The Battle Of The Yield Curves

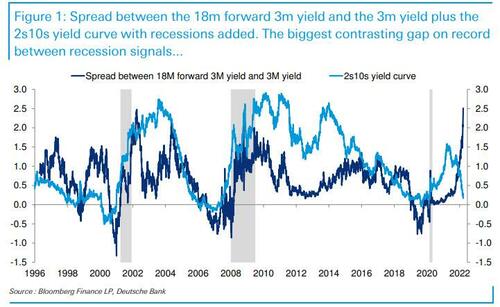

It’s not just Wall Street’s increasingly less shrill army of legacy permabulls that has dismissed the collapsing 2s10s yield curve in favor of other, less relevant alternatives when it comes to timing the next recession: during Monday’s speech by Jerome Powell, the Fed chair did so too, because as DB’s Jim Reid explains, the Fed has “long preferred measures like the spread between the 18m forward 3m yield and the 3m yield which as our CoTD shows is now the steepest since on record with data going back to 1996.”

This has profound implications, the biggest one being that the Fed won’t see a 2s10s inversion as a reason to slow down rate hikes and that on their measure they have a record level of steepness in their curve to play with before the curve gets to a flat enough level to worry them.

In other words, the Fed won’t realize that the US is in a full-blown until as much as 9-12 months after the fact. For his part, Jim Reid writes that “I can’t help but smile when I think that only a year ago the FOMC’s median dot indicated there’d be no rate hikes until at least 2024, and now Fed Funds futures are pricing in nearly 200bps more in 2022… in addition to the 25bps we saw last week.

That said, since the Fed is always wrong about pretty much everything and since Wall Street’s permabulls are among the most clueless animals in the world, we certainly agree with Reid that the 2s10s is a far better lead indicator since we can go back with a successful track record over far more cycles than the Fed’s preferred measure but in any case, it’s fair to say the record difference between the measures is now stark and worth debating.

While this is a topic we will certainly revisit frequently in the coming weeks as the US slides into stagflationary recession, Reid reminds us that it’s worth noting that around the time of the last few inversions there was always a chorus of “this time is different”. A good example was in March 2006 when Bernanke said “I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come, for several reasons. First, in previous episodes when an inverted yield curve was followed by recession, the level of interest rates was quite high, consistent with considerable financial restraint. This time, both short- and long-term interest rates–in nominal and real terms–are relatively low by historical standards. Second, as I have already discussed, to the extent that the flattening or inversion of the yield curve is the result of a smaller term premium, the implications for future economic activity are positive rather than negative. Finally, the yield curve is only one of the financial indicators that researchers have found useful in predicting swings in economic activity.”

Sound familiar? Get ready for the battle of the yield curve and the economy over the next 12-18 months.

Meanwhile, just three additional data points – as we showed last week when we laid out the details of every Fed hiking cycle over the last 70 years alongside the time to recession, none of the US recessions in the modern era have occurred until the 2s10s has inverted.

And while on average it takes 12-18 months from inversion to recession during a hiking cycle, the Fed has never before started a rate hiking cycle when inflation was already 7.9%. Expect a much faster recession onset this time.

Point #2: the 2Y fwd 2s10s curve just inverted…

… putting to rest any discussion, however contrived and artificial, that the US is about to enter a recession… which, incidentally, is just what the Fed wants.

Third and final – and undisputably most most concerning point – every Fed hiking cycle in the fiat high debt era, has led to some kind of financial crisis somewhere across the world

Tyler Durden

Thu, 03/24/2022 – 10:05