Fed’s Favorite Inflation Indicator Hotter Than Expected In September

The Fed’s favorite inflation indicator – Core PCE – printed hotter than expected in September (+2.7% vs +2.6% exp), flat with August’s 2.7% rise…

Source: Bloomberg

The headline PCE rose 0.2% MoM, which dragged down YoY PCE to +2.1% – its lowest since Feb 2021…

Source: Bloomberg

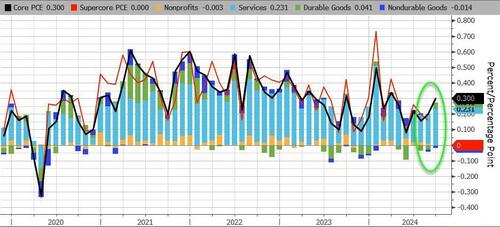

On a MoM basis, PCE appears to be accelerating with Durable Goods and Services costs picking up…

Source: Bloomberg

And finally, the so-called SuperCore PCE (Services Ex-Shelter) rose 0.3% MoM leaving the YoY cange ‘sticky’ at around 3.2%…

Source: Bloomberg

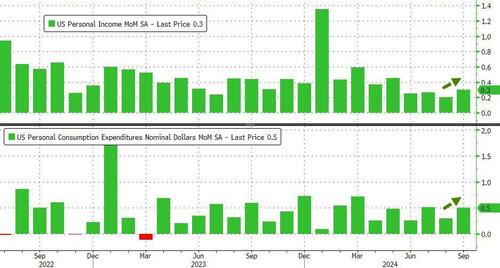

Personal Incomes rose 0.3% MoM (as expected) but Spending rose by more (+0.5% vs 0.4% exp)…

Source: Bloomberg

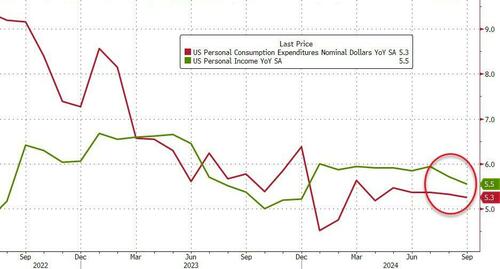

But on a YoY basis, bond spending and income growth is slowing…

Source: Bloomberg

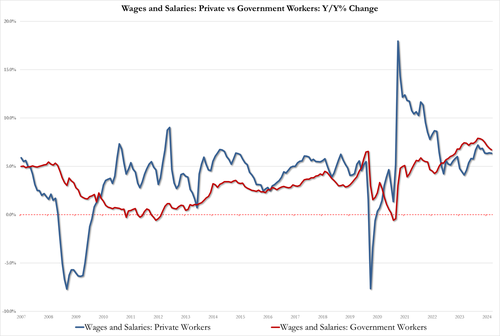

On the income side, Private wage growth 6.4% in Sept, unch while Government wage growth 6.7% in Sept, down from 6.9%, and well below record high 7.9% in March…

Source: Bloomberg

Finally, acyclical inflation is awkwardly stuck extremely high while the cyclical segment of inflation has reverted to normal…

Source: Bloomberg

Not exactly the kind of data that enshrines The Fed with a god-given right to cut rates.

Tyler Durden

Thu, 10/31/2024 – 08:41