FOMC Minutes Show “More Restrictive” Fed Worried About ‘Entrenched’ Inflation

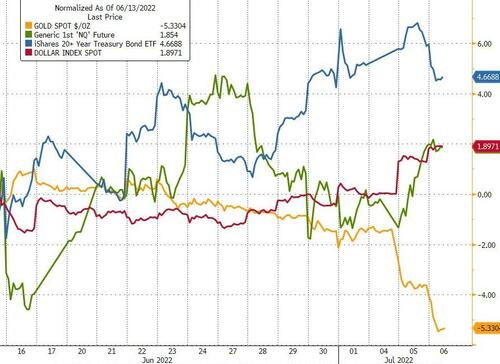

Since the last FOMC statement and press conference on June 15th where The Fed hikes 75bps – its largest hike since 1994 – and the WSJ leak on the 13th, bonds have been bid as recession fears dominate and gold has been dumped as inflation anxiety eases. The Dollar and stocks have managed modest gains…

Source: Bloomberg

Most notably, Fed rate-trajectory expectations have dovishly plunged since the last FOMC

Source: Bloomberg

And while July remains an 80% lock for 75bps, the expectations for hikes in September have tumbled and for the rest of the year, almost gone…

Source: Bloomberg

All of which is ironic since The Fed adjusted its ‘DotPlot’ UP to the market’s hawkish view at the last FOMC and now the market has adjusted dramatically more dovish than Fed expectations…

Source: Bloomberg

One more thing before we get to the details, US Macro data has continued to disappoint since The FOMC meeting with ‘soft’ survey data really decelerating.

The odds of a US recession are 38% in the next 12 months, according to the latest forecast from Bloomberg Economics, after consumer sentiment hit a record low and interest rates surged, with The Atlanta Fed’s GDPNOW model crashing to -2.1%…

So the main focus of The Minutes will be whether The Fed uses them to suggest any ‘less hawkish’ bias than was projected at the press conference…

The highlights are as follows…

On the possibility of even more restrictive policy:

“At the current juncture, with inflation remaining well above the Committee’s objective, participants remarked that moving to a restrictive stance of policy was required to meet the Committee’s legislative mandate to promote maximum employment and price stability. In addition, such a stance would be appropriate from a risk management perspective because it would put the Committee in a better position to implement more restrictive policy if inflation came in higher than expected….Such a stance would be appropriate from a risk management perspective because it would put the Committee in a better position to implement more restrictive policy if inflation came in higher than expected.”

On the July meeting:

“Participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting.”

On entrenched inflation:

“Participants judged there was a significant risk higher inflation could become entrenched if the public questions the Fed s resolve… Participants saw little evidence to date of a substantial improvement in supply constraints, and some of them judged that the economic effects of these constraints were likely to persist longer than they had previously anticipated… Participants noted that inflation remained much too high and observed that it continued to run well above target”

A potential pause?:

“Participants noted that, with the federal funds rate expected to be near or above estimates of its longer-run level later this year, the Committee would then be well positioned to determine the appropriate pace of further policy firming and the extent to which economic developments warranted policy adjustments.”

On financial market impacts:

“Downside risks included the possibility that a further tightening in financial conditions would have a larger negative effect on economic activity than anticipated.”

On Fed credibility:

“Many participants noted that the Committee’s credibility with regard to bringing inflation back to the 2 percent objective, together with previous communications, had been helpful in shifting market expectations of future policy and had already contributed to a notable tightening of financial conditions.”

On recession fears (none!):

“In their consideration of the appropriate stance of monetary policy, participants concurred that the labor market was very tight, inflation was well above the Committee’s 2 percent inflation objective, and the near-term inflation outlook had deteriorated since the time of the May meeting”

On Fed balance sheet losses:

“Neither unrealized losses on the Federal Reserve’s existing securities portfolio nor negative net income would impair the implementation of monetary policy or the Federal Reserve’s ability to achieve its dual-mandate objectives.”

On the ‘supply-constrained’ inflation problem:

“a few participants noted that, in other sectors of the economy, their contacts reported that they were postponing investment or construction projects because of rising input and financing costs.”

And finally, on the risks The Fed is facing:

Participants emphasized that they were highly attentive to inflation risks and were closely monitoring developments regarding both inflation and inflation expectations. Most agreed that risks to inflation were skewed to the upside and cited several such risks, including those associated with ongoing supply bottlenecks and rising energy and commodity prices

Participants judged that uncertainty about economic growth over the next couple of years was elevated In that context, a couple of them noted that GDP and gross domestic income had been giving conflicting signals recently regarding the pace of economic growth, making it challenging to determine the economy’s underlying momentum. Most participants assessed that the risks to the outlook for economic growth were skewed to the downside

Downside risks included the possibility that a further tightening in financial conditions would have a larger negative effect on economic activity than anticipated as well as the possibilities that the Russian invasion of Ukraine and the COVID-related lockdowns in China would have larger-than-expected effects on economic growth.

Read the full Minutes below:

Tyler Durden

Wed, 07/06/2022 – 14:04