The US Is Going Back Towards Mercantilism

By Michael Every of Rabobank

All that is solid melts into hair

In the 1848 Communist Party Manifesto Marx noted, “All that is solid melts into air, all that is sacred is profaned, and man is at last compelled to face with sober senses his real conditions of life, and his relations with his kind,” describing the dynamics of industrial capitalism steamrolling pre-existing feudal societies.

In 2024, revolution and profanities are in the air in Washington, D.C. President-elect Trump’s cabinet picks have two clear qualities: personal loyalty to him, and complete rejection of D.C. status quo and politesse: Zeldin (Environmental Protection Agency), Gaetz (Attorney General), Gabbard (Director of National Intelligence), Homan (Border Czar), RFK, Jr. (Health and Human Services), Hegseth (Defence), Ratcliffe (CIA), with suggestions the choice of FBI head will be similar, to say nothing of Ramaswamy and Musk’s ‘DOGE’. For markets thinking “These aren’t economic positions,” the shortlist for Treasury Secretary is Lutnick or Bessent, both favoring a neo-Hamiltonian policy of raising tariffs to shift US exports from Treasury bonds to physical goods, so reducing the trade deficit and income taxes in tandem. If Gaetz is supposed to completely reshape the DOJ, Ratcliffe the CIA, RFK, Jr. the HHS, Gabbard the DNI, Zeldin the EPA, Homan the border, Hesgeth the Pentagon, and Ramaswamy and Musk the entire civil service, why do Lutnick or Bessent mean business as usual at Treasury? Note Marx advocated for free trade because it “hastens the social revolution”: the more free trade, the more Marxists win, he said.

In 2024, “All that is solid melts into hair, all that is sacred to D.C. is profaned, and the US is at last compelled to face with sober sense the realpolitik conditions of life, and its international relations with not-its-kind,” describing the dynamics of an attempted return to industrial capitalism steamrollering pre-existing financial capitalism with neo-feudal properties.

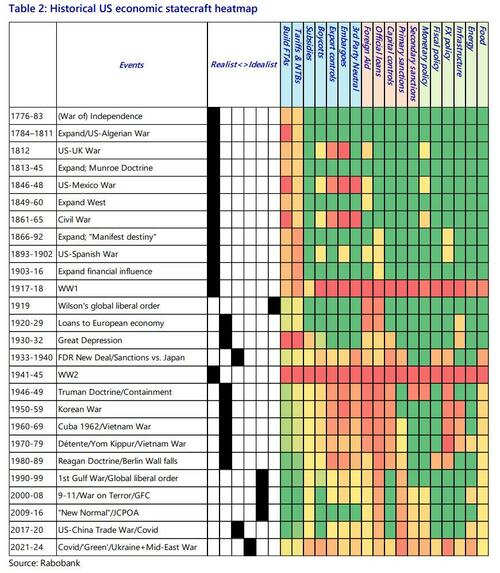

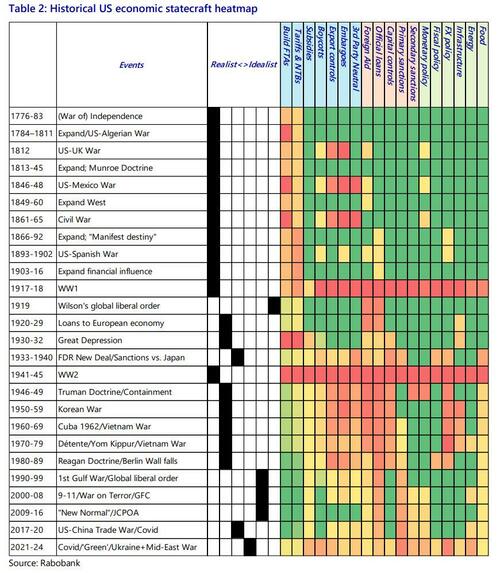

In short, the US looks like it is going back towards mercantilism, as I’ve argued was logical since before Trump won the first time, and to economic *statecraft* over economic policy, as I recently underlined in how macrostrategy is trumped by a geopolitical ‘Grand Macro Strategy’.

If you keep that in mind, recent Fedspeak is not as shocking as it might appear. Barkin’s argument that one should not try to forecast things that haven’t happened yet(!) as “If you do, you’re really going to get yourself in a real world of hurt,” speaks to our present uncertainty. More concretely, we also had Logan talk about the possibility of a higher long-term US neutral rate, and yesterday we got what could potentially be another Powell Pivot of sorts.

The Powell who cut rates 50bps just before the US election when data was strong, while saying all was well and he wasn’t being political, and who followed with a 25bp cut after the election despite markets going gangbusters, just said he is in now in no hurry to keep cutting even as US payrolls ostensibly collapsed last month. In D.C., that may get tongues wagging about being dovish pre-election, which didn’t help Trump, and hawkish post-election, which won’t help Trump. Which won’t help the Fed. Powell also struggled with questions over the impact of mass deportations and tariffs: “We can do the arithmetic. If there are fewer workers there’ll be less work done,” Powell said, before adding, “This is getting me into political issues that I really want to stay as far away from as I possibly can.” Really? If such policies are enacted, the Fed will have to include their impact in their dot plots and rate decisions, and either agree or disagree that tariffs can be offset by a stronger dollar and a supply-side response, etc.

Recall our US strategist Philip Marey has been saying for months that Trump would win and enact tariffs, and that this would force the Fed to hold at 4.25%. Are Logan and Powell, and even Barkin, edging in that direction? If so, which way are markets who were still dreaming of lower for longer going to edge? And which way is Trump going to edge vis-à-vis the Fed? Recall that among the sacred things on the chopping block now is potentially the Fed’s independence.

Yet also recall that when one enters the world of economic statecraft and mercantilism, monetary policy is no longer just about CPI, unemployment, or financial stability. It’s a tool that can be used for many different things, both domestically and internationally, in the same way that a simple knife can either peel fruit or stab someone in the back.

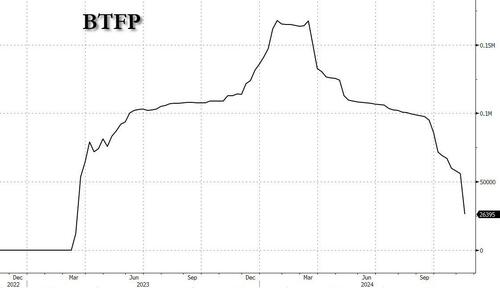

On which note(?), the Fed’s BTFP facility put into place to stop market panic over bank failures brought on by Barkin-style rates hedging strategies is dropping even as Treasury yields are moving higher. Is this noise? Is all now well so BTFP is no longer needed? Or, as some mutter in revolutionary times, are we seeing a Great Game in D.C. akin to that between the US and the rest of the world? We don’t know; but not knowing this is going on is no help either.

Elsewhere in D.C., the SEC’s Gensler is to step down, marking further sweeping change ahead. Bitcoin didn’t retake recent highs on the news but is still up over 100% year-to-date and 31.5% on the month. Now we just need to work out what it’s actually going to be used for in whatever global system emerges under US mercantilism. Is it just another asset bubble anaesthetic, or does it have a role as an external digital FX anchor? Note gold is still going down for now: not a surprise given a Eurodollar-shortage certainty under any US mercantilism, to say nothing of “Powell’s new flexibility” in not just cutting rates ad ridiculum.

Speaking of which, Bloomberg reports that some traders are taking options bets on a 75bps cut from the ECB in December, which offers a ten-fold payoff if it occurs. Obviously, this is not our house view. However, the fact that someone is prepared to take that kind of punt points to either excess exuberance and liquidity or excess panic – at least over Europe’s prospects in a realpolitik world with an axe-throwing US Defence Secretary and a Treasury Secretary favouing tariffing Europe until its bilateral trade surplus disappears one way or another, and/or it agrees to march in lockstep with the US over China, and/or it immediately doubles its defence spending.

On another front, Azerbaijan’s COP29 has seen the hosts proclaim oil and gas are gifts from God, and has been declared as “no longer fit for purpose” by environmental activists. Only UK PM Starmer showed up from the West to flaunt even more aggressive green goals just as a rumoured US free trade/geopolitics deal might appear manna from heaven for him. However, it’s one logically requiring a complete U-turn on his entire political-economy industrial strategy, as rumours are the UK will send anti-Brexit, pro-EU, and pro-working-with-China Lord Mandelson as its US ambassador.

In key data, Japan’s Q3 GDP was 0.9% annualized vs. 0.7% expected, but lower than consensus in nominal terms and on the GDP deflator: USD/JPY, which was briefly at 156.75 this morning(!), is now around 154.9 – recall this was 140.6 in mid-September. China’s new home prices fell 0.5% m-o-m in October vs. -0.7% the previous month, and industrial production was 5.3% y-o-y vs. 5.6% expected, and retail sales 4.8% vs. 3.8%, miraculously suggesting that that despite the last set of trade numbers, China might be ‘rebalancing towards domestic demand’ just as protectionist and mercantilist backlashes appear globally. There will be no takers in D.C., of course, and it will be interesting to see what President Biden says to Xi Jinping, and all attending, when they meet in Lima, Peru at the APEC summit tomorrow: “If you didn’t enjoy the last four years much, hold my beer(?)”

All that we can know today is that nothing is solid anymore: not tradition; politesse; facts; data; ‘expert’ advice; policy; institutions; nor even ideologies. All are melting down – and some things are still melting up.

Tyler Durden

Fri, 11/15/2024 – 12:00