“What’s Unfolding In Europe In Recent Days Is A Fresh Big Negative Supply Shock”

It is probably not a coincidence that around the time the stock of German energy giant and largest utility gas consumer, Uniper was plunging amid speculation it would have to be bailed out due to soaring nat gas prices…

One number to consider. Uniper probably is paying currently ~€30 million extra for the gas it’s buying in the spot market. Multiply that for 365 days: ~€11 billion. And that’s one single European utility. Now think about other big buyers of Russian gas. And start multiplying. https://t.co/6hKzinI7Pw

— Javier Blas (@JavierBlas) June 30, 2022

… Deutsche Bank’s chief FX strategist George Saravelos penned a note in which he said that he was becoming increasingly concerned about the unfolding energy situation in Germany.

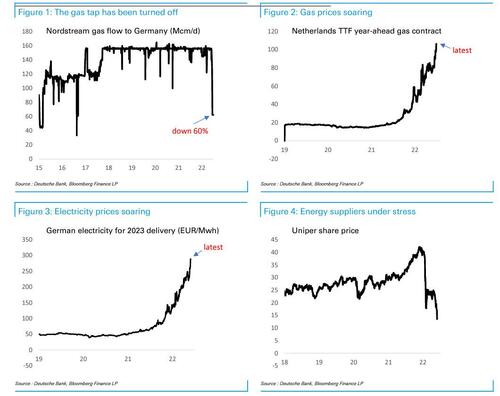

Here’s why: two weeks ago, Russia reduced Nordstream gas flows by 60% on the back of an alleged disruption over Siemens part supplies (chart 1). While the immediate availability of gas in Germany is not an issue, the energy market is starting to price a risk of a complete disruption to gas supplies for winter, and year-ahead natural gas prices are making fresh record highs (chart 2).

Most concerning however, is the skyrocketing price of electricity. Prices for 2023 delivery have also soared to all-time highs and have now tripled from the start of the year (chart 3). French and Italian electricity prices are similarly soaring. Which brings us tot he abovementioned collapse in the share price of Germany’s largest utility gas consumer, which just dropped to record lows amid speculation of an imminent bailout (chart 4).

As the DB strategist admits, his underlying assumption this year was that gas supplies to Europe would continue: even though the Nordstream pipeline is set to shut for ten days during July 11-21 for regular maintenance, press reports suggest that authorities are attempting to find a solution on sanctions restrictions to move gas turbine components back to Russia. Yet the German government is stating that disruptions are politically motivated and there are risks supply may be completely shut off.

So, as Saravelos warns, if the gas shutoff is not resolved in coming weeks this would lead to a broadening out of energy disruption with material upfront effects on economic growth, and of course much higher inflation, or as he puts it, “beyond the market’s worries about slower global growth in recent months, what is unfolding in Europe in recent days is a fresh big negative supply shock.”

If so, it would clearly make the ECB’s job more difficult and their reaction function ambivalent. But as far as the EUR/USD exchange rate goes, it would provide clear downside as not only would the energy import bill rise due to even higher prices, but it would raise the risk of an imminent German recession on the back of energy rationing. So while DB’s EUR/USD forecasts imply a range-bound euro over the summer months, the bank’s chjef FX strategist is worried that the energy situation is providing clear downside risks.

As for July 22, or a Friday three weeks from today, fellow DB strategist Jim Reid asks whether this could be the most important day of the year: “while we all spend most of our market time thinking about the Fed and a recession, I suspect what happens to Russian gas in H2 is potentially an even bigger story. Of course by July 22nd parts may have be found and the supply might start to normalise. Anyone who tells you they know what is going to happen here is guessing but as minimum it should be a huge focal point for everyone in markets.”

Tyler Durden

Fri, 07/01/2022 – 08:10