The Illusion Of Growth: How Inflation Skews Our Perception Of The Stock Market

Authored by Alexander Frei via The Epoch Times,

Americans can readily see the effects of record-high inflation every time they shop. Prices have soared, from the grocery store to the gas pumps. Although inflation has cooled, families are still feeling the pinch.

And the harm doesn’t end there: Inflation also is making stock markets appear stronger than they really are and cutting into returns for everyone, including those with retirement accounts.

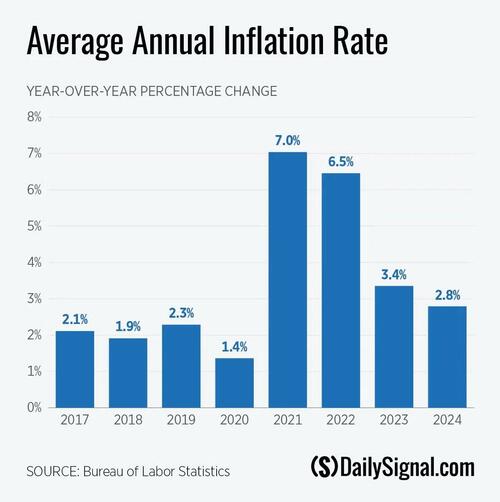

We seldom hear about that last point. When media outlets discuss the latest inflation rate, they typically highlight the average annual percentage change in the consumer price index. The CPI tracks a basketful of goods, including housing, food, energy, insurance, and more, measuring the average price increases of these items over time.

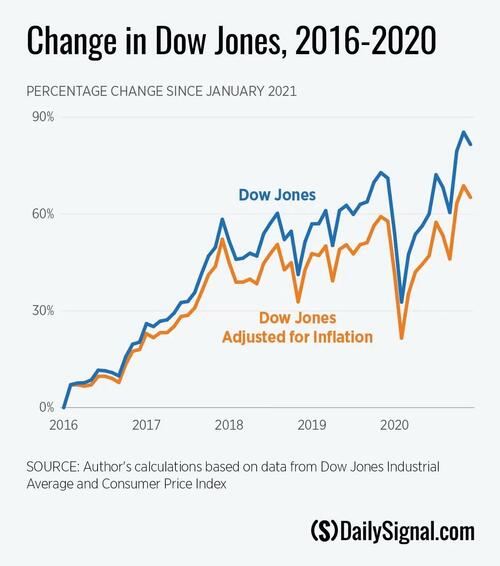

From 2016 to 2020, the inflation rate averaged 1.9 percent, which resulted in a cumulative price increase of about 7.7 percent over four years. The Federal Reserve’s target rate—about 2 percent—typically goes unnoticed by consumers, as wages tend to rise at a similar pace.

But from 2021 to the present, the inflation rate has averaged 4.9 percent, leading to a cumulative price increase of 19.6 percent. At these elevated levels, wages struggle to keep up, making inflation more noticeable for consumers. A recent poll revealed that 63 percent of voters say they believe the U.S. economy is on the wrong track and 62 percent characterize it as weak.

Yet despite this negative sentiment, the stock market appears to be booming. On Oct. 21, the Dow Jones and the S&P 500 hit all-time highs.

However, these indexes alone don’t tell the full story.

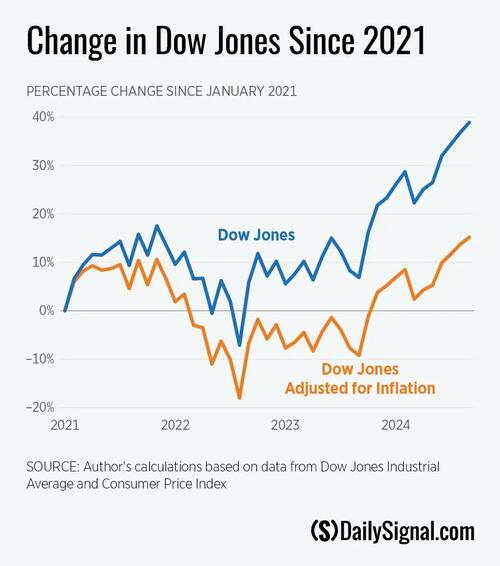

Inflation can distort how we perceive market gains. Although it may appear that investments in the stock market are yielding record-breaking returns, these returns are more moderate once they’re adjusted for inflation.

In short, inflation not only hurts consumers, it hurts investors—which includes most Americans. This hidden tax on savings and investments quietly eats away at real profits, leaving Americans with far less purchasing power than it appears on the surface.

To estimate how this would affect someone who invested in the stock market in January 2021, you compare the Dow Jones Industrial Average with its inflation-adjusted counterpart. Although the nominal stock market gains since 2021 show an increase of 39 percent, this growth shrinks to just 15 percent when adjusted for inflation.

Inflation, often overlooked in stock market discussions, has a tangible impact on investment returns. Investors who focus solely on nominal gains without considering inflation may develop a false sense of optimism about their portfolio’s performance.

So how can inflation have such a notable effect?

In simple terms, as prices rise, even significant returns lose their purchasing power. More money is required to buy the same goods and services, eroding the real value of one’s gains. As everything becomes more expensive, higher earnings or investment returns don’t stretch as far, making it harder to keep up with the true cost of living.

For comparison, one can track the average returns starting from 2016 to 2020. During this period, both the Dow and the inflation-adjusted Dow are much closer together, suggesting that inflation had a lesser effect on eroding profits. Indeed, despite the COVID-19 shock, the inflation-adjusted Dow rose by approximately 65 percent while the non-adjusted Dow increased by 81 percent.

Inflation is not just a consumer issue—it affects everyone, from families trying to make ends meet to investors on Wall Street. The disconnect between nominal market gains and their inflation-adjusted counterparts helps explain why many Americans, despite a seemingly booming stock market, voice concerns about the economy.

This illusion of growth highlights the need for a sharper focus on controlling inflation. Reducing wasteful government spending and bringing down inflation is essential not only to preserve the real value of investments, but to ensure that economic prosperity is felt across all levels of society.

Reprinted by permission from The Daily Signal, a publication of The Heritage Foundation.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Tyler Durden

Fri, 11/01/2024 – 20:05