WTI Dips After Crude Inventories Build To Highest In 3 Months

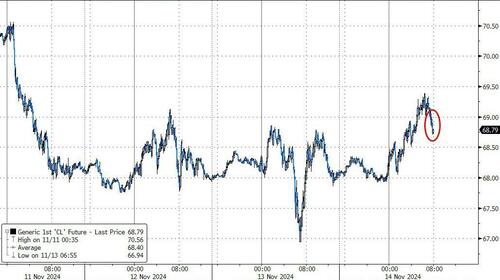

Oil price are trading higher this morning after treading water for two days (lower than pre-election) following API’s report of a (unexpected) small crude inventory draw and despite a strong dollar.

However, the IEA on Thursday warned that the oil market faces a surplus of more than 1 million barrels a day next year, which could swell further if OPEC+ decides to press ahead with supply hikes.

“World oil supply is rising at a healthy clip. Following the early November US elections, we continue to expect the United States to lead non-OPEC+ supply growth of 1.5 mb/d in both 2024 and 2025, along with higher output from Canada, Guyana and Argentina,” the report noted.

” … Total growth from the five American producers will more than cover expected demand growth in 2024 and 2025 … Our current balances suggest that even if the OPEC+ cuts remain in place, global supply exceeds demand by more than 1 mb/d next year.”

In its Short-Term Energy Outlook released Wednesday the Energy Information Administration also predicted supply will exceed demand beginning in the second quarter of next year.

API

-

Crude -800k

-

Cushing -1.9mm

-

Gasoline +300k

-

Distillates +1.1mm

DOE

-

Crude +2.09mm

-

Cushing -688k

-

Gasoline -4.41mm

-

Distillates -1.39mm

US Crude stocks unexpectedly rose last week according to the official DOE data (as opposed to the small draw reported by API). Product inventories tumbled though (as did stocks at the Cushing hub)…

Source: Bloomberg

Total US crude stocks are back at their highest since early August…

Source: Bloomberg

The Biden admin added 567k barrels to the SPR last week…

Source: Bloomberg

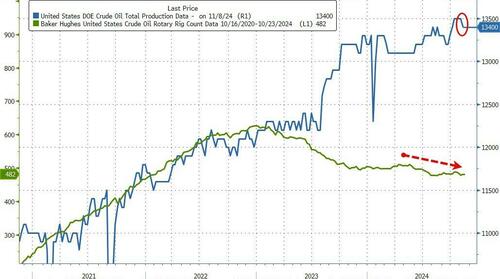

US Crude production dipped from record highs…

Source: Bloomberg

WTI was trading around $69 ahead of the official print.

“The coming weeks will be critical in shaping the near-term outlook for the oil market,” said Ole Hvalbye, an analyst at SEB AB. “The continued strength of the US dollar is exerting downward pressure on commodities overall, while ongoing concerns about demand growth are weighing on the outlook for crude.”

Tyler Durden

Thu, 11/14/2024 – 11:08