Goldman: DOGE Sparks “Cautious View” On Gov’t IT & Services And Defense Stocks

Elon Musk’s Department of Government Efficiency (DOGE) launched a precision strike against the “Deep State” by winding down USAID and rolling it into the State Department, with Secretary of State Marco Rubio now serving as the acting administrator of the once-rogue agency, which had functioned as an unlimited piggy bank for globalist Democrats. In a broader push for government efficiency, President Trump announced a freeze on all foreign assistance spending and has offered federal workers buyouts, including the entire workforce of the CIA and many other agencies.

A new era of government efficiency, led by Musk, a special government employee at DOGE, has unsettled investors in Government IT & Services and large-cap Defense companies.

Goldman Noah Poponak, Connor Dessert, and others updated clients on these two sectors, including commentary from various management teams, whispers from traders, and their take on market drivers.

“We are relatively cautious on Government IT given risk around customer budgets, and we have Sell ratings in Defense given top-line, margin, and valuation concerns,” the analysts noted.

Here’s their take on both sectors in the era of DOGE:

Government IT & Services:

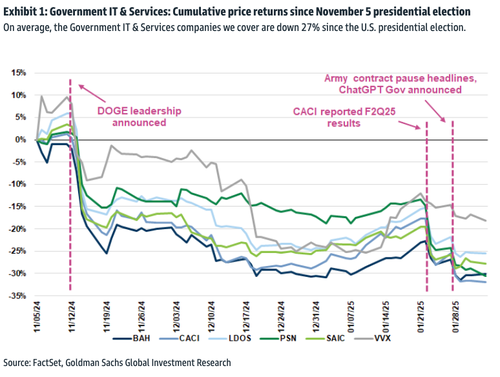

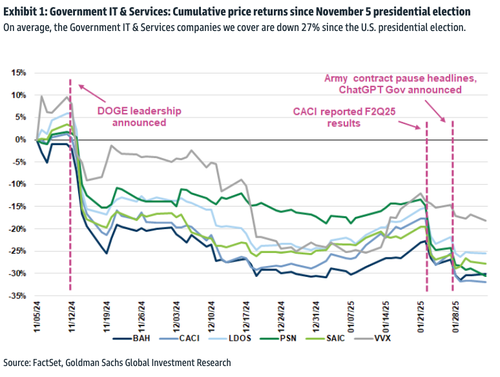

Proposed and effected government measures have driven uncertainty and de-risking activity across the group, with selloff activity appearing to be concentrated around three major events over the last three months: 1) commentary from the Trump administration cementing the formation of DOGE, 2) earnings results that either had slower bookings or pointed to a forward near-term risk of slower bookings, and 3) Federal agency change headlines, Army contracting headlines, and the introduction of OpenAI’s ChatGPT Gov product. We reiterate our cautious Government IT & Services view.

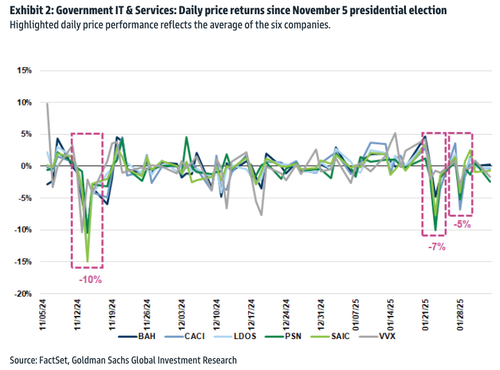

Large-cap Defense:

We think the Pentagon has shifted risk to companies via contract terms, and continue to see risk to both end-market growth and industry margins going forward. Defense managements are articulating the potential for positives from new government spending initiatives; but some also warned of slower bookings and revenue growth in the near-term. Lockheed took incremental write downs on programs where we believe contract terms differ from the past, while stating more fixed price in the industry was possible. We reiterate our cautious Defense view.

Focusing on more Government IT & Services, the analysts explained the sector is plagued with “uncertainty concerning the path of forward government spending” because of DOGE.

The analysts pointed out that since President Trump won in November, government IT & services stocks in their coverage have tumbled on average 27%. They noted that short-term uncertainty in any government leadership transition is expected. However, they warned that DOGE’s agenda could upend budgets for the companies in their coverage and “reiterate a more cautious view of the sector into 2025.”

Here are the major drivers pressuring Government IT & Services stocks lower over the last several months (all about DOGE & Trump):

-

November 12, 2024: President-elect Trump announced that Elon Musk and Vivek Ramaswamy will lead the Department of Government Efficiency (“DOGE”). DOGE is tasked with helping President-elect Trump dismantle Government Bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure Federal Agencies [Statement]. In the days following this announcement, the broader Government IT & Services space sold off 15-20%. While government spending measures had been a central point of Trump’s campaign, this announcement cemented the incoming administration’s focus on the matter, increasing investor uncertainty about the revenue profiles of Government IT companies going forward.

-

January 22, 2025: CACI reported F2Q25 earnings after market close. While investors may have regarded softer bookings with caution, P&L results were strong and ahead of consensus. The next day, CACI sold off nearly 10%, with the broader Government IT & Services group down 7% on average by 1/23 market close. We think this may have indicated a supply of Government IT shares waiting to sell, and the earnings report may have been a liquidity event, rather than a singular focus on the earnings quality of CACI.

-

January 27-28, 2025: It was reported that U.S. Army contracting was on hold as newly confirmed Secretary of Defense, Pete Hegseth, halted new Army contract awards and solicitations for new programs. OpenAI also announced ChatGPT Gov, a product tailored specifically to U.S. government use cases with increased security measures over its other enterprise products. The DoD later clarified that it had not paused contract awards, but was instead reviewing financial assistance programs that may be affected by the Jan 27 OMB Memorandum M-25-13. Nevertheless, the Government IT & Services group was down 5% on average by 1/28 market close. We think confusion about Army contracting headlines drove some of the negative price action here. We also think OpenAI’s announcement prompts the following question: What mix of federal work scope currently outsourced to Government Services companies could be performed in-house with technology advancements like Generative AI? It is unclear how or to what extent Generative AI products will be implemented across the U.S. government. There are a number of regulatory, technological, and security thresholds that must be met before a widespread, formal adoption of the technology occurs.

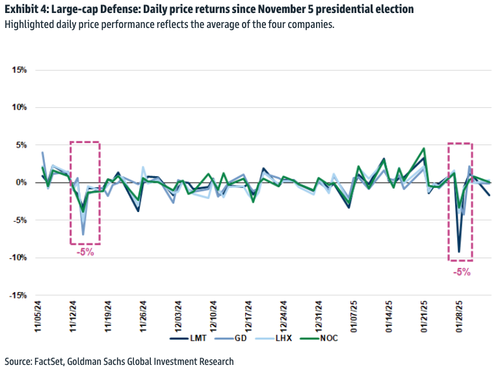

In the defense sector, the analysts said their LMT, GD, NOC, and LHX coverage all reported earnings last week. They reiterated a cautious view on these companies because DOGE and the new administration will likely change contract terms and reduce spending.

Summary of their large-cap defense coverage:

-

LMT (1/28): LMT shares were down 9% on 1/28, due in our view to incremental charges the company took related to classified Aeronautics and MFC programs, as well as out-year FCF dynamics. On the call, the company welcomed the Trump administration’s focus on government efficiency, reductions to bureaucracy, and limiting administrative burdens. In response to questions about whether the DoD was favoring fixed-price contracts, the company responded that while the DoD recognizes fixed-price contracting for immature / higher-risk technologies is not optimal, if the contracting mix moves more towards fixed-price, the company will maintain its disciplined bid process. See our earnings takeaways here.

-

GD (1/29): GD shares were down 4% on 1/29, likely due to Aerospace top-line missing consensus by 8% and initial 2025 guidance below consensus on earnings and free cash flow. With respect to DOGE, the company noted on the call that improvements in the efficiency and cost structure of organizations are something it would embrace. See our earnings takeaways here.

-

NOC (1/30): NOC shares were flat on 1/30 after the company posted 4Q24 segment EBIT below consensus and guided to 2025 segment EBIT below consensus. On the call, the company noted the administration is very focused on efficiency, and that it sees that as an opportunity to work with the customer on efficiency measures. See our earnings takeaways here.

-

LHX (1/30): LHX shares were flat on 1/30 after the company reported a mixed quarter and 2025 guidance. In the earnings release, the company stated that it could see an impact to its 1Q25 bookings and revenue as U.S. government contracting officers examine executive orders pertaining to new contracts. On the call, the company noted its willingness to work with the DOGE, having recently submitted a letter to the Committee outlining recommendations for the national defense apparatus and the public-private relationship. See our earnings takeaways here.

The analysts ended the note with a comprehensive list of the Government IT & Services and large-cap defense companies in their coverage and included updated valuations, key risks, and strategic considerations as a new era of DOGE unfolds:

-

BAH (Buy): Our 12-month price target of $150 is derived from a target 16.3X next 5-8 quarter estimated EV/EBITDA. Key risks include DoD spending priorities, organic revenue growth, and premium valuation.

-

CACI (Sell): Our 12-month price target of $362 is derived from a target 10.3X 5-8 quarter estimated EV/EBITDA. Key risks include DoD spending priorities, M&A integration, and M&A pipeline.

-

LDOS (Neutral): Our 12-month price target of $148 is derived from a target 10.6X 5-8 quarter estimated EV/EBITDA. Key risks include (1) DoD spending priorities, (2) core company bookings, (3) pace of organic growth.

-

PSN (Buy): Our 12-month price target of $109 is based 85% on fundamental value (15.9X 5-8 quarter EV/EBITDA) and 15% on a theoretical M&A component (20.0X EV/EBITDA multiple). Downside risks include downward shifts in DoD spending priorities, the company’s Middle East exposure, and execution and subsequent integration of the company’s M&A pipeline.

-

SAIC (Sell): Our 12-month price target of $101 is derived 85% from a target 8.8X 5-8 quarter estimated EV/EBITDA and 15% from an M&A component of 12.6X EV/EBITDA. Key risks include DoD spending priorities, organic revenue growth, free cash flow conversion.

-

VVX (Sell): Our 12-month price target of $52 is derived from a target 7.7X 5-8 quarter estimated EV/EBITDA. Key risks include: 1) DoD spending priorities, 2) Contract renewal and new bid competition, and 3) Geopolitical dynamics.

-

GD (Sell): 12-month price target of $231 is derived from a sum of the parts based on comparable company valuations in each business segment. Key risks include: (1) business jet demand, (2) DoD spending priorities, and (3) capital deployment.

-

LHX (Sell): Our $198 12-month price target is derived from targeting a 6.50% FCF yield on our 2025E estimates. Risks include (1) DoD spending growth and priorities; (2) program execution; and (3) capital deployment decisions.

-

LMT (Sell): Our 12-month price target of $418 is derived from target relative (to S&P 500) CY25E P/E (ex-pension) multiple of 0.90X. Key risks include: (1) Geopolitics, (2) DoD spending priorities, and (3) capital deployment.

-

NOC (Sell): Our 12-month price target of $424 is derived from target relative (to S&P 500) CY25E P/E (ex-pension) multiple of 0.90X. Key risks include (1) Geopolitics, (2) DoD spending priorities, and (3) major program profit margins.

Welcome to the era of DOGE.

Tyler Durden

Wed, 02/05/2025 – 13:05