US Big Banks Suffer Biggest Deposit Outflow Since April… Until The Fed ‘Adjusted’ Them

Money market funds saw yet another week of inflows (+$40BN), taking the total AUM to a new record high of $6.508 TN…

Source: Bloomberg

The inflow into MM comes as bank deposits (on a seasonally adjusted basis) dropped a modest $13BN to the week-ending 10/23…

Source: Bloomberg

But, on a non-seasonally-adjusted basis, total deposits plunged $133BN (the biggest weekly decline since April)…

Source: Bloomberg

Excluding foreign deposits, it’s even uglier. On an NSA basis, US deposits plunged $131BN – the biggest weekly drop since April (Large banks -$97BN, Small banks -$34BN). But, by the magic of The Fed’s PhDs, the ‘seasonal adjusted’ domestic deposits fell just $3BN (Large banks +$8BN, Small banks -$11BN)…

Source: Bloomberg

This is the biggest Large bank deposit drop since May…

Source: Bloomberg

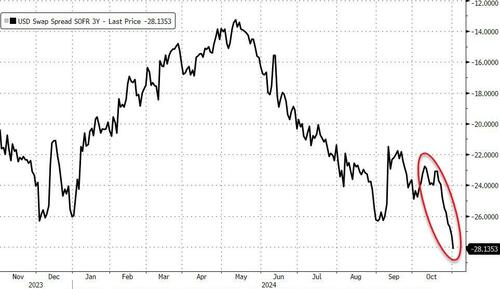

This should only be worrying if we see liquidity problems in the banking system starting to occur.

Wait, what?

Source: Bloomberg

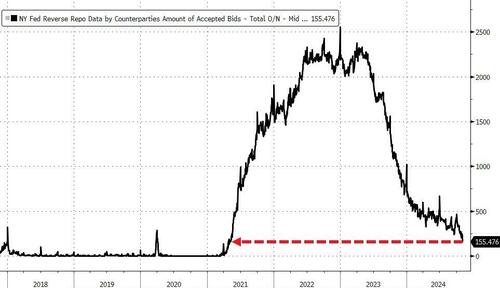

…and reverse repo usage is collapsing (liquidity needs?)

Source: Bloomberg

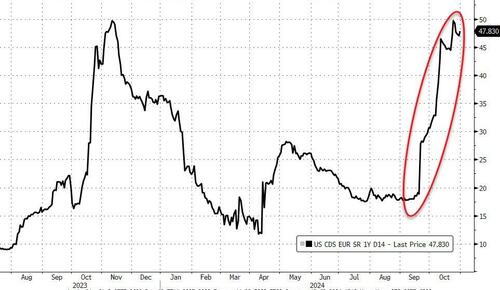

Is that why USA sovereign risk is blowing out?

Source: Bloomberg

Are they holding back a banking crisis for Trump’s victory?

Tyler Durden

Fri, 11/01/2024 – 16:40