Election Day Exuberance Sparks ‘Buy All The Things’ Theme

Stocks up, Bonds (prices) up, Gold up, Bitcoin up, Crude up… VIX & Dollar down… as ISM Services soars on Election Day.

All the majors were green on the day with a squeeze in Small Caps leading the way…

Traders should not be surprised – we haven’t had a down-day on election day for the S&P 500 since 2000:

11/3/2020 +1.78% ELECTION DAY

11/4/2020 +2.20%11/8/2016 +0.37% ELECTION DAY

11/9/2016 +1.11%11/6/2012 +0.79% ELECTION DAY

11/7/2012 -2.37%11/4/2008 +4.08% ELECTION DAY

11/5/2008 -5.27%11/2/2004 +0.01% ELECTION DAY

11/3/2004 +1.12%11/7/2000 -0.02% ELECTION DAY

11/8/2000 -1.58%11/5/1996 +1.05% ELECTION DAY

11/6/1996 +1.46%11/3/1992 -0.67% ELECTION DAY

11/4/1992 -0.67%

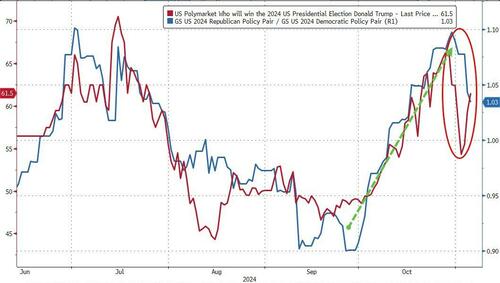

The Trump Trade saw another very small profit-taking day today as PolyMarket odds increased…

Source: Bloomberg

NVDA overtook AAPL once again to become the world’s largest market cap company…

Source: Bloomberg

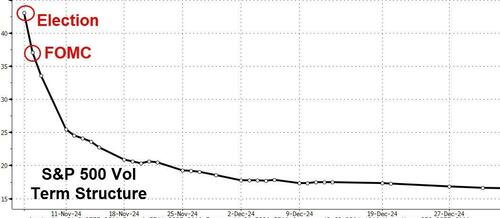

VIX was slammed lower as the inverted curve starts to unwind into ‘less uncertainty’ (don’t forget FOMC Thursday)…

But the vol term structure has a long way to fall from its extreme inversion as we await Thursday…

Source: Bloomberg

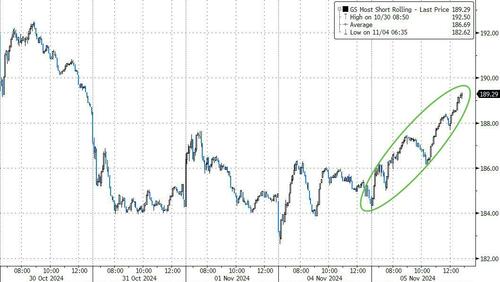

“Most Shorted” stocks were a one-way street of squeeze today…

Source: Bloomberg

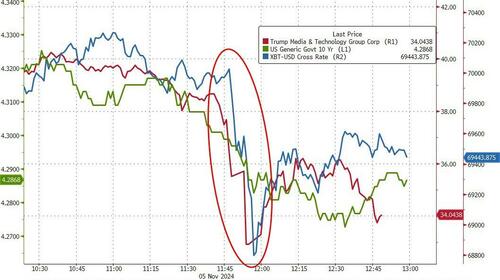

BUT there was one stock that was wild today: DJT

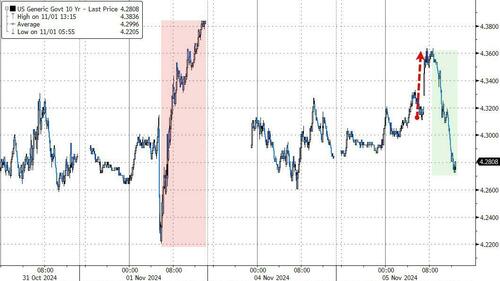

Treasury yields were all over the place, hurt early on by knock-on effects from a terrible auction in Gilts, then strong ISM Services pushed yields higher still only to see a strong 10Y auction slam yields back lower (and when DJT started to crack, so did bond yields)…

Source: Bloomberg

Only the 2Y yield remains higher post-payrolls…

Source: Bloomberg

Bitcoin, bond yields, and DJT all dumped at the same time (around 1430ET)…

Source: Bloomberg

The dollar dived once again, back to three-week lows…

Source: Bloomberg

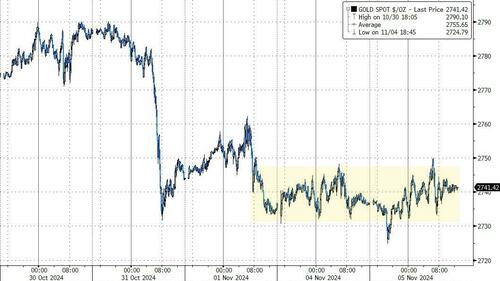

Despite the intraday volatility elsewhere, gold continued to tread water around $2740…

Source: Bloomberg

Bitcoin was a bit chaotic today, ripping back above $70,000 only to get slammed lower as DJT and bond yields slipped…

Source: Bloomberg

Crude traded wild today. Strong open was hit by Israeli HLs (Gallant fired), but then the machines realized that Gallant was the less war-hawky one…

Source: Bloomberg

Finally, with the election almost over, traders wil turn to Thursday’s shenanigans with The Fed…

Source: Bloomberg

Today saw rate cut expectations slump again (50-50 chance of 1 or 2 cuts in 2024 and 50-50 chance of 2 or 3 cuts more in 2025).

Tyler Durden

Tue, 11/05/2024 – 16:00