Job Openings Unexpectedly Jump Over 8 Million On Record Surge In Construction Job Openings

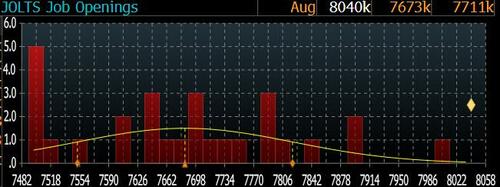

One month after the “catastrophic” July JOLTS report presaged the ugly August jobs report, which in turn prompted the Fed to cut a “jumbo” 50bps and spooked markets that a recession may be imminent, moments ago the BLS reported that in August (as a reminder, the Job Openings and Labor Turnover report lags the Payrolls report, which is due on Friday, by one month), job openings unexpectedly jumped by 329K from an upward revised 7.711 million in July (up from 7.673 million) to 8.040 million in August, smashing the median estimate of 7.673 million, and coming above the highest Wall Street estimate.

The August print was the biggest monthly increase in job openings since last August!

What is remarkable is that this unexpected spike in job openings comes at a time when 3rd party metrics, such as the ISM Mfg employment index keeps sinking, dropping to 43.9 in September…

…. with the divergence between the JOLTS job openings and the ISM’s percentage of respondents who believe employment will be lower, hitting a record high.

But what is even more remarkable – and laughable – is that the surge in job openings was primarily due to a time series which we pointed out last month indicated a collapse in the construction sector as the divergence between the job openings in the construction sector and actual construction jobs hit a record high. Well, after that particular print, the BLS decided to reverse the entire July loss and then some.

So how big was the August jump in construction job openings? Funny you ask: it was the biggest on record!

And while this number was clearly bullshit, coming at a time when new home starts is the lowest in years, the BLS decided to double down and reported that the balance of the job openings surge in August came from state and local government jobs, which surged by +78,000.

Because when in doubt how to goose the economy may as well as just make the deep state bigger.

Ignoring the data manipulation, in the context of the broader jobs report, in August the number of job openings was 925K more than the number of employed workers, 510K more than the number of unemployed workers (which the BLS reported was 7.115 million), up from last month’s 548k, which was the lowest since April 2021.

Said otherwise, in July the number of job openings to unemployed dropped to just 1.07, a plunge from the June print of 1.16, the lowest level since May 2021 and now officially below pre-covid levels.

While the job openings data set was an upside shock thanks to a record surge in construction sector jobs, where the weakness continued was in the number of hires, which resumed their drop, sliding by 99k to 5.317 million, just shy of the lowest since the covid crash, while the number of quits plunged to a fresh 4 years low of 3.084 million.

Finally, no matter what the “data” shows, let’s not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it – or some 70% to be specific – is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 33%

In other words, more than two thirds, or 70% of the final number of job openings, is made up!

Tyler Durden

Tue, 10/01/2024 – 10:34