Unaffordable Housing And Homeless Encampments: How Did It Get This Bad?

Authored by Charles Hugh Smith via OfTwoMinds blog,

To reverse the damage wrought by financialization, we must reverse financialization.

The post-election hope that festering problems can now be solved doesn’t seem to extend to unaffordable housing and homeless encampments, two blights on the socio-economic landscape. Perhaps this reflects a sense that these blights aren’t readily fixable, or an unsure grasp of the causes of these blights.

Let’s focus on the primary cause that led to unaffordable housing and homeless encampments. There are many contributing factors, of course, such as the NIMBY (not in my back yard) restrictions on new housing, the soaring cost of construction permits, materials and labor, and so on, but all these factors are subservient to one: financialization, which enriched the wealthy and incentivized them to pursue housing not as shelter for their family but as a low-risk investment that generates income and capital appreciation.

As the wealth to be parked in assets exploded to unprecedented heights, those seeking housing as an investment outbid those seeking housing as shelter. As demand generated by financialized investment pushed housing valuations higher, the wealthy gained more capital to be sunk into housing, creating a virtuous cycle of increasing demand and higher valuations.

Those without substantial portfolios of stocks and housing could no longer afford a home as shelter.

Lest you think this is an exaggeration, consider An estimated 26% of Fort Worth’s single family homes are owned by companies, city says. That is a non-trivial percentage of homes owned by corporations, and this doesn’t include homes owned as rentals / short-term rentals (AirBNBs) by wealthy individuals, households, trusts, etc. So up to one-third of all single family homes being owned by investors of one type or another in desirable regions is not unreasonable.

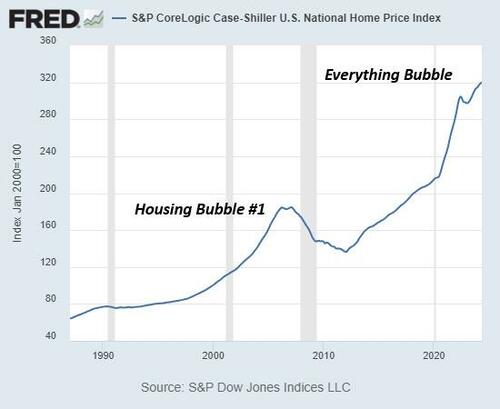

Note that this is 26% of single-family homes, not rental apartments. For context, the U.S. has about 145 million housing units, 15 million of which are unoccupied (second homes, available for rent, rarely occupied, left empty, etc.) 82 million single-family homes of which 68 million are owner-occupied, and about 45 million rental households.

The flood of capital seeking housing created a wave of gentrification that wiped out remaining pockets of low-cost housing. Cheap housing was available in undesirable neighborhoods until financialization created trillions of dollars seeking assets that could be snapped up, renovated and sold or rented at a profit.

Once small landlords learned that studio apartments in the newly renovated flophouse were now renting for $2,000 a month, they naturally raised their rents to “market.” Gentrification–driven by financialization–pushed rents higher, too.

With all the cheap rental housing gentrified, those on the margins ended up on the street. This includes addicts and those suffering from mental illness, but it also includes people who fell on hard times who were now priced out of any shelter other than an underpass or sidewalk.

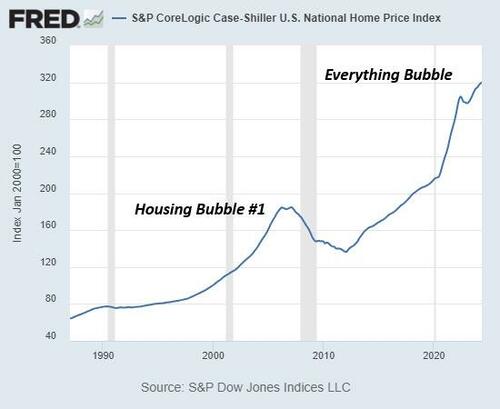

Let’s tell the story in charts. Here is the Case-Shiller housing index, which shows the 2007-8 housing bubble as a modest blip compared to the current financialization-driven Everything Bubble which has pushed housing valuations out of reach in desirable (i.e. places with plenty of jobs) regions.

Measured by per capita–how many housing units are there per person in the U.S.–there is no housing shortage, as the number of housing units per capita has never been higher.

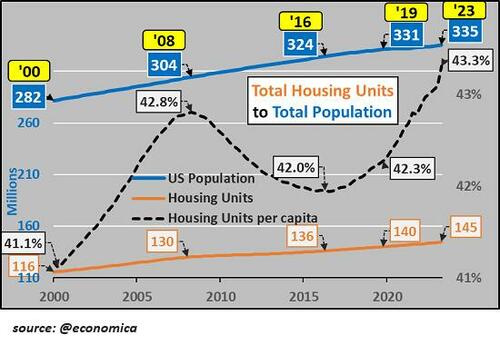

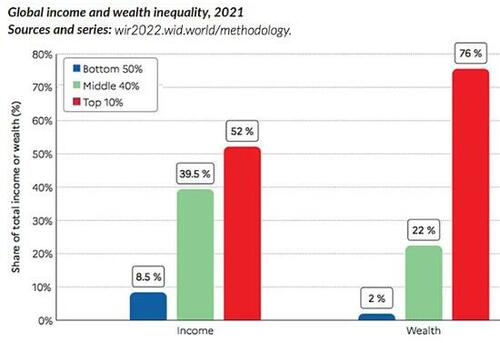

Wealth and income equality in the U.S. tracks the global asymmetries shown here: the top 10% collect half the income and own 76% of the wealth / assets. (In the U.S., the top 10% own 90% of all stocks.)

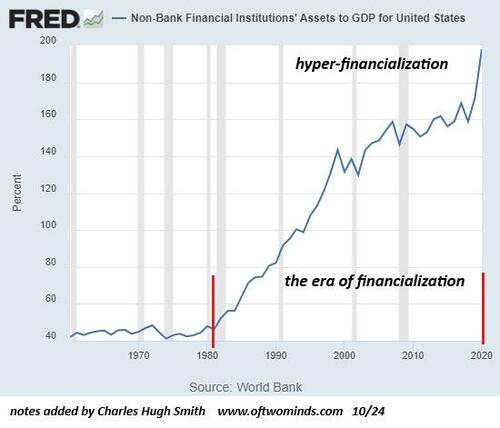

Non-bank financial assets are a proxy for financialization, which rose by roughly $50 trillion since the 2009 financial crisis.

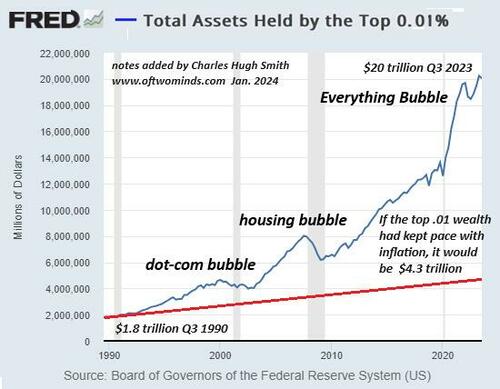

The wealth held by the top 0.01% soared by $7 trillion just since 2019, topping $20 trillion. If this elite’s wealth had only risen with inflation. it would be around $4.3 trillion rather than $20 trillion. The increase far above inflation was generated by financialization.

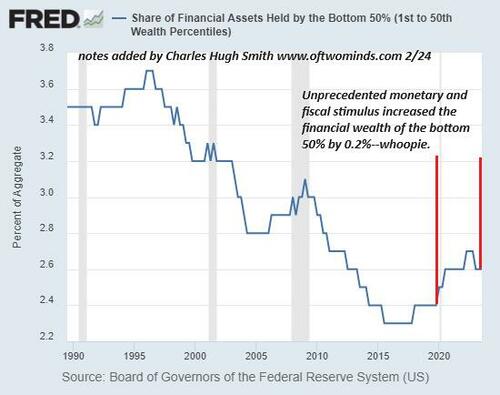

All the monetary and fiscal stimulus, the super-low interest rates and massive appreciation of assets didn’t do much for America’s bottom 50% of households, who saw their share of the nation’s financial wealth fall from 3% in 2010 to 2.6% as tens of trillions of wealth were added to the swollen portfolios of the top 10%–wealth that sought a safe haven in housing.

Financialization has widened the gap between the top 10% and the bottom 50% to the kind of extreme asymmetry that typically presages social upheaval.

To reverse the damage wrought by financialization, we must reverse financialization. Doing anything other than this will have little effect, for no matter how many new homes are built, the wealth of the top 10% will have increased such that they will easily outbid mere wage-earners for the new housing. Building more homes for the wealthy to snap up with their ballooning wealth won’t address the root cause of unaffordable housing and homeless encampments: financialization.

Gordon Long and I discuss The Slow Death of the Single Family Home (30:57 min) in this new podcast.

To further the discussion of the opportunities and limits of state power, I’m making my 2018 book Pathfinding Our Destiny free (Kindle ebook) from November 7 to November 9. Yes, the book is now in the “free box” out on the sidewalk until Saturday, 11/9/24.

I was invited to discuss the upsides and downsides of central planning on two recent podcasts:

Charles Hugh Smith on the China Real Estate Bubble (29:28 min) Host Richard B. of the Financial Repression Authority

Charles Hugh Smith on The failure(s) of central planning across the globe (42:56 min) Host Rob S. of the Contrarian Capitalist (Substack)

* * *

Tyler Durden

Sat, 11/09/2024 – 11:40