‘Homes Are Still Overpriced, Unaffordable’ As Fed-Cut Sparks Mortgage-Rate Melt-Up

This wasn’t supposed to happen…

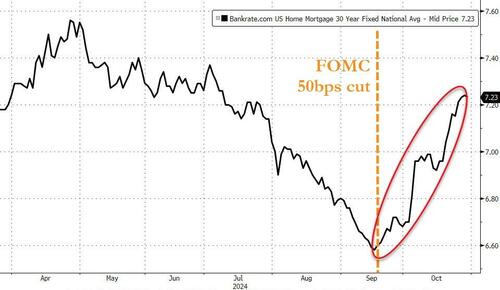

Treasury yields have taken off rather dramatically since The Fed slashed rates by 50bps in mid-September…

A few more cuts by the Fed and the average mortgage rate will hit an all time high. pic.twitter.com/3Jllcwnayj

— zerohedge (@zerohedge) October 30, 2024

…as the market seems to be screaming ‘policy error’ rather loud (or political pandering if you squint a little).

But it’s not just Wall Street that is questioning The Fed’s actions, Main Street is hurting even more as mortgage rates have soared back near recent highs – crushing the optimism that The American Dream is back for some.

As The Fed telegraphed its rate-cut (and then unleashed it), mortgage applications suddenly soared (after stagnating at multi-decade lows for months) amid optimism that the housing market was back and affordability might shift back into realm of possibility for many…

Source: Bloomberg

…but since the rate-cut, mortgage applications have plunged back near recent lows once again as mortgage rates soared back (from two-year lows) above the 7.00% Maginot Line…

Source: Bloomberg

It is a difficult time for home shoppers as they have been whipsawed by mortgage rates and media enthusiasm for The Fed’s actions, but ‘homebuyer confidence’ remains extremely low (especially compared to homebuilder confidence)…

Source: Bloomberg

As Bloomberg reports, the jump in rates serves as a double whammy for homebuyers, choking off affordability and discouraging more owners from listing properties.

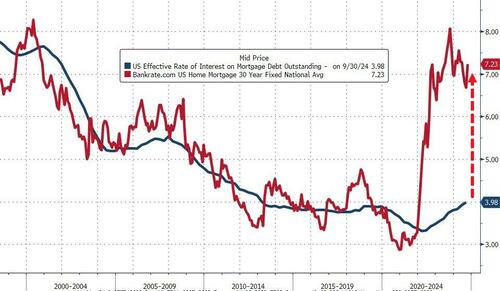

The supply of housing has been kept tight by the so-called lock-in effect. Few homeowners are willing to sell if it means taking on a higher mortgage rate.

Source: Bloomberg

“It’s going to put a damper on sales – affordability has gone down and the lock-in effect has increased,” said Scott Buchta, head of fixed income strategy for Brean Capital.

“We think we’ll need a sub-5.5% mortgage rate to unthaw the housing market, which probably doesn’t happen any time soon unless we go into a recession.”

And a recession is not exactly the kind of environment that prompts homebuyers to pile in to their largest debt (asset).

The issue facing homebuyers is not a new one – it’s been in place since the COVID lockdowns – as home prices soared even as mortgage rates exploded higher…

Source: Bloomberg

“I’m seeing a ton of homes that are overpriced, and you’re seeing multiple price reductions,” said David Lampe, an agent with the Principal Team at Metro Brokers.

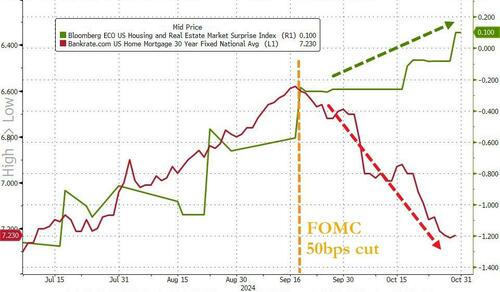

That didn’t stop the enthusiasm pushing many to buy and spark upside surprises to recent housing macro data. Sadly, we suspect that decoupling from the reality of mortgage rates will be short-lived…

Source: Bloomberg

The excitement is waning.

“There was a lot of excitement in July, August and September as rates were coming down,” mortgage banker Shant Banosian in Waltham, Massachusetts said.

“When rates start approaching 7%, it changes peoples’ budgets big time.”

Well, rates are back above 7.00% again (well above), and given the recent surge in economic data…

Source: Bloomberg

…another Fed rate-cut in the face of this strength will only worsen the situation (send long-end yields higher and drag mortgage rates higher).

So, be careful what you wish for next week (and we don’t mean on the 5th).

Tyler Durden

Thu, 10/31/2024 – 14:25