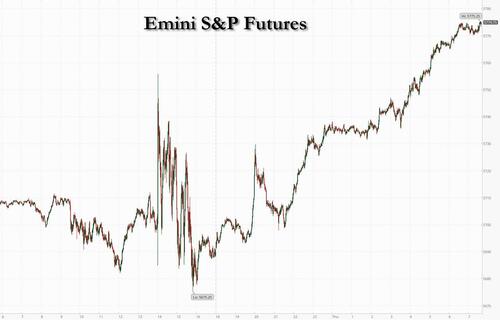

Futures Rip To New All Time Highs After Fed Rate Cut, As Yields, Commodities Jump

The Fed’s first (jumbo) rate cut since the depths of the covid crash resulted in mixed reaction in markets, with initial gains for stocks fizzling and ultimately tepid moves in Treasuries, corporate bonds and commodities. However, this reversal to the kneejerk reaction has also since reversed, and US stock futures are bouncing this morning, rising to new record highs, amid gains across Europe and in Asia, while gold is heading back toward a record high and copper prices hit the strongest level in two months to lead a broad rally in base metals in what appears to be a gradual awakening of the reflation trade. As of 8:00am, S&P futures are up 1.7%, and Nasdaq futures surged more than 2.1% as part of a global risk-on trade. Similar to past rate cuts in slowing macro environments, the Nasdaq and Russell are outperforming. Pre-mkt, Mag7 names are all higher by at least 1.6%, Semis are stronger too with NVDA +3.3%. Europe’s Stoxx 600 index advanced as much as 1.4%, while Asian stocks were a sea of green, as a basket of Asian currencies notched up a 14-month high even as the Japanese yen plunged with traders once again eyeing yield differentials. The yield curve is bull steepening though 30Y is unchanged and USD is flat. Commodities are higher led by the Energy complex with precious metals outperforming base (Gold +1.3%, Silver +4.0%). The macro data today (Jobless Claims, Home Starts) will be ignored given the dovish press conference from Powell; expect multiple indices and sectors to make ATHs today.

In premarket trading, cryptocurrency-linked companies rally as Bitcoin climbs with US equity futures; Coinbase, Riot Platforms, Marathon Digital and CleanSpark all rose. Here are some other notable premarket movers:

DoorDash (DASH) gains 3.9% after BTIG upgraded the food-delivery company to buy from neutral, saying its checks signal continued strength, while touting “under-appreciated” longer term drivers.

Mobileye (MBLY) shares rise 7.6% after Intel said it does not currently have any plans to divest a majority interest in the company.

Steelcase (SCS) shares fall 6.9% after the maker of office furniture gave a third-quarter revenue forecast that fell short of the average analyst estimate.

In a move that Donald Trump called either political intervention or confirmation the US economy is doing much worse than indicated, the Fed cut rates by 50 basis points, a big move designed to preserve the strength of the US economy amid mounting risks to the labor market which has been flooded with illegal aliens. Jerome Powell said taking the step now would help to limit the chance of a full-blown downturn, while being careful to avoid committing to this as the new pace for rate reductions. Michelle Bowman dissented, voting for a 25-basis-point cut, the first time a Fed governor has done that since 2005.

Wednesday’s decision reinforced expectations that the US economy will escape a downturn. A survey of Bloomberg Terminal subscribers shows 75% expect the US to avoid a technical recession by the end of next year. At the same time, traders ramped up their bets on cuts to come from the Fed too, with more than 70 basis points of reductions seen for the rest of this year. That’s higher than the half-point of further easing implied by the Fed’s dot plot. A Citigroup trader called the jumbo cut, and so did JPMorgan, though the latter is less sure about what comes next. Mohamed El-Erian, meanwhile, saw the cut as dovish, while others on Wall Street suggested it indicated that the Fed regrets not cutting at its previous meeting.

“What we are seeing is the belief that the Fed has everything under control and they are going to engineer a soft landing and therefore risk assets are moving ahead strongly,” Jon Bell, a portfolio manager at Newton Investment Management, said on Bloomberg TV.

The Fed’s first reduction in more than four years was accompanied by projections indicating an additional 50 basis points of cuts across the remaining two policy meetings this year. Fed Chair Jerome Powell said launching the unwind of the central bank’s historic tightening campaign with a big move while the US economy is still strong would help limit the chances of a downturn.

“The Fed is embarking on what I see as a series of rate cuts,” said Stephen Jen, the chief executive at Eurizon SLJ Capital. The size of the initial move “won’t make a big difference as equities should soon stabilize, bond yields will likely drift lower for good reasons — like disinflation and not a hard landing. The dollar should continue to weaken against a broad range of currencies,” he said.

It wasn’t just the Fed making waves: the pound strengthened to the highest against the dollar since March 2022, surpassing $1.33, after the Bank of England kept rates on hold Thursday, and warned investors it won’t rush to ease policy. Government bonds retreated, money markets pared wagers on 2024 rate cuts and UK stocks trimmed an advance.

“We should be able to reduce rates gradually over time,” Governor Andrew Bailey said in a statement, stressing that such a path would depend on price pressures continuing to ease. “It’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.”

Norway’s krone led gains against the dollar after the central bank kept borrowing costs unchanged and signaled no intention to cut them before next year as it contends with inflation risks. The lira rose after the Turkey’s central bank held its main interest rate at 50%, as expected, with the statement broadly unchanged, i.e. no significant softening in language as some were hoping for.

European shares jumped 1.1% to their highest in over two-weeks and near record highs, with mining and automobile shares leading gains. Telecommunications and utilities stocks are the biggest laggards. Here are the biggest movers Thursday:

Ocado jumps as much as 16% after the grocer reported third-quarter retail sales that came ahead of consensus estimates. The company also raised its FY24 revenue guidance for Ocado Retail.

Davide Campari-Milano rise as much as 8.3%, reversing a portion of yesterday’s sharp losses, after a Campari group holding company, Lagfin, said it would buy more shares in the Italian beverage maker

Merck KGaA gains as much as 2.9%, the most since July, after Goldman Sachs initiated coverage of the German health-care group with a buy recommendation

Next shares jump as much as 6.9%, hitting a fresh record high, after the clothing retailer boosted its full-year pretax profit forecast. Additionally, the company’s first-half total group sales surpassed estimates

Babcock International climbs as much as 3.7% after the support services firm said organic revenue and underlying operating profits grew in the five months to the end of August

Bytes Technology shares rise as much as 7.1%, the biggest jump in 11 months, after reporting strong trading in the first half of the year. Analysts at Shore and Jefferies note that recent share underperformance suggests potential for re-rating

Air France-KLM shares rise as much as 4.3% after BNP Paribas Exane upgrades the stock to neutral from underperform. The broker notes that factors that weighed on the stock this year

REC Silicon rallies as much as 33% after the Norwegian silicon firm announced it will supply Sila Nanotechnologies with US-produced silane for use in the production of Sila’s anode material from its manufacturing facility in Moses Lake, Washington

Kone falls as much as 4.6% in Helsinki after announcing a new strategy for 2025-2030, including new mid-term financial targets, aiming to lead in employee and customer experience, sustainability and innovations

Note AB falls as much as 15%, the most since December, after the Swedish electronics contract manufacturer trimmed its outlook as consumer demand continued to lag

S4 Capital shares plunge as much as 15% to the lowest level in almost six months after the digital advertising company warned that annual like-for-like net revenue will decline more than previously anticipated

Earlier in the session, an Asia gauge of stocks rallied by the most in a week, while an index of Asian currencies rose to the strongest level in more than a year. The MSCI Asia Pacific Index gained 1.3%, with Japanese exporters including Toyota and Hitachi among top gainers. Both stocks jumped by the most in over a month as the yen plunged having priced in a much more dovish Fed. Hong Kong’s benchmark climbed 2% to the highest level in two months, helped by gains in technology firms. Property-developers in both China and Hong Kong gained, as the latter cut its base interest rate following the Fed’s eased policy.

“I am upbeat on Asian equities following the Fed’s 50 basis points rate cut,” said Rajeev De Mello, chief investment officer at GAMA Asset Management SA. Investors will increase their expectations of a soft landing scenario and that is beneficial for emerging markets and Asia, he added. Some of the less loved asset classes, like small caps, and emerging market equities “should really take solace” that the Fed tightening cycle is over and that monetary easing has started, he said.

On the monetary policy front, Bank of Japan Governor Kazuo Ueda faces the delicate task on Friday of making sure investors are firmly aware of rate hikes to come, without ruffling markets even as he stands pat on policy. The yen swung between gains and losses in volatile trading Thursday.

In FX, a gauge of the dollar weakened 0.4%, pulling it closer to its January lows as the Bloomberg Dollar Spot Index reversed an earlier gain to fall 0.5%. The Norwegian krone has climbed to the top of the G-10 FX leader board, rising 1.4% after the Norges Bank left rates unchanged and signaled they would remain there for the rest of the year. The Aussie dollar rises 1% after jobs data impressed. The pound is up 0.5% ahead of the Bank of England decision where borrowing costs are widely seen on hold.

In rates, the treasuries curve is steeper as US trading begins, after front-end outperformance during Asia session and London morning drove 2s10s spread above 11bp to widest level since June 2022. Treasury front-end yields are richer by nearly 3bp with longer-dated yields little changed, steepening 2s10s, 5s30s spreads by 3bp and 2bp on the day; 10-year is around 3.71% with bunds and gilts in the sector lagging by ~1bp; of note here is that the last time yields rose after a 50bps rate cut was… October 2008. Something to keep in mind. Front-end gilts pared early gains after Bank of England rate decision, with the 2-year rising from to 3.885% from around 3.86%.The Bank of England left rates unchanged at 5% and said it won’t rush to ease further. US session includes weekly jobless claims data and a 10-year TIPS reopening.

In commodities, oil advanced as the risk-on tone swept across wider markets, with traders monitoring escalating tensions in the Middle East. WTI rising 1% to $71.65 a barrel. Gold resumed its ascent back toward a record, and was last some $33 higher to around $2,592/oz; silver rallied and copper climbed to its highest level since mid-July, spurred on by the Fed’s move. Bitcoin hit a three-week high.

Looking at today’s calendar, the roster of Fed speakers is empty for the day and the economic agenda is thin too, with initial jobless claims top of the bill. Darden Restaurants, the owner of the Olive Garden chain, is reporting, with logistics giant FedEx set to update after the close in New York. And there’s a policy decision from the Bank of England today (where it kept rates unchanged), ahead of the Bank of Japan on Friday and after Hong Kong cut rates for the first time since 2020.

Market Snapshot

S&P 500 futures up 1.3% to 5,695.00

STOXX Europe 600 up 0.9% to 519.46

MXAP up 1.4% to 185.45

MXAPJ up 1.1% to 578.97

Nikkei up 2.1% to 37,155.33

Topix up 2.0% to 2,616.87

Hang Seng Index up 2.0% to 18,013.16

Shanghai Composite up 0.7% to 2,736.02

Sensex up 0.2% to 83,137.98

Australia S&P/ASX 200 up 0.6% to 8,191.92

Kospi up 0.2% to 2,580.80

German 10Y yield little changed at 2.20%

Euro up 0.4% to $1.1161

Brent Futures up 1.1% to $74.44/bbl

Gold spot up 0.9% to $2,583.13

US Dollar Index little changed at 100.63

Top Overnight News

US House defeated the Republican stopgap funding bill, while House Speaker Johnson said he will craft a new stopgap spending bill.

Iranian cyber actors in late June and early July sent unsolicited emails to individuals then associated with Biden’s campaign that contained excerpts taken from stolen material from Trump’s campaign, while Iranian cyber actors have continued their efforts since June to send stolen material associated with Trump’s campaign to US media organisations, according to US intelligence agencies.

China to ramp up policy steps to revive economy but no ‘bazooka’ stimulus seen. China expected to trim its Loan Prime Rate (LPR) tonight, w/the Fed’s outsized cut giving the PBOC more flexibility to ease. RTRS

Industries such as finance, consumer tech and property — key drivers of China’s growth for much of this century — are now out of favor. Instead, the most powerful Communist Party leader since Mao Zedong is funneling resources toward endeavors such as electric vehicles and chip production. “High quality” growth is the new mantra, not “high speed.” BBG

Brazil’s real looks set for a boost from carry trades after the central bank lifted its interest rate for the first time since 2022 and signaled more hikes are coming — just three months after halting an easing cycle. BBG

ECB’s Centeno says the central bank may need to accelerate the pace of easing. BBG

The BOE will probably hold its key rate at 5% today, following last month’s cut. Governor Andrew Bailey may offer more hints that it will ease again in November, though Bloomberg Economics expects officials to signal caution. BBG

Putin under growing pressure to authorize a troop mobilization as Russia’s military loses soldiers at a faster rate than it can recruit them. WSJ

Harris and Trump are tied nationally at 47%, but she’s leading by 4 points in PA according to new data published in the NYT. NYT

Microsoft is working with Anduril on combat goggles for the US Army in a project that may generate as much as $21.9 billion over a decade. BBG

Apple will face pressure from the EU to open its iOS to rivals or face sig. fines. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were in the green as the region reacted to the Fed’s oversized 50bps rate cut. ASX 200 was underpinned and printed a fresh record high albeit despite somewhat ambiguous jobs data which showed headline Employment Change topped forecast but was entirely due to Part-Time work as Full-Time jobs contracted. Nikkei 225 outperformed and surged above the 37,000 level on the back of a weaker currency. Hang Seng and Shanghai Comp conformed to the positive mood with the former led higher by strength in tech and property after the HKMA cut rates by 50bps in lockstep with the Fed, while the mainland index was also boosted following the PBoC’s continued liquidity efforts and despite the lingering EU tariff concerns.

Top Asian News

HKMA cut its base rate by 50bps to 5.25%, as expected in lockstep with the Fed, while it stated that the US interest rate cut will have a positive impact on the city’s economy and will provide some room for easing of local interest rates.

China’s Commerce Minister said regarding the EU’s electric vehicle probe that China will continue to negotiate ‘until the last minute’ and the investigation has undermined ‘confidence’ of Chinese companies in investing in Europe. It was separately reported that EU capitals will not get to vote on Chinese EV duties next week with the poll removed from the committee agenda for September 25th, according to Politico.

Chinese policymakers will likely step up measures to at least help the economy meet its 2024 growth target with more focus on boosting demand to fight deflationary pressures, “but any forceful stimulus looks unlikely”, via Reuters citing advisors/analysts. Elsewhere, the Chinese government has been urged by a think tank to strengthen coordination of policy in order to improve economic governance, via People’s Daily.

Taiwan raises RRR by 25bps.

European bourses, Stoxx 600 (+1%) opened the session on a very strong footing, taking positive leads from firm APAC session overnight as the region digested the Fed’s decision to opt for a 50bps cut. European sectors hold a strong positive bias; Basic Resources takes the top spot alongside Tech, owing the positive risk on sentiment. Utilities and Telecoms are the laggards. US Equity Futures (ES+1.4%, NQ +1.6%, RTY +2%) are indicative of a very strong open, with clear outperformance in the economy-linked RTY, benefitting from the Fed’s decision to opt for a larger 50bps cut. Apple (AAPL) faces a warning from the EU to open up its iPhone operating system to rival technologies, according to Bloomberg; failure to comply could risk a fineFine could be up to 10% of global annual turnover.

Top European News

Norwegian Key Policy Rate 4.5% vs. Exp. 4.5% (Prev. 4.5%); the policy rate forecast implies that the policy rate will remain at 4.5% to the end of 2024 before being gradually reduced from Q1-2025.

ECB’s Knot says there is room for further cuts if inflation outlook holds. “More or less fine with market’s cut expectations”.

ECB’s Schnabel slide release: sticky services inflation is keeping headline inflation at elevated level; Real wage catch-up remains incomplete in large parts of the euro area; Signs that transmission of monetary policy tightening is weakening. Labour demand remains high amid low unemployment and persisting labour shortages. Pass-through of higher wages to producer prices is stronger in the services sector. Demand for services has been resilient but is starting to weaken. Price pressures in the services sector are broad-based and global. Geopolitical uncertainty remains a key risk to the outlook.

Swiss Government Forecasts: Sees 2024 CPI at +1.2% (prev. 1.4%), 2025 CPI seen at +0.7% (prev. 1.1%); 2024 GDP maintained at 1.2%, 2025 GDP seen at +1.6% (prev. +1.7%)

New car registrations: -18.3% Y/Y in August 2024 (vs +0.2% in July 2024); battery electric market share 14.4% (vs 21% in August 2023), according to ACEA.

FX

USD is mostly lower vs. peers (CHF and JPY the exceptions), after the two-way price action seen in the aftermath of the FOMC rate decision and press conference. DXY is still holding above the YTD low printed yesterday at 100.21 in the aftermath of the 50bps cut.

EUR is firmer vs. the USD but below yesterday’s post-FOMC best at 1.1189. Attention is on whether the decisions taken on Wednesday by the Fed will be enough to make a sustained breach of the 1.12 mark.

GBP is firmer vs. the USD but below yesterday’s best levels which saw Cable print a fresh YTD peak before running out of steam ahead of 1.33 during Powell’s press conference. Attention today turn’s to the BoE, where it is widely-expected to keep the Base Rate at 5%, most likely via a 7-2 vote split.

JPY is losing out to the USD despite the dollar being broadly softer vs. peers. This in part could be more a by-product of the current risk environment rather than a policy read between the Fed vs. BoJ.

Antipodeans are both benefiting from the current risk environment whilst also digesting domestic data releases. AUD is the top performer across the majors post-strong employment data, albeit, it is worth noting that a lot of the increase was driven by part-time jobs.

EUR/NOK fell from 11.70 to 11.6657 in an immediate reaction to the Norges Bank policy announcement before extending to an 11.6517 session low. The Bank kept rates unchanged at 4.50% (as expected), and guided the first rate cut to be in Q1’25 (prev. guided Q2’25); disappointing some expectations of potentially guiding towards Q4-2024 (i.e. December’s meeting).

PBoC set USD/CNY mid-point at 7.0983 vs exp. 7.0924 (prev. 7.0870).

Brazil Central Bank raised its Selic rate by 25bps to 10.75%, as expected with the decision unanimous, while it stated the pace of future adjustments and overall adjustment magnitude will be guided by the firm commitment to reaching the inflation target and that the current scenario requires more restrictive monetary policy.

Fixed Income

USTs lifted from overnight lows but still just about in the red for today’s session as markets continue to digest the FOMC ahead of data this afternoon. Currently holding around the 115-00 mark, which is at the top-end of the day’s range and clear of the overnight 114-22 base.

Bunds are slightly softer, in-fitting with USTs which continue to digest the FOMC, alongside supply from France and Spain which were well received but sparked no real reaction. Bunds are back above the 134.00 mark though the 134.31 peak is someway shy of Wednesday’s 134.86 best.

Gilts are essentially flat ahead of the BoE policy announcement, where an unchanged outcome is expected though this will undoubtedly be subject to dissent with 7-2 most likely though 6-3 and 8-1 are also plausible outcomes.

France sells EUR 12bln vs exp. EUR 10-12bln 2.50% 2027, 0.75% 2028, 2.75% 2030 and 2.00% 2032 OAT.

Spain sells EUR 5.56bln vs exp. EUR 5-6bln 5.15% 2028, 3.10% 2031, and 3.45% 2043 Bono.

Commodities

Firm trade in the crude complex as a function of the post-FOMC risk appetite, softer Dollar, and heightened geopolitical landscape. Brent’Nov hit a USD 74.54/bbl high following a low print of 72.91/bbl.

Higher across precious metals, largely as a function of the Dollar, bond yields, and geopolitics. Spot silver outperforms but as it retraces the slump seen yesterday. Spot gold meanwhile found resistance as USD 2,600/oz yesterday before pulling back. XAU trades in a current USD 2,551.16-2,585.13/oz range.

Strong performance across base metals thus far amid the jumbo Fed rate cut and softer Dollar, whilst the firm APAC performance and report of the likelihood of more Chinese stimulus only added to the tailwinds.

Qatar set November-loading Al-Shaheen crude term price at USD 2.09/bbl above Dubai quotes which is the highest premium in five months, according to sources.

Indian refiners using Russian insurance cover for Russian oil Cargoes priced above USD 60bbl, via Indian Gov source.

Geopolitics: Middle East

“[Israeli PM] Netanyahu holds a security assessment session today at the headquarters of the Ministry of Defense in Tel Aviv”, according to Al Arabiya

Israel submitted a new proposal that includes the release of all hostages at once and securing the exit of Hamas leader Sinwar from the Gaza Strip along with anyone who wishes to leave the Gaza Strip, according to Sky News Arabia citing Israeli media. Furthermore, Israel Broadcasting Corporation said the proposal includes the release of Palestinian prisoners, the disarmament of the Gaza Strip, the application of another mechanism of governance there, and an end to the war.

Lebanon’s Foreign Minister told CNN that Hezbollah was hit hard and a response is a must for it, according to Asharq News.

US Defence Secretary Austin spoke to Israel’s Defence Minister Gallant to review regional security developments and reiterated US support for Israel amid Iran and Hezbollah threats, according to the Pentagon.

Japan’s Icom (6821 JT) said it was investigating facts surrounding reports that two-way radios bearing the Icom logo exploded in Lebanon, while it later stated that it is not possible to confirm whether the radio product related to Lebanon explosions was shipped by the Co. and noted that the sales of batteries required to operate the device were discontinued about 10 years ago.

Israel army and Hezbollah exchange fire at the border, according to Walla News’ Elster.

Geopolitics: Other

US has no immediate plans to withdraw Typhon missile system from the Philippines which is being used in joint training exercises with the US and the Philippines testing the feasibility of the system’s use in the event of a conflict, while a Philippine government source said there is strategic value in keeping the missile system in the Philippines to deter China.

North Korea said it tested a new tactical ballistic missile on Wednesday which was a modified strategic cruise missile and used a super large warhead in the tactical ballistic missile test which was supervised by North Korean leader Kim. Furthermore, Kim said the country must maintain overwhelming attack capabilities of conventional weapons while continuing to increase nuclear capabilities, according to KCNA.

US event calendar

08:30: Sept. Initial Jobless Claims, est. 230,000, prior 230,000

Sept. Continuing Claims, est. 1.85m, prior 1.85m

08:30: 2Q Current Account Balance, est. -$260b, prior -$237.6b

08:30: Sept. Philadelphia Fed Business Outl, est. 0, prior -7.0

10:00: Aug. Existing Home Sales MoM, est. -1.3%, prior 1.3%

10:00: Aug. Leading Index, est. -0.3%, prior -0.6%

DB’s Jim Reid concludes the overnight wrap

After keeping rates on hold for 14 months, the Fed finally reversed course and delivered a 50bp cut last night, lowering the fed funds target to the 4.75-5.00% range. This was an 11-1 decision with Bowman becoming the first Fed Governor to dissent since 2005, favouring instead a 25bp cut. The larger cut came amid a dovish shift to the Fed’s inflation and unemployment projections compared to June, with 2025 PCE inflation lowered two tenths to 2.1% and unemployment raised two tenths to 4.4%. The SEP also showed a notable shift in the balance of risks, with a clear majority of the FOMC now seeing unemployment risks weighted to the upside but inflation risks as broadly balanced.

However, accompanying the larger cut was a signal of a fundamentally strong economy with no suggestion that continued 50bp cuts were likely. Growth projections were little changed and the dot plot showed the median FOMC member expecting the fed funds range at 4.25-4.50% at year-end. That implies a total of 50bp of further easing over the November and December meetings. In the press conference, Powell repeatedly framed the decision as a “recalibration”, saying that “there is no sense that the committee is in a rush” and adding that “I do not think that anyone should look at this and say that this is the new pace” for easing going forward. Following the meeting, our US economists continue to see the Fed cutting by 25bps per meeting through to March 2025 before slowing to a quarterly pace thereafter. That would leave the fed funds rate in the 3.25-3.5% range at end-2025, near DB’s estimate of nominal neutral.

While fed fund futures had favoured a 50bp cut going into the meeting, market sentiment had showed signs of drifting back towards 25bp. The implied pricing of a 50bp cut fell to below 60% earlier in day, its lowest since the start of the week. In part that echoed comments in the morning by former Cleveland Fed president Mester, who said that “there’s a good case for just doing a series of 25s”. Indeed, our own flash poll for yesterday’s CoTD suggested that the 50bp cut might be the bigger shock to many people, with 62% of responders expecting the smaller 25bp move.

Consistent with this, rates and equities saw a strong initial reaction to the decision, but this then reversed as Powell spoke although equities are notably higher again in Asia. While December fed funds futures ended the day -4.8bps lower, reflecting the larger cut, Fed pricing for a year from now in September 2025 actually moved +2.6bps higher on the day. For Treasuries, the 2yr yield fell by 11bps after the rate announcement to trade -7bps lower on the day, but it ended the session up +1.4bps at 3.62% and is trading at 3.65% this morning as we type. Further out on the curve, 10yr yields fell -4bps to trade marginally lower on the day following the Fed decision but more than reversed the move later on, closing +5.8bps higher at 3.70%. 10yr yields are another +1.7bps higher overnight. On the whole, the rates moves were consistent with our strategists’ take earlier in the week (see here) favouring a twist steepening in the event of a 50bp cut.

On the equity side, the S&P 500 had been trading flat on the day and spiked by nearly 1% on the Fed decision. However, it gave up these gains and a bit more to close -0.29% lower on the day, ending a run of 7 consecutive gains. The NASDAQ (-0.31%) and the Mag-7 (-0.14%) also posted moderate losses, while the small cap Russell 2000 (+0.04%) saw a slight outperformance. This up-and-down move was also visible across other asset classes. The dollar fell by -0.6% against the euro intra-day but recouped those losses later on. Gold touched $2600/oz for the first time ever as Powell began to speak but was down -0.41% to $2558.91/oz by the close.

However Asia has seen a resurgence in risk appetite with S&P (+0.97%) and NASDAQ (+1.41%) futures flying this morning. The Nikkei (+2.49%) though is the star of the show helped by a -0.6% decline in the Yen as the BoJ starts its 2-day policy meeting. Elsewhere, the Hang Seng (+1.26%) is also trading sharply higher after resuming trading post this week’s holiday as the Hong Kong Monetary Authority cut its interest rate for the first time since 2020, easing by 50bps to 5.25%, mirroring the Fed’s policy easing. Elsewhere, the CSI (+0.70%) and the Shanghai Composite (+0.42%) are seeing a mild rebound from seven-month lows while the KOSPI (-0.25%) is bucking the region’s trend after trading resumed following their three-day national holiday.

Early morning data showed that Australia’s unemployment rate remained steady in August at 4.2% while the number of employed people grew by 47,500 (v/s 26,000 expected). Meanwhile, the participation rate remained at its record level of 67.1%. Following the release of the jobs data, the Australian dollar (+0.38%) is extending its gains for the fourth straight session trading at 0.6790 against the dollar. Meanwhile, yields on the 10yr Australian government bonds have moved +7.3bps higher trading at 3.94% as we go to press.

Looking forward, central banks will stay in the spotlight today, as the Bank of England are announcing their latest policy decision. They delivered an initial rate cut at their previous meeting in August, but it was a close 5-4 vote in favour, and this time around it’s widely expected that they’ll leave rates unchanged at 5%. In his preview, DB’s UK economist also thinks they’ll keep rates unchanged, but the particularly interesting feature of today’s decision will be the vote on the pace of QT for the next 12 months. He thinks that there’ll be a QT increase of around a wider range between £107-127bn, implying a quarterly sales target of £5-10bn. But the risks are skewed to them sticking to a £100bn envelope. See the full preview here

Ahead of that, we also had the UK CPI release for August yesterday, which was in line with consensus at +2.2%. The details were also as expected, with core CPI rising to +3.6%, and services CPI up to +5.6%. In turn, that led investors to dial back the probability of a rate cut at today’s meeting, which fell from 24% to 16% by the close. UK gilts underperformed as well, with the 10yr yield up +7.9bps, and sterling strengthened +0.40% against the US Dollar.

Elsewhere in European markets, there were decent losses as investors looked forward to the Fed’s decision after the close. That meant all the major equity indices lost ground, including the STOXX 600 (-0.50%), the FTSE 100 (-0.68%), the CAC 40 (-0.57%) and the DAX (-0.08%). Euro Stoxx futures are bouncing back +1.11% this morning as I type though. Euro Sovereign bonds fell back yesterday, with yields on 10yr bunds (+4.7bps), OATs (+6.1bps) and BTPs (+7.4bps) moving higher.

Finally, there were a few other US data releases yesterday. Among others, data from the Mortgage Bankers Association showed that a 30yr fixed mortgage rate was down to 6.15% in the week ending September 13, which is the lowest its been in just over two years. Otherwise, housing starts rose to an annualised pace of 1.356m in August (vs. 1.318m expected), their highest level since April. Building permits were also up to an annualised pace of 1.475m (vs. 1.410m expected), their highest since March.

To the day ahead now, and one of the main highlights will be the Bank of England’s monetary policy decision. Otherwise, we’ll hear from the ECB’s Knot, Schnabel and Nagel. Data releases include the US weekly initial jobless claims, existing home sales for August, and the Conference Board’s leading index for August. Finally, there’s an earnings release from FedEx.

Tyler Durden

Thu, 09/19/2024 – 08:16