Polymarket Is Singlehandedly Moving The Entire US Bond Market

Online betting exchange Polymarket has not only taken the attention space by storm, rapidly becoming one of the most downloaded Apple apps…

The mainstream lost its monopoly over media. Now it’s losing its monopoly over polls, prediction markets and shaping public opinion as trust shifts to independent new entities pic.twitter.com/wnyyck4ebB

— zerohedge (@zerohedge) October 17, 2024

… it is also quickly becoming a key driver behind the world’s largest and most liquid bond market.

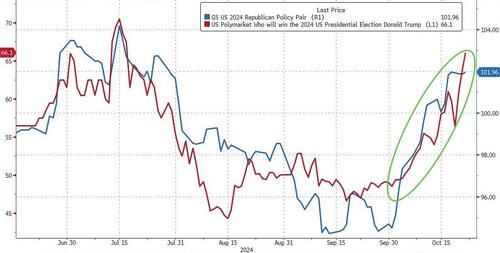

According to Bloomberg’s Masaki Kondo, Polymarket has become instrumental in setting at least the near-term price signals not only for the $28 trillion marketable US Treasury markets, but also for FX markets: that’s because both Treasuries and the Mexican peso appear to be pricing in a rising probability of Donald Trump winning the US presidential election, as indicated by Polymarket, while ignoring traditional polls which for the most part still show Kamala in the lead.

As Bloomberg chart below shows, the benchmark 10Y yield has been closely tracking the spread in the perceived odds of a vote victory between Trump and Kamala Harris. This difference has now surpassed 30% points, according to the latest data from Polymarket, with Trump seen as a odds-on favorite, and where Polymarket competitors such as Kalshi and PredictIt now also show almost identical odds albeit with a notable delay behind Polymarket, which has emerged as the undisputed leader in the online betting space.

In FX, USDMXN has also been tracking the Polymarket spread higher.

Even such Bloomberg luminaries as John Authers admit Polymarket’s role in setting bond prices:

In the last few months, it’s striking that the 10-year yield has traced the Trump odds according to Polymarket — an offshore market that may be over-influenced by a few large bettors, but which seems to be driving opinion on Wall Street.

Of course, Polymarket is just the starting signal: the actual driver behind the blowout move in yields, which as we noted earlier have surged by a whopping 50bps since the Fed’s very unironic 50bps rate cut one month ago…

… is a Pavolian response to what happened last time Trump won. Indeed, bond trader memory may still be fresh as the 10-year yield soared almost 80bps in about a month after Trump’s last victory in November 2016.

Granted, one can argue that “this time is different”, as the jump in yields back then was in part driven by the start of the Fed’s tightening cycle while the direction of Fed policy is the opposite now (even if paradoxically yields have surged since the Fed cut rates), but the kneejerk reaction to a market that is now aggressively pricing in a Trump presidency (see “Wall Street Going “All-In On Trump“) is clearly there.

Incidentally, a Trump win leading to higher yields would also underscore our observation made back in June, that a resilient US economy, one where deficits will only grow, will prevent the central bank from cutting interest rates as fast as a slowdown in inflation would suggest. Moreover, for the Mexican peso, Trump’s proposed tariffs on imports is seen as a major negative.

Then again, that may just be the first leg of the trade: the second one will be when yields tumble because, as Michael Hartnett warned, the outcomes of the election will be two: i) the next trade war with China will be deflationary and ii) the result of the election will see a big drop in government spending and thus, inflation.

For now however, keep an eye on how fast and how high yields will rise along with odds of a Trump presidency, and when stocks will finally notice the ongoing rout in the bond sector. For some clues on the latter, Goldman trader Ryan Sharkey warns that historically, a 2 standard deviation move in US 10 yr yield, equivalent to around 60 bps today over a month, is when equity market returns start to get hit.

As Goldman concludes, given we’ve moved 46bps MTD, this simple rule of thumb argues that a move towards 4.30% is where things would get tricky for stocks: speed of the move matters and keep an eye on real yields.

Better yet, just keep your eye on Polymarket.

Tyler Durden

Tue, 10/22/2024 – 15:05