Behind The Bond Sell-Off

Authored by Louis-Vincent Gave via Evergreen Gavekal blog,

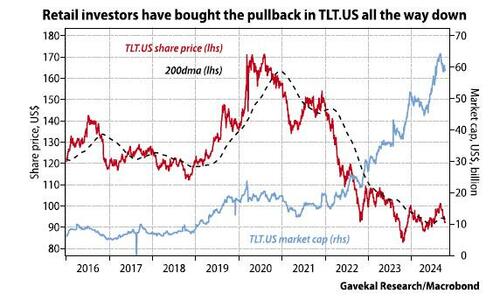

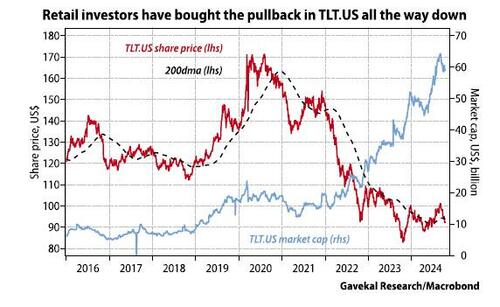

TLT.US, the long-dated US treasury ETF, is back trading below its 200-day moving average, and on current form is looking at its fourth year running of negative price returns.

Not that this sell-off reflects any lack of retail investor enthusiasm for US bonds. Quite the contrary.

As US treasuries pulled back, flows into TLT.US went parabolic – and the ETF’s market cap rose from US$10bn in 2019 to US$60bn today.

But long-dated bonds continue to sell off. And like successes, sell-offs usually have many fathers.

When it comes to today’s bond bear market, it’s possible to point to four main explanations.

1) Essentially, the market is slowly realizing that the post-2008 “new normal” era of depressed nominal growth is well and truly over. The real estate bubbles have been digested, while bank and consumer balance sheets have been repaired.

Consequently, the world’s major central banks will not push interest rates back to zero any time soon. Zero rates were a historical aberration that need not be repeated. In this case, why own long bonds that yield less than short-term bills? Giving up today’s higher T-bill yields for the hopes of lower treasury note yields down the road makes little sense. This explanation for the sell-off is by far the likeliest. Incidentally, this means that we could now see a little bit of a rally in the oversold bond markets, as data to be published in the coming weeks looks to come in soft. Following Hurricanes Helene and Milton, jobless claims are likely to pick up, while production numbers may show some temporary softness on the back of short-term supply chain disruptions.

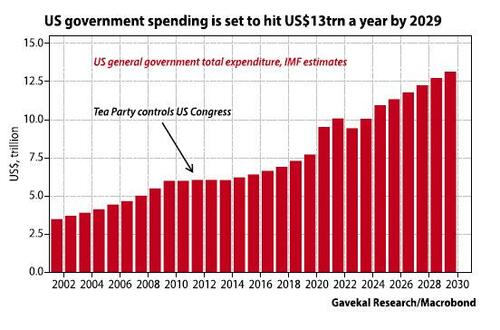

2) It’s the issuance. Any debate about how to tackle the US government’s runaway budget deficit has been notably absent from the US electoral campaign. The deficit did not feature in either the presidential or vice presidential debates. And when challenged on the topic, the presidential candidates have typically fallen back on worn-out tropes like “slashing inefficiencies” or “getting the rich to pay their fair share.” Meanwhile, the outstanding stock of US government debt continues to grow. According to the International Monetary Fund, US government spending will hit US$13trn a year by 2029 (compared with US$2.5trn when Bill Clinton left office). And these forecasts do not factor in proposed additional spending by Donald Trump or Kamala Harris.

Against this backdrop, in the past few weeks an assortment of legendary investors—Paul Tudor Jones, Stanley Druckenmiller, Leon Cooperman— have taken to the airwaves to warn about the unsustainability of the current fiscal path. This illustrates how the zeitgeist surrounding the US fiscal situation may be changing. In the new zeitgeist, investors are more likely to sell rallies in bonds than to buy dips.

3) It’s the inflation. One of the more interesting developments in the past year is how resilient inflation has proved to be. Sure, inflation rolled over hard from its 2022-23 highs. But given easier year-on-year comparisons, the balance-sheet recession in China, the pull-back in oil prices and much lower prices for wheat, corn and other foods, you might have expected inflation absolutely to collapse. Yet the consumer inflation rate has remained above 2.4%.

That is the past. What happens now that the world’s major central banks, except the Bank of Japan, are cutting interest rates? Now that oil inventories are severely depleted? Now that the US and EU seem set to embrace higher tariffs and reject China’s cheap industrial goods? In the shorter term, it also appears that Helene and Milton might also prove inflationary, with higher used car prices, and higher car and house insurance premiums.

4) It’s the shifting geopolitical environment. Last week saw both the IMF meeting in Washington and the Brics summit in Kazan in Russia. The timing clash was probably not an accident. Clearly, Brics leaders such as Vladimir Putin and Xi Jinping, and perhaps even Narendra Modi, are keen to underscore that there is an “old” Western world and a “resurgent” Global South. And this Global South is keen to dedollarize its trade, create new settlement systems not reliant on Swift, and diversify its central bank holdings. Given these aims, perhaps it should be no surprise that precious metals have climbed to new highs while long-dated US treasuries have sold off.

Putting this all together leaves investors with some fairly straightforward questions.

-

Will global growth roll over from here? In the short term, US data could soften in the aftermath of the two recent hurricanes. But in the longer term, an easing of fiscal policy seems to be on the cards regardless who wins the US presidential election. Meanwhile in China, the government is pushing most of its stimulative buttons. So the two largest contributors to global growth over recent years seem likely to add more growth in 2025 than they did in 2024.

-

Will the US government tighten its belt and take it easy on debt issuance? This seems highly unlikely.

-

Will inflation continue to decelerate? Given the growing belief that trade tariffs are the answer to the world’s ills, this also seems unlikely.

-

Will the geopolitical environment brighten? Perhaps. Donald Trump is promising to put an end to the Ukraine war if he’s elected, and may even seek some kind of deal with China. But for now, betting in line with the underlying trend of ever more decoupling would seem to make sense

Tyler Durden

Fri, 11/01/2024 – 13:20