With Just Months Left In His Term, SEC Chair Gensler Will Likely Abandon Nearly All Of His ESG Initiatives

In news that should surprise no Zero Hedge readers, SEC Chair Gary Gensler is going to be forced to abandon his idiotic plans for incorporating ESG into public disclosures, according to a new report from Bloomberg Law.

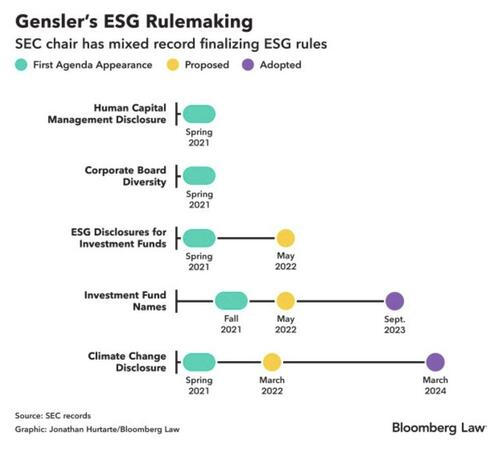

As a reminder, prior to basically all of Wall Street abandoning its love affair with ESG, Gensler pushed for public companies to disclose climate risks, workforce management, and board diversity.

He also proposed rules to curb greenwashing and misleading ESG claims by investment funds.

Now, nearing the likely end of his term, most major ESG regulations remain unfinished.

With less than five months left in Gensler’s tenure, they likely won’t be completed, according to Bloomberg. A conservative backlash against ESG and federal agency power has sparked legal challenges to SEC rules on corporate emissions reporting, weakening the commission’s influence.

Tyler Gellasch, who was a counsel to former Democratic SEC Commissioner Kara Stein and is president and CEO of investor advocacy group Healthy Markets Association, told Bloomberg: “It’s clear the commission leadership is exhausted and feeling buffeted by the courts, Congress and industry complaints.”

Plans for requiring human capital and board diversity disclosures remain unresolved, and final rules on ESG-focused funds are still pending. Even if the SEC adopts them by January, a Republican-controlled Congress and White House could overturn them via the Congressional Review Act.

After a surge of significant rulemaking in 2022 and 2023, the SEC’s activity has slowed in 2024. Bloomberg Law reports that SEC Chair Gary Gensler has fallen behind his predecessors, Jay Clayton and Mary Jo White, in advancing major regulatory matters through open meetings this year.

Susan Dudley, a George Washington University professor who oversaw the White House regulatory policy office under President George W. Bush said about propsed ESG fund rules: “If it’s a Republican Congress and Trump administration, you could imagine they would be willing to disapprove those.”

Gensler’s policies saw massive pushback during his tenure.

Bloomberg Law writes that in 2022, Republican attorneys general from states like West Virginia and Louisiana urged the SEC to drop proposed fund regulations after pushing it to abandon climate rules for public companies.

When the SEC adopted a diluted version of the climate rule in March, all 27 Republican-led states either sued or backed the lawsuit with a court brief.

The SEC, under Gensler, has faced significant legal defeats, including the Fifth Circuit’s June ruling striking down hedge fund fee disclosures and the Supreme Court’s decision limiting the agency’s enforcement power. The SEC decided not to challenge the Fifth Circuit ruling, ending its defense of the hedge fund rules.

Alexandra Thornton, of the Center for American Progress, says it’s unclear what regulations remain viable after these losses.

We’ll venture a guess…none.

Tyler Durden

Tue, 09/10/2024 – 07:45