Forget “Retro-Fitted Narratives”, Nomura Warns Equities Are Still A “Flows & Positioning Story”

Equities are still a “flows and positioning” story, as opposed to what Nomura’s Charlie McElligott says are a few silly macro narratives just being “retro-fitted” at this point.

Case in point, and an observation made by many in recent days:

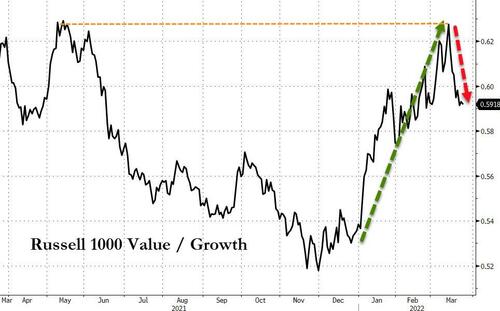

…how did we go from the “inflation hawk” Fed pivot that created the past five month Equities zeitgeist of “higher interest rates / FCI tightening = destruction of high-multiple Stocks that are really just “long Duration” assets…

…to suddenly now over the past 2 weeks to the TINA argument of “higher interest rates benefit Stocks, because they act like TIPS but with pricing-power”

LOLOLOL

McElligott’s “Pin your tail on the narrative”-rant aside, key flow themes in recent days include:

Systematic Strategy re-leveraging and again buying Stocks, after having slashed Equities exposure (Vol Control, Risk Parity) or gone outright “short” (CTA Trend) since 4Q21

Notable resumption of “peak Retail” lookalike behaviors in fits of “speculative frenzy” harkening back to periods of 2020 / 21: “meme stock” leadership on the rally, massive Call buying volume via YOLOing of short-dated, deep OTM upside options in Retail favorites

As opposed to these pockets of single-name upside grabbing noted above, Equities Index / ETF options greeks had been largely “flattish Delta” in recent days, where flows have been very mixed; however, yesterday was the first time that we saw SPX / SPY options with a clear “Positive Delta” bias all day via Call buying

Notably, SpotGamma‘s January op-ex-linked analog continues to work…

And specifically looking at yesterday, McElligott notes that price-action certainly possessed characteristics of the “new” qtr / month end Pension Rebalancing flows.

I say “new,” bc estimates into the start of last week were for a “buy” of Equities, but that was before a 9% rally in S&P thereafter!—so instead, the flows have reversed, turning “buy Bonds, sell Equities” on the pension rebalancing.

Color from the UST desk: “We saw a pretty good amount of buying in the long end of the curve into the equity close for the second day in a row – this in addition to some pretty solid buying into and out of the 20yr auction. Flows were pretty supportive today”

While we all saw the late-day Equities weakness, likely programmatic selling, as our S&P 500 future “imbalance” monitor showed the largest net “sell pressure” day in institutionally sized contract “large lots” experienced over the past 1m period (and that covers a LOT of “big down” days!)

McElligott concludes by noting that this rebalancing is already coming off the back of a multi-year / long-term LDI “de-risking” trend, with the Milliman Pension Funding Ratio at 1.0236, the “most funded” that the top 100 US Corporate Pensions have been since 2008…

…hence, we have seen persistent “buy Duration, sell Stocks” flows as they gradually rebalance to match liabilities (note: let’s hope somebody is telling them about an “inflationary” regime and the impact it has )

Finally, as SpotGamma details, there is lots of talk around the 4510 JPM put-strike, and its implications for current prices.

Our view on this is quite simple: by default the ~45k put contracts at 4510 here are decaying, and that will buoy/pin markets into 3/31. That, along with the other 450SPY/4500 area contracts supports the idea of looking for mean reversion back into 4500.

However if sellers emerge, possibly though some exogenous geopolitical catalyst, then those high gamma puts will add a lot of firepower to a move lower.

This is jump risk, and its material.

Tyler Durden

Thu, 03/24/2022 – 12:25