$5 Billion Per Day Nightmare Looms Amid Rising Risk Of Paralyzing US Port Strikes

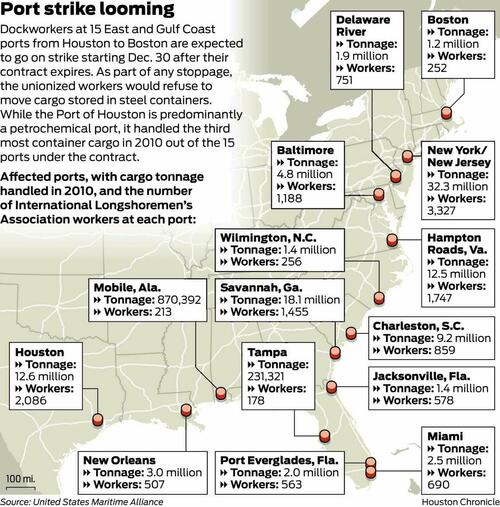

Goldman analysts have created a framework specifying that if the International Longshoremen’s Association (ILA) and the US Maritime Alliance (USMX)—a coalition of port operators and carriers—fail to reach a new contract agreement in three days (or by the end of September 30), a strike along East and Gulf Coast ports could erupt, jeopardizing $5 billion in daily international trade.

“We analyzed the potential impact to trade value into the East Coast and Gulf Coast Ports if work disruption were to occur (we take no view on the likelihood of any outcome),” Goldman’s Jordan Alliger told clients on Thursday.

Alliger continued, noting that “upwards of $4.9bn per day is at risk in international trade along the East and Gulf coasts, along with the potential for supply chains to likely become less fluid due to emergent congestion, which in turn could result in a re-emergence of transport price inflation.”

Clients were reminded about the scale of the potential labor action early next week. Any strike would immediately result in 45,000 ILA workers walking off container ports. These ports represent 52% of all port traffic in 2023. In other words, any disruption would spark massive supply chain snarls for the eastern half of the nation.

Alliger and his team of analysts shared their “high-level” thoughts on the situation:

Even without any work disruption there has likely been some diversion to West Coast Ports and maybe even some Canadian ports (although likely not significant in Canada). In addition, various channel checks also suggest some pull forward in demand likely occurred both into the East/Gulf and West Coast to try to get ahead of any potential work disruption (and other political and geopolitical reasons). Exhibit 1 shows Strong West Coast port traffic as well as rail intermodal strength – possible inferences to early demand and/or diversion.

Looking at the growth YTD, now 67% through the year, we have seen 1.28mn more containers so far in 2024, or around 95% of the needed annual growth to catch up to where we would be if growth was at a normalized rate from 2019, which could be pointing toward 1) pull forward in demand and 2) diversion to the west coast. We also note that three of the four east/gulf coast ports that have reported August data have shown a lower seasonality from July to August, which could be showing the share shift to the west coast, as more and more shippers would likely have started to shift to the west coast as we near contract expiry.

China to WC shipping rates, while down 15% from July highs remain at very robust levels ($6,800-$6,900) – essentially 3.9x versus one year ago.

If there were to be a work disruption – then more traffic would likely be diverted to west coast ports. This could create additional logistical burdens on shippers, and we believe could lead to at least a short term spike in transport costs to the shipper – depending on how long any potential work disruption could last. This could also cause general inflation to be impacted.

In terms of companies, we see potential upside risk for those with heavy exposure to WC from added volumes initially – such as UNP/BNSF amongst rails. Although all the rails could see some business at some point – if more goods comes into WC and have to go to NY for instance – eventually there could be interchange with NSC or CSX. But the immediate positive impact would likely be for WC rails, and another heavy west coast participant could be JBHT – which handles intermodal with meaningful exposure to the WC as its main partner is BNSF.

Broadly a potential work disruption could likely tighten up transports markets and congestion could rise – meaning truckers could see price related upside as trucks and drivers at least initially could become constrained in the west coast.

From an air and forwarder perspective, work disruption has historically had a positive impact on forwarders, and to the extent shippers miss an ocean shipping window (it takes about 45 days door to door to move something from China to the USA) it could require them to utilize more air capacity. Tighter capacity in air could also have a positive impact on parcel players (FDX, UPS), as well as possibly heavier weight cargo.

Overall supply chain congestion could likely rise. About two months ahead of the West Coast Longshoreman contract ratification on August 31, 2023, our Supply Chain Congestion tracker showed an approximate 40% sequential rise – dropping off post ratification. Note that while the initial impacts to transport providers could likely be favorable from a demand (depending on location) and price perspective (in the three months leading up to ratification spot truck rates rose about 12% sequentially) – certain network intensive sub-sectors (e.g. rails) could see networks become less fluid the longer a stoppage lasts as potentially goods back up at ports and/or warehouses – posing some risk to operations based on prior experience. Even if any work disruption lasts only a few days, it could take a week or more to clear up the congestion and eliminate the backlogs.

Bottom line, while we do not take a view on any potential outcome, we point out the various risks and potential upsides to a work disruption; and our analysis shows a risk to ocean goods value at up to $4.9bn per day.

The analysts estimate “that a potential work disruption could impact ~61% of total US ocean trade and 25% of total US daily trade in October.”

Separately, the CEO of Flexport—one of the largest US supply-chain logistics operators—recently warned that “the biggest wild card in the presidential election that nobody’s talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election.”

The biggest wild card in the presidential election that nobody’s talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election. 🧵

— Ryan Petersen (@typesfast) September 18, 2024

Earlier this week, Goldman’s Alliger informed clients that US congestion at ports is 2 out of 10 ahead of potential strikes.

Meanwhile, strike preparations are being made at the Port of New York-New Jersey, as officials at the major port urged shippers to wind down cargo business.

Details about contract proposals between ILA and USMX remain non-existent in the public domain, as contract expiry is slated for Monday.

Tyler Durden

Thu, 09/26/2024 – 17:20