Historic Treasury Front-End Selloff Approaching Peak As 2Y Notes Trade Below “Fails Charge”

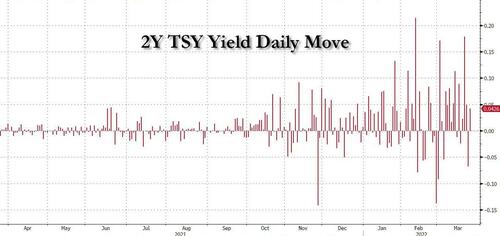

It has been a harrowing month for rates traders, with 2-Year TSY yields blowing out by more than 17bps on two occasions in the past three weeks, representing two of the three biggest one-day selloffs since 2009 driven by the Fed’s historic hawkish pivot which now sees at least one rate hike on every FOMC meeting for the rest of 2022 and with banks such as Goldman and Morgan Stanley expecting two 50bps rate hikes in May and June.

The unprecedented liquidation in the front-end has led to a massive pile up of shorts in bills and 2Y notes. As Curvature’s Scott Skyrm notes overnight, the market sell-off led to massive short positions across the short-end of the curve (as a reminder, when investors short the market they need to physically have possession of the securities to do so; if they don’t own the securities, they have to borrow them and for Treasuries they do so in the repo market, where the greater the negative repo rate on a given Treasury, the stronger the shorting pressure is). As shown in the chart below, two bills and 2 Year Note are trading at or below the Fail Charge (-2.75%); bills maturing on 6/23 averaged at -2.55% on Tuesday and -3.10% yesterday, while year bills (2/23/23) averaged at -3.20% two days ago and -0.95% on Wednesday, and even July 12 bills trading slightly Special averaging at -0.50% yesterday.

Worse, 2 Year Notes were clearing over the past few days, but some failed yesterday, closing at -3.00% amid an unprecedented front-end shorting frenzy. Why would someone cover a short below the Fail Charge, Skyrm asks rhetorically and answers that “some firms have internal rules that require their Repo traders to cover, no matter what the rate is!”

So as an epic pile up of shorts keep accumulating and pushing 2Y yields ever higher, so high that even Goldman now expects the 2s10s to invert as soon as next quarter when the 2Y hits 2.60%…

… some are taking the other side, and in a note published overnight from Bloomberg’s Ven Ram, the Markets Live commentator writes that “we may be fast approaching its zenith for this year as bond traders are probably in the last lap of pricing the Federal Reserve’s intent to raise rates aggressively.”

According to Ram’s calculations, two-year yields have surged about 145 basis points this quarter, roughly equivalent to about 205 basis points of Fed tightening based on historical correlations. And with the Fed’s dot plot pointing to about 10 hikes between this year and next, the two-year yield may reach a peak at 2.51% and settle around a 2.18%-2.26% range

In an outlier scenario, it is conceivable that two-year yields go higher than the peak mentioned if the markets price in tightening on a scale seen in 1994. That cycle is “the best analogy” to what the Fed aims to do now, Federal Reserve Bank of St. Louis President James Bullard said this week. Back then, the monetary authority doubled its benchmark to 6% in just more than a year.

In other words, that would mean the market factoring in even more hikes than what the Fed has penciled in, though that scenario would necessarily involve inflation prints remaining stubbornly high past the first half of the year, by which time the Fed would have already raised rates by 75 basis points to 100 basis points.

Looking back, Ram notes that in November, when the two-year yield was around 0.42% (and when the dot plot hinted at just a handful of hikes in 2022), he suggested that front-end Treasuries represented an “accident waiting to happen”, and warned that the yield was in danger of breaching 1.75% based on the dot plot then. However, with the Fed having revised its median view of rates to factor in a much more aggressive path, the selloff has extended beyond that level.

So fast forward to this week when Chair Jerome Powell sent bond yields spiraling when he remarked that the Fed was open to raising rates by 50 basis points in May should the data warrant such a response. He also outlined the Fed’s intent to start its balance sheet run-off sooner than in the previous cycle, which may sap sentiment more than usual, though that would pose bigger issues for longer-duration maturities.

The selloff after his remarks has exacerbated fault lines in the market, with the Bloomberg Treasury Index having declined 5.93% through Tuesday, making it the worst quarter for U.S. bonds in data going back to 1973. At the same time, the Bloomberg Global Bond Aggregate Index is suffering its biggest drawdown on record.

Historically, after such massive oversold liquidations, the subsequent move is a sharp reversal in flows as profit-taking begins; in this case profit-taking would be coupled with a record short squeeze. Meanwhile, with the war still raging in Europe Ram notes that there is still a possibility of systemic risk, an eruption of which may slow the Fed’s hand and send front-end yields much lower.

As the Bloomberg analyst concludes, “all told, front-end Treasuries seem closer to the last leg of the selloff that has been rippling through the markets for a few months now.”

Tyler Durden

Thu, 03/24/2022 – 19:40