Another Catastrophic Quarter From Boeing

In a time when literally nothing can go right for Boeing, and even its satellites are now randomly exploding in space…

A Boeing satellite just exploded.

Dozens of satellite fragments are now flying around the geostationary arc.

This company just can’t stop taking massive Ls… pic.twitter.com/EvRhXAAYUr

— Christian Keil (@pronounced_kyle) October 22, 2024

… this morning Boeing confirmed just how bad it all really is, when it reported yet another batch of catastrophic earnings just hours ahead of another momentous event for the company, a labor vote set for later Wednesday where the workers will decide whether to end their ongoing strike.

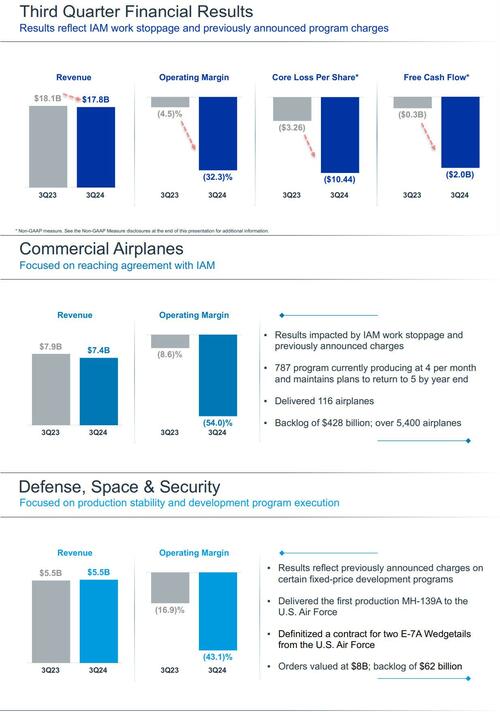

Here are the highlights: for Q3, Boeing reported a net loss of $6.17 billion, bringing total losses in 2024 to stunning $8 billion. This was on revenue of $17.84 billion which was down 1% from a year ago, and missed estimates, and generated adjusted cash burn of $1.96 billion, also worse than expected. The company reported revenue of about $17.8 billion, down about 1% from the same period last year. The figures closely matched the preliminary numbers it released last week. Here is the full breakdown:

Adjusted EPS loss $10.44, missing estimate loss/shr $10.31

Revenue $17.84 billion, missing estimate $17.89 billion

Commercial Airplanes revenue $7.44 billion, -5.5% y/y, missing estimate $7.66 billion

Defense, Space & Security revenue $5.54 billion, +1% y/y, missing estimate $5.6 billion

Global Services revenue $4.90 billion, +1.8% y/y, missing estimate $5.02 billion

Commercial airplanes operating loss $4.02 billion vs. loss $678 million y/y, missing estimate loss $3.15 billion

Defense, Space & Security operating loss $2.38 billion vs. loss $924 million y/y, missing estimate loss $1.94 billion

Global services operating earnings $834 million, +6.4% y/y, missing estimate $853.2 million

Negative adjusted free cash flow $1.96 billion, estimate negative $1.87 billion (Bloomberg Consensus)

Negative operating cash flow $1.35 billion vs. positive $22 million y/y, estimate negative $1.99 billion

And so on, you get the picture and if you don’t here it is:

Of note, Boeing’s commercial airplane division had an operating loss of about $4 billion versus a $547 million-loss a year earlier as Boeing announced a new delay for the first 777X jetliner and set plans to end wind down production of its 767 freighter.

Boeing’s defense and space business lost $2.38 billion in the quarter as it recorded additional cost overruns on fixed-price contracts for its KC-46 tanker, Starliner spacecraft and other programs. Ortberg ousted the division’s chief, Ted Colbert, early in his tenure as CEO.

Boeing said its slumping cash flow reflected “lower commercial widebody deliveries, as well as unfavorable working capital timing, including the impact of the IAM work stoppage.”

This meant that Boeing’s net cash declined by about $2.1BN to $10.5BN, and while the consolidated debt was roughly unchanged and still investment grade, rating agencies have both warned that Boeing is about to be junked unless it raises billions in new cash.

The company also reported it had a total backlog of $511 billion, which included over 5,400 commercial airplanes. Good luck delivering those.

“This is a big ship that will take some time to turn, but when it does, it has the capacity to be great again,” new CEO Kelly Ortberg said in a message to employees on the results.

In his first public presentation, Ortberg laid out a blunt assessment of what must change, saying Boeing has “some really big rocks that we need to get behind us to move the company forward.” Among the most immediate tasks, he said, is ending a strike that has crippled Boeing for weeks. Workers vote later today on whether to ratify a new contract offer.

“It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again,” Ortberg said and laid out a four-pronged plan that includes rebuilding a culture where management is close to the action to prevent “the festering of issues.” He’s also brought back detailed business reviews intended to unearth operations breakdowns before they morph into full-blown crises. And as it works to stabilize its business, he insisted Boeing can’t lose focus of building an all-new airplane.

“Boeing is an airplane company and at the right time in the future, we need to develop a new airplane,” Ortberg said in prepared remarks to investors. “But we have a lot of work to do before then.”

As reported previously, in its preliminary report last week Boeing it would end production of its 767 tanker jet and push back the release of its upcoming 777X widebody jet. The company also said it would a take $5 billion in pre-tax charges, with $3 billion coming from the commercial airlines division and $2 billion coming from its defense business.

Boeing also entered into an agreement to secure $10 billion in credit from a consortium of banks, and filed a mixed shelf registration with the SEC to offer up to $25 billion in new debt securities, common stock, preferred stock, and other share offerings. The WSJ reported Boeing would pursue a $10 billion stock offering via the filing, sources said.

The new credit agreement and debt and stock offerings come as the company is mired in a labor dispute with its largest labor union, representing 30,000 workers. Last week, CEO Ortberg announced the company would lay off 10% of its labor force, or around 17,000 employees, across all the divisions to shore up its financial position.

The layoffs, which will come as early as next month, will occur as Boeing’s labor dispute with the International Association of Machinists (IAM) may be nearing a close. Boeing workers will vote later on Wednesday whether to approve a new contract proposal.

The cost of the strike so far has been substantial for both Boeing and the workers, with one trade group estimating the total cost is nearing $5 billion.

“First and foremost on everybody’s mind today, is ending the IAM strike. We have been feverishly working to find a solution that works for the company and meets our employees’ needs,” Ortberg said.

Ortberg also added: “We need to reset priorities and create a leaner, more focused organization.”

For investors, the main event will be the strike vote later today, said Ken Herbert, an analyst with RBC Capital Markets. When Ortberg and Boeing Chief Financial Officer Brian West host an earnings call later this morning, listeners be looking for details on the underlying state of Boeing’s business during the labor strife and its plans for recovery.

“Honestly, to me it’s just how much is he comfortable saying now given that he’s been there two months, the strike’s still going on and he’s got a massive long-term strategic hill to climb,” Herbert said.

The planemaker has been beset by cascading crises since a door-shaped panel blew off a 737 Max 9 model during flight in early January. The accident has put the focus on sloppy workmanship and poor oversight at Boeing, with regulators capping output to help steady processes and the board appointing new senior management, including hiring Ortberg in August as CEO.

Ortberg sought to lay out a road map for Boeing’s revival, infused with a sense of optimism that customers and employees want the company to succeed. Which likely means he is already drafting his resignation.

Tyler Durden

Wed, 10/23/2024 – 10:55