Led By Gen X, 401(k) Millionaires At Fidelity Hit A New All Time High

Bear witness to one of the miracles of inflation: it won’t be long until everyone is a millionaire…one way or the other. But for now, nominal millionaires have hit an all time high at Fidelity, according to a new report from Bloomberg.

In the second quarter, Americans aged 44 to 59 increased their IRA contributions to a five-year high, with total contributions up 30% from last year, according to a Fidelity Investments report.

Fidelity Wealth President Roger Stiles noted that, despite financial pressures like college costs, aging parents, and healthcare expenses, Gen X savers are prioritizing retirement.

The Bloomberg report states that:

Gen X believes an average net worth of $873,000 is needed for financial comfort, according to a Charles Schwab survey.

The average 401(k) balance for Gen X at Fidelity was $182,100 in Q2, while the average IRA balance was $97,215.

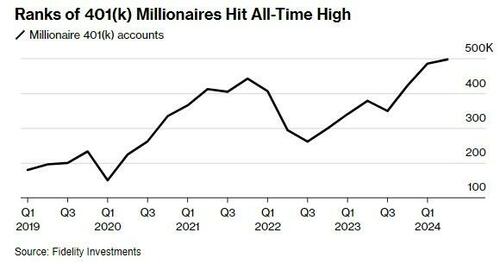

The number of 401(k) millionaires at Fidelity reached a record 497,000, a 2.5% increase from the first quarter.

Combined contributions and market gains led to a third consecutive quarter of growth in retirement accounts.

The average 401(k) balance increased to $127,100, and the average IRA balance rose to $129,200, up just 1% since March 31.

Fidelity/Bloomberg’s analysis came from “more than 48 million IRA, 401(k) and 403(b) retirement accounts as of June 30”.

Recall, we wrote just days ago about how the IRS was making it easier for Americans to tap their retirement accounts. The new rules bring to life one of the provisions of the SECURE Act 2.0, a law passed at the end of 2022 that made many tweaks to retirement plans. With this one, retirement account owners can withdraw up to $1,000 for “emergencies,” and the IRS isn’t tightly defining that word.

Whether you’ve had a car wreck or simply went overboard ordering from GrubHub, the provision will let you take money out of your account without being subject to the typical 10% penalty for withdrawals before age 59 1/2. You’ll still owe ordinary income tax — while facing a potential opportunity cost in the form of gains you may miss out on by cashing out.

But maybe it’s better to “use it before you lose it” and Kamala’s unrealized gains taxes start eating away at it…

Tyler Durden

Thu, 08/29/2024 – 21:00