Apple Slides After Guiding Below Consensus, Missing On Wearables, China And Service Revenues

Update (530pm ET): AAPL is sliding to session lows after hours after revealing some very lukewarm guidance on the call, saying it now expects Q1 revenue to grow in the low to mid-single digits YoY (assume 4-6%). The sellside consensus is at 7%.

As Bloomberg notes, “low to mid single digits” growth means a slowdown for Apple, which just reported a 6% sales rise. So it’s understandable why shares moved south after that pronouncement. They’re now down about 2% in extended trading.

So much for the AI revolution sparking a new iPhone supercycle (which would lead to double digit revenue growth).

$AAPL FQ1 guide is low to mid-single-digit revenue growth vs consensus of 7%. That also does not imply the double digit #superCycle growth that some have predicted.

— Walter Piecyk (@WaltLightShed) October 31, 2024

* * *

Ahead of earnings, UBS had Apple sentiment at a relatively subdued 6/10. That’s because despite AI enthusiasm following Apple’s WWDC event over the summer, UBS analyst David Vogt’s checks and other ancedotal evidence indicated iPhone unit sell-through in the Sept quarter was effectively flattish year over year at around 46 mn versus global sell-through up 2% y/y. Vogt previewed, anticipating September Quarter results largely in line with his forecast of $94 bn/$158 bn with a chance for upside driven by iPad and flattish iPhone units of 46 mn versus sell-through up 2% y/y. Factoring in 5 mn iPhone channel fill, David forecasts 51 mn iPhone units and iPhone revenue of $45.7 bn and expectations of 4-5 mn beat (following a report from IDC suggesting 56 mn units in Q3) with balanced December Quarter commentary. David anticipates only a modest tailwind from AI in the Dec Quarter and forecasts 78 mn iPhone units and remains at neutral and a $236 price target.

Furthermore, despite multiple observations that AI is not boosting iPhone sales (see “Apple Intelligence is here. Early users are underwhelmed”), investors continue to give Apple the benefit of the doubt of a successful iPhone 16 launch, which thus far is not overly supportive based on checks/sell-through. Many appear to be holding out for further confirmation until the rollout of Apple Intelligence but David anticipates balanced commentary regarding December Quarter iPhone demand. Valuation is a common pushback, but absent a significant iPhone miss UBS is not sure the Q3 results will be much of a catalyst either way for the stock. In terms of flows, more long only demand/buyers for the most part.

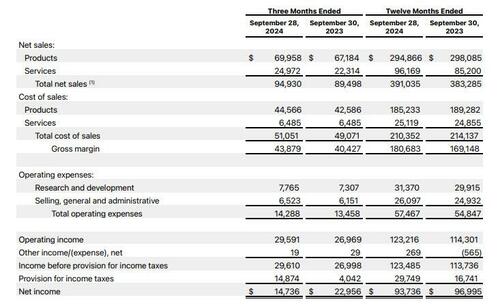

So with all that in mind, here is what AAPL just reported for the quarter ended Sept 30:

- Adjusted EPS 1.64 c vs. $1.46 y/y, beating estimates of 1.58

- Revenue $94.93 billion, +6.1% y/y, beating estimates of $94.36 billion

- Products revenue $69.96 billion, +4.1% y/y, beating estimates $69.15 billion

- IPhone revenue $46.22 billion, +5.5% y/y, beating estimates $45.04 billion, and an all time record for the company’s fiscal Q4.

- Mac revenue $7.74 billion, +1.7% y/y, in line with estimates $7.74 billion

- IPad revenue $6.95 billion, +7.9% y/y, missing estimates $7.07 billion

- Wearables, home and accessories $9.04 billion, -3% y/y, missing estimate $9.17 billion

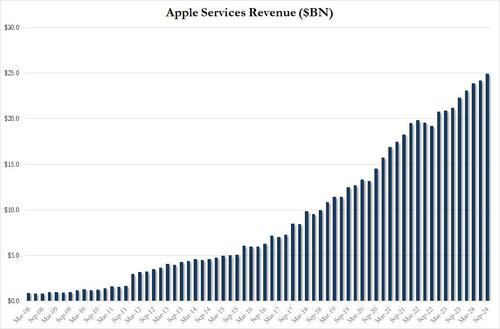

- Service revenue $24.97 billion, +12% y/y, missing estimate $25.27 billion

- Products revenue $69.96 billion, +4.1% y/y, beating estimates $69.15 billion

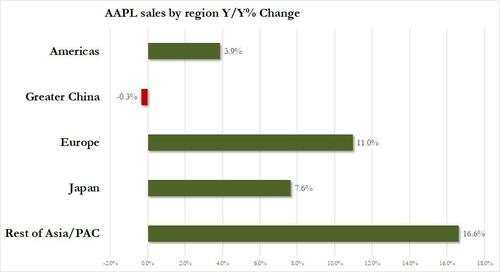

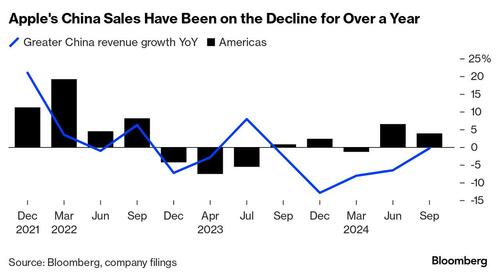

The one – very big – fly in the ointment was the usual suspect: China, where revenues unexpectedly dropped again, down 0.3% YoY:

- Greater China rev. $15.03 billion, -0.3% y/y, missing estimate $15.8 billion

Going down the line”

- Total operating expenses $14.29 billion, +6.2% y/y, below estimates $14.35 billion

- Cost of sales $51.05 billion, +4% y/y, above estimates $50.81 billion

- Gross margin $43.88 billion, +8.5% y/y, above estimate $43.46 billion

- Cash and cash equivalents $29.94 billion vs. $29.97 billion y/y, above estimate $26.04 billion

And so on:

Looking at a breakdown of sales by product category we find that revenue from the iPhone came in higher than expected, lifting overall revenue. It came in at $46.2 billion, beating estimates of $45 billion and growing over $1 billion year-over-year. Yet while Apple’s marketing engine around Apple Intelligence worked, the number came in somewhat shy of the more optimistic forecasts.

The rest of the product suite was mixed with Mac revenue coming in line with est at $7.74bn, while both iPads and wearables missed expectations ($6.95BN vs exp. $7.07BN, and $9.04BN, vs exp. $9.17BN).

- Macs came in with an about $100 million annual revenue increase, meeting Wall Street estimates of $7.7 billion. New Macs released this week should help that product segment in the current quarter.

- The iPad was a surprising miss, coming in just shy of $7 billion despite the release of the new iPad Pro and iPad Air models earlier this year. A new iPad mini released this month is unlikely to help materially.

- Wearables, Home and Accessories was another disappointment, declining considerably and missing Wall Street expectations. There simply is not a lot of excitement in Apple’s wearables segment right now — and the new AirPods are now an early-adopter product that aren’t likely to generate much momentum in the fourth quarter.

- The other concerning part about Wearables, Home and Accessories is that revenue continues to fall despite Apple launching a $3,500 device that is its first major new product category in a decade as part of the segment this year.

As Bloomberg notes, the iPad and Wearables numbers “are pretty concerning” and it feels like the overall wearables segment for Apple is tapering –– but it’s worth noting two of the bigger drivers there (the Apple Watch Ultra and AirPods Pro) haven’t seen meaningful updates in two years.

To be sure, it wasn’t all bad news: the fact that sales of iPhone — despite looking the same for half a decade and including little to no compelling upgrades over the prior few models — increased is a testament to Apple’s marketing might and brand strength. There are no signs of the iconic product slowing down.

But, at some point, Apple is going to need to inject some innovative — not iterative — changes in order to once again stand out from the crowd. Apple is extraordinarily lucky that its competitors in the consumer electronics space are doing absolutely nothing to take advantage of the opportunity in front of them to outpace Apple.

There was another disappointment: contrary to expectations for a modest rebound, China sales declined for a fifth consecutive quarter, down 0.3%, and printing at $15.03BN, below the $15.8BN estimate. The rest of the world saw growth, modest in the Americas at 3.9%, and stronger in Europe and APAC, both double digits.

As Bloomberg notes, Greater China continues to be a weak spot for Apple and the company hasn’t done much to push new products, pricing and initiatives in that market — or other emerging areas — to offset the issues.

The weakness there, which Apple will try to explain away in its conference call, is because of a combination of nationalism and interest in local products, whose designs are getting better. The local players are also trying new things like foldables while Apple continues to use the same design it rolled out five years ago.

Still, while revenues have declined for 5 quarter, the modest upward movement in YoY sales is encouraging.

Once again, Apple reached a new record in terms of its installed base of devices around the world. Yet with iPhone revenue ahead but China revenue missing, there’s a question: Did iPhone grow in China?

And while we wait for the answer, there was more disappointment for AAPL because after wearables and China missed, so did Service revenue, which at $24.97BN, up 12%, came light of estimates $25.27BN.

While services revenue was at an all-time record, the softness could become even softer in the future if governments continue to get their way and make Apple open up its App Store to alternative distribution and payment methods.

Commenting on the quarter, CFO Luca Maestri said that “our record business performance during the September quarter drove nearly $27 billion in operating cash flow, allowing us to return over $29 billion to our shareholders. We are very pleased that our active installed base of devices reached a new all-time high across all products and all geographic segments, thanks to our high levels of customer satisfaction and loyalty.”

Well at least the company is buying back stock hand over fist (it repurchased $25BN in the quarter), because shareholders are increasingly leery to do so. And speaking of blemishes, it is also worth noting that the dollar value for inventories in the quarter was around $900 million higher than the same period a year ago. Suppliers are a part of that: remember, Apple doesn’t make its own phones!

Putting it together, these mixed results will affirm concerns among investors that Apple is losing its shine considerably in China while continuing to flood the market with products that consumers simply don’t find appealing, as well as devices that are only iterative tweaks from prior versions. And so far, nothing Apple has shown in terms of its AI technology has the look of a company that is set to own a core piece of that industry moving forward.

Tyler Durden

Thu, 10/31/2024 – 17:16