US Manufacturing Survey Hits 16-Month-Lows But Prices Paid Spiked In October

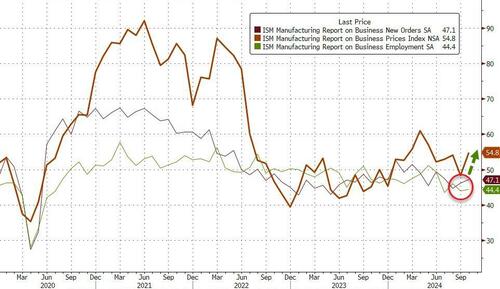

Minutes after the BLS reported the biggest drop in manufacturing jobs since the COVID lockdowns, S&P Global reported its US Manufacturing PMI rose to 48.5 in October (still in contraction) from 47.3 in September (as ‘hard data’ has exploded higher this month. ISM’s Manufacturing PMI was worse than expected, dropping from 47.2 to 46.5 in October – the lowest since June 2023…

That is the fourth straight month of contraction (sub-50) for the Manufacturing PMI

Source: Bloomberg

The ISM Manufacturing Prices Index spiked back higher in October as both new orders and employment remain in contraction sub-50)…

Source: Bloomberg

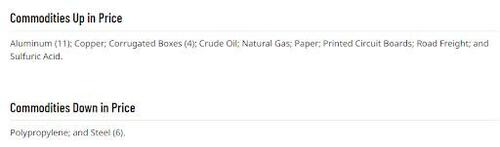

Commodity prices are UP!

Stagflation, much?

The responses from ISM survey participants was a shitshow:

-

“Right-sizing continues. Contingency plans have been formulated to anticipate trade policies that will impose tariffs on key materials.” [Chemical Products]

-

“Market demand has significantly decreased in the second half of 2024 and is expected to be soft through the first quarter of 2025. Although inflation has stabilized and returned to historical levels, and interest rates are decreasing, there appears to be a general pessimism in the economy that is driving customers to be more restrictive in their capital expenditures, including investment in commercial vehicles. Uncertainty in the outcome of the upcoming election has resulted in several risk analysis studies to be prepared, particularly focused on the future of the electric vehicle (EV) migration and trade restrictions/penalties.” [Transportation Equipment]

-

“Sales have been very slow the past six months. Interestingly, though, inquiries are up more than 30 percent from a year ago. This indicates there is pent-up demand, but customers are skittish about national and global economic conditions. We are hearing directly from customers that they need to order equipment to satisfy their requirements but are going to keep projects as long as possible before pulling the trigger.” [Machinery]

-

“Business levels remain depressed. It feels like a ‘wait and see’ environment regarding where the economy is heading; customers don’t want to commit to inventory, which is resulting in lower order levels.” [Fabricated Metal Products]

-

“This has been an interesting fourth quarter already. The port strikes, hurricanes and election will all affect us in some way. Our industry is energy intensive, so our largest concern is the national and state mandates toward electrification. Electrical components were already in short supply, and with the substation and power line damages, we expect the electrical supply chain will be even worse.” [Paper Products]

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, offers some optimism…

“The US manufacturing downturn extended into its fourth successive month in October, marking a disappointing start to the fourth quarter for the goods-producing sector. Although the rate of decline moderated, order books continued to deteriorate at a worryingly steep pace, and a further build-up of unsold stock hints at further production cuts at factories in the coming months unless demand revives.

“The survey does, however, provide some encouragement that the current soft patch could prove short-lived. Hurricanes have been blamed for supply disruptions, which should therefore ease in November, and manufacturers are feeling more positive about the outlook than at any time since May, hoping that demand will pick up once the uncertainty generated by the Presidential Election clears.

“It’s notable that orders for investment goods such as plant and machinery have fallen especially sharply in recent months. Headcounts have also been cut for a third straight month, underscoring the reluctance among firms to expand in the face of heightened geopolitical uncertainty, with firms citing tensions around the US election as well as intensifying international conflicts. There is therefore some potential upside to the manufacturing sector if the political environment becomes more conducive to spending and investment after the election.”

Hope springs eternal!! But The fed will cut 25bps next week because jobs/ISM and ignore the surge in Prices Paid and Core PCE?

Tyler Durden

Fri, 11/01/2024 – 10:06