Goldman’s Hatzius: Can US Consumers Weather Commodity-Shock-Driven Recessionary Impulse?

Goldman Sachs chief economist Jan Hatzius told clients Wednesday that the Russian invasion of Ukraine and the resulting commodity shock of soaring crude oil prices are “eerie parallels” to the geopolitical and economic turmoil three decades ago during the Gulf War. Hatzius makes the case consumers are in a much better position to weather an economic shock unlike in the past.

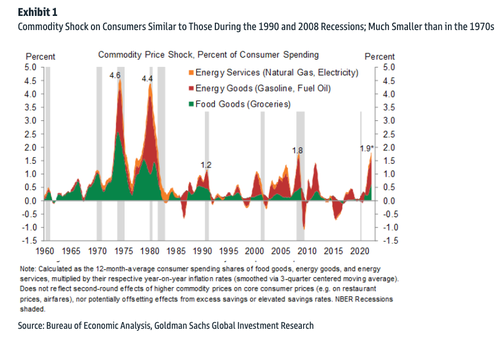

Hatzius notes the latest spike in energy and agriculture prices, represents 1.9% of US consumer spending over the last year, adding that today’s commodity shock on consumers is similar to 2008 and 1990.

Goldman predicts soaring commodity costs are eroding the real incomes of consumers. They forecast 2022 GDP above potential (+1.9% Q4/Q4 basis vs. potential of +1.75%, consensus of +2.7%, and FOMC median projection of +2.8%), adding the risk of recession is increasing (Morgan Stanley told clients last week to expect a downturn in 5-10 months).

“Higher commodity prices can also increase the risk of recession by constraining the ability of policymakers to respond to growth shocks,” Hatzius said.

On Monday, Fed Chair Powell said, “a brief burst of inflation associated with commodity price shocks” risks “extending the period of high inflation could push longer-term expectations uncomfortably higher.”

Hatzius asks: “Could the current commodity price shock tilt the economy into recession as it did in 1990 against a similar backdrop of heightened geopolitical risk and declining consumer confidence?”

He noted the size of the commodity shock shouldn’t be the focus but rather the health of the consumer.

Compared with the commodity shocks in the early stages of 1974, 1980, 1990, and 2008 recessions, consumers now have $2 trillion of excess savings accumulated during the virus pandemic, rising year-on-year trend in real incomes (but still negative bc of high inflation), and record-high household wealth-to-income ratio as significant buffers to combat price shocks for now.

Hatzius believes, “it would take a sustained oil price increase to $200 per barrel to produce an income shock similar in magnitude to those that precipitated the 1974 and 1979 recessions—and this would significantly increase the 2022 recession odds.”

He said his commodity team’s upside target for Brent is around $165 per barrel, though he cannot rule out such an outcome ($200) if things worsen in Ukraine.

He pointed to “eerie parallels” of today’s commodity shock that could produce an economic downturn similar to 1990-91.

Hatzius concluded by saying recessions risks are rising over the next year between 20-35% range as an overheating labor market and fiscal tightening by the Fed could drag on growth.

The consumer might be stronger than most believe, well, at least in Goldman’s view. Maybe this is why we have yet to see gasoline demand destruction.

Tyler Durden

Thu, 03/24/2022 – 20:40