil and refinery production of diesel.

By the end of February, Europe’s distillate stocks had already fallen to the lowest seasonal level since 2008. Singapore’s stocks are currently at the lowest seasonal level since 2006.

Middle distillates such as diesel and gas oil are primarily used in freight transport, manufacturing, farming, mining, and oil and gas extraction, making them the most cyclically sensitive part of the oil industry. Synchronised global expansion in North America, Europe and Asia has created an acute shortage much as it did in 2007/2008.

In consequence, distillate prices are leading the entire oil market higher, with upward pressure on diesel prices spilling over into the adjacent market for gasoline and the upstream market for crude.

In the United States, the average on-road price of diesel has climbed by 61% over the last year compared with a 47% rise in gasoline prices, according to the EIA.

In 2008, distillate shortages helped to push crude to an inflation-adjusted peak over $187 per barrel around the middle of the year, after distillate stocks hit abnormal seasonal lows a few months earlier.

Ukraine Invasion

A similar scenario seems to have been playing out this year. But Russia’s invasion of Ukraine and sanctions imposed in response threaten to make the shortage of distillates even more severe.

Russia is a major exporter of middle distillates as well as distillate-rich residual fuel oil and crude, primarily to countries in Europe. Russia accounted for 29% of Europe’s imported crude oil and 39% of its imported products in 2020, according to BP (“Statistical review of world energy”, BP, 2021).

Russia’s Ukraine invasion and escalating sanctions pose an increasing threat to these distillate and other oil flows.

Futures markets have anticipated a possible disruption by pushing distillate prices to an enormous premium over crude. Front-month European gas oil futures prices are trading at a premium of $46 per barrel over Brent, up from $15 before the invasion and less than $4 a year ago.

In real terms, current gas oil prices of around $167 per barrel are already in the 97th percentile for all months since 1990, though still well below the inflation-adjusted peak of $226 in 2008.

Ultra-high prices are a signal to refiners to maximize crude processing and distillate production, and to consumers to reduce diesel use as much as possible, to rebuild depleted inventories.

Over the next three months, diesel output needs to accelerate significantly, consumption growth must slow, and the market must avoid a significant loss of Russian exports. If that is not possible, the result is likely to be a severe price spike, which will enforce a reduction in consumption through a business cycle slowdown.

Tyler Durden

Fri, 03/25/2022 – 05:00