Bonds, Bullion, & Black Gold Drop, Dollar Pops As Fed Confirms Hawkish Stance

ISM data confirming a contraction in employment across Manufacturing and Services, but showed prices remain extremely high screamed ‘stagflation’ and the ‘recession’ trade continued with growthy stocks rallying and commodities dumped. The Fed Minutes confirmed an “even more restrictive” stance on rates and the need to maintain (or rebuild) The Fed’s inflation-fighting credibility.

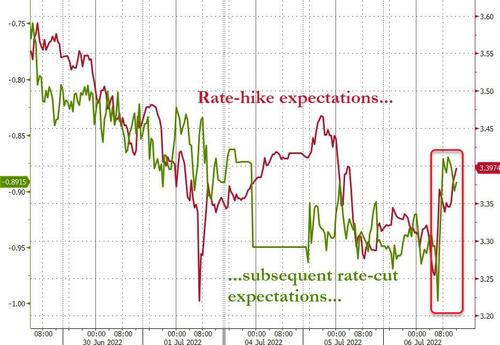

Overall the rate-trajectory shifted hawkishly today (but not by much)…

Source: Bloomberg

Specifically, rate-hike odds for July and September rose very modestly on the day

Source: Bloomberg

As Goldman’s Chris Hussey remarked, markets this year have been trapped on a merry-go-round of worry, with a rotating cast of concerns: growth, inflation, recession, rates, inflation, growth, stagflation, repeat. Right now it seems we are in ‘recession’ mode.

Small Caps were lower on the day as Nasdaq extended yesterday’s big rebound…

Rather oddly – barbelling – Utes and Tech were the best performing sector on the day. Energy was the ugliest horse in the glue factory today…

Source: Bloomberg

Value and Growth factors managed gains today after yesterday’s massive growth outperformance (but as the chart below shows, we’ve seen these false starts before)…

Source: Bloomberg

Note that all of the gains in stocks of the last few days have been in ‘defensive’ sectors with ‘cyclicals’ flat…

Source: Bloomberg

Yesterday’s big short squeeze ran out of ammo today early on but did try to push back higher after Europe closed…

Source: Bloomberg

Bonds erased all of yesterday’s gains and then some with the belly of the curve smashed higher in yield (5Y +16bps, 30Y +9bps)

Source: Bloomberg

30Y Yields tested back below 3.00% for the first time since May today, then snapped higher…

Source: Bloomberg

The yield curve flattened notably on the day again…

Source: Bloomberg

The dollar extended yesterday’s gains…

Source: Bloomberg

Bitcoin was lower on the day but rebounded back above $20,000 during the US session…

Source: Bloomberg

The dollar strength and hawkish shift did gold no favors today as it fell further with Futs at their lowest since Aug 2021…

Oil prices fell once again with WTI trying and failing to regain $100 (as Brent broke below $100)…

As wholesale gasoline prices plunged again, now at their lowest since the start of May…

Finally, we note that next week brings the start of second quarter earnings season and a flurry of updates from Corporate America. However, this two week period is the ‘most-bullish’ segment of the year historically…

Source: Bloomberg

Oh and then there’s this… Bond volatility is on the verge of reaching its highest level ‘since Lehman’…

Source: Bloomberg

Think about how that will trigger a VaR shock!!??

Tyler Durden

Wed, 07/06/2022 – 16:00