Nearly 40% Of Cars Financed Since 2022 Are Underwater

The delayed day of reckoning has arrived for millions of Americans who purchased vehicles during the pandemic auto boom. Many are now finding themselves trapped in a shitstorm of negative equity and burdened by costly monthly payments, all while low- and mid-tier consumers face mounting financial strain amid elevated inflation and high interest rates.

Before we dive into the new auto data, let’s revisit our latest coverage of the slow-rolling auto crisis:

-

July 2022: Are We Headed For An “Auto Loan Crisis” As Delinquencies Begin To Rise?

-

December 2022: Perfect Storm Arrives: “Massive Wave” Of Car Repossessions And Loan Defaults To Trigger Auto Market Disaster, Cripple US Economy

-

January 2023: “It’s The Perfect Storm”: More Americans Can’t Afford Their Car Payments Than During The Peak Of Financial Crisis

-

November 2023: Americans Panic Search “Give Car Back” As Subprime Auto Loan Delinquency Erupts

-

February 2024: “Garbage Deals”: Dealership Puts Customers In Cars With $3,000 Monthly Payments

-

May 2024: Bad-Loans Hit Record-High As Used-Car Prices Suffer Worst Bear-Market Ever

-

July 2024: Auto Insider Warns More Americans Fall Behind On Car Payments As Repos Soar 23%

Bloomberg Intelligence’s Joel Levington published a new report Monday, citing new data from CarEdge that showed a staggering 39% of vehicles financed since 2022 carry negative equity, including 46% of EVs …

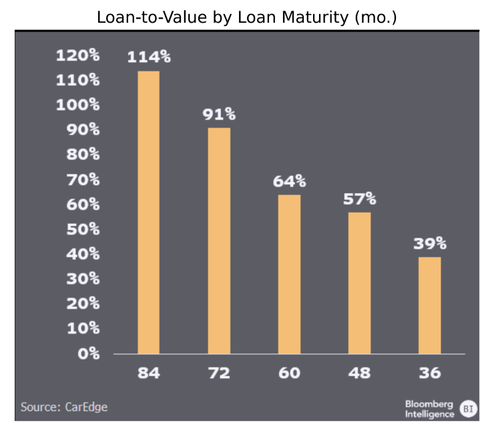

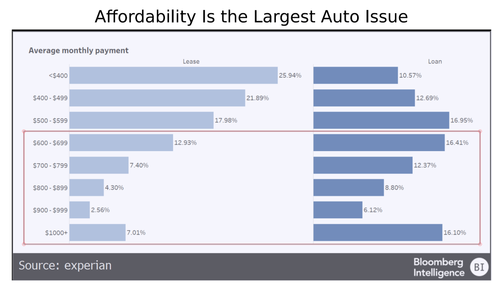

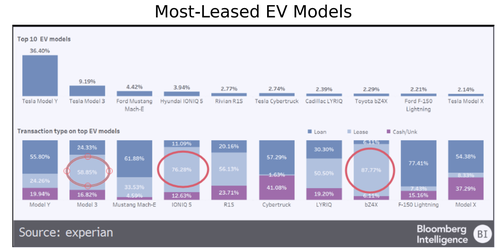

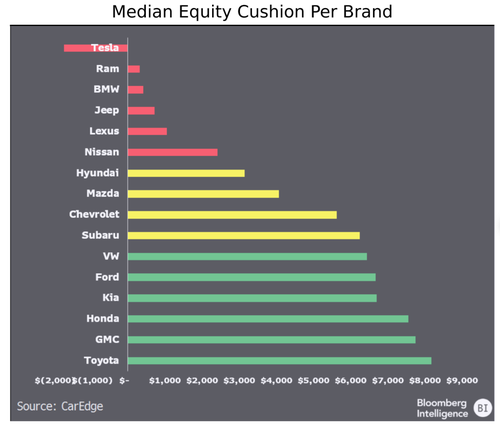

39% of automobiles financed since 2022 have negative equity, including 46% of electric vehicles in the hole in 2024, according to a recent study by CarEdge. The affordability struggle is real, with 60% of loans and 34% of leases over the benchmark levels that consumers seek, based on data from Edmunds and CarEdge. Financially stretched buyers may further weigh on captive finance units and auto asset-backed indexes. The equity cushion at Tesla is notably troubling, while Toyota, GM, Ford and VW have ample flexibility

BI provided clients with a chartpack showing the negative equity storm brewing for Americans will only worsen:

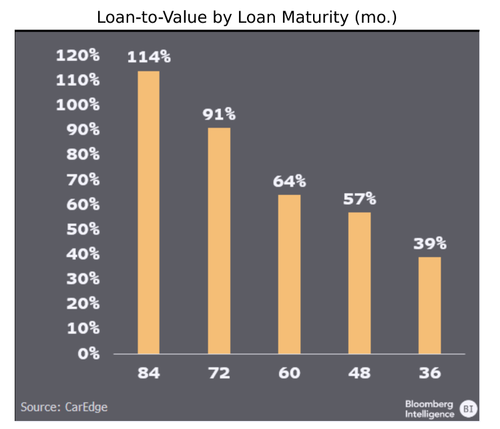

84-Month Auto Loans With 114% Loan-to-Value Scream Risk

60% of Loans, 34% of Leases Over Customer Preference Levels

Tesla Model Y, Hyundai Ioniq 5 and Toyota bz4X Among Most Leased

Audi, Porsche, Mercedes, Polestar and Volvo Among Most Leased

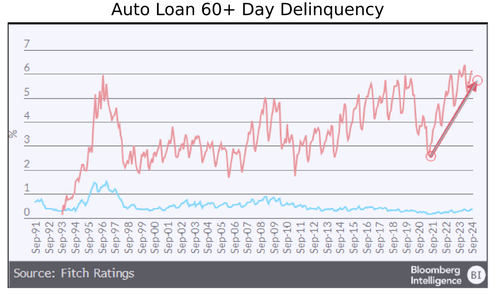

Subprime Loan Delinquencies Near Record Highs

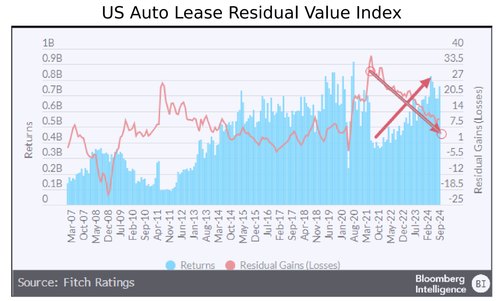

Residual Values Down, Returns Up

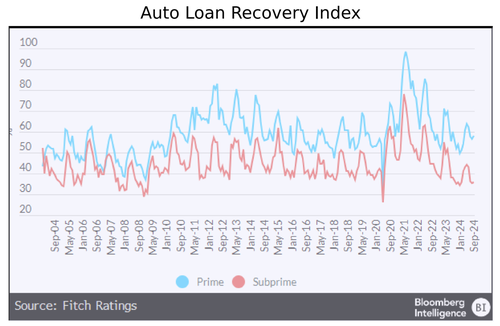

Recoveries Plunge as Used Vehicle Values Decline

Median Tesla Loans Have Negative Equity

The Manheim Used Vehicle Value Index has tumbled into a bear market since peaking in early 2022. Falling auto prices and lengthy loan terms for borrowers spell bad news.

Bankrate data shows that new 60-month auto loans peaked at around 8% (a two-decade high) earlier this year and fell to around 7.29% at the end of October.

What a mess for consumers with these underwater loans.

Tyler Durden

Mon, 11/18/2024 – 12:45