2,000 Workers Gone: Klarna Is First Major Company To Unleash Mass Layoffs Thanks To AI

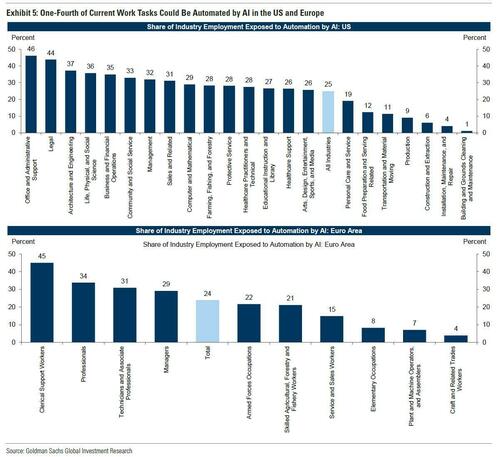

Last March, when the world was just learning about the AI crazy that would send markets to bubbly, nosebleed levels, we quoted a report by Goldman’s chief economist Jan Hatzius who used data on occupational tasks in both the US and Europe, to find that “roughly two-thirds of current jobs are exposed to some degree of AI automation, and that generative AI could substitute up to one-fourth of current work. Extrapolating our estimates globally suggests that generative AI could expose the equivalent of 300 million full-time jobs to automation” as up to “two thirds of occupations could be partially automated by AI.”

Translation: one-third of a billion layoffs (at least) in the US and Europe, or as we put it, “Think of it as the robotization of the service sector.“

Well, it may not be 300 million – yet – but the first 1,200 job losses to take place exclusively thanks to artificial intelligence are now in the books, as a result of mass layoffs taking place at Swedish fintech giant Klarna which has already fired well over 1,000 of its workers and plans to axe almost half of its 5,000 workers thanks to AI, as the lossmaking Swedish buy now, pay later company gears up for a stock market flotation.

As the FT reported, CEO Sebastian Siemiatkowski heralded the benefits of AI in Klarna’s second-quarter results on Tuesday, which showed a significant narrowing of its net loss from SKr854mn ($84mn) a year earlier to SKr10mn.

The Swedish fintech has already cut its workforce from 5,000 to 3,800 in the past year, and Siemiatkowski said that Klarna could employ as few as 2,000 employees in the coming years as it uses AI in tasks such as customer service and marketing.

“Not only can we do more with less, but we can do much more with less. Internally, we speak directionally about 2,000 [employees]. We don’t want to put a specific deadline on that,” he added.

Separately, Klarna has imposed a hiring freeze on workers apart from engineers and is using natural attrition rather than lay-offs to shrink its workforce.

Not surprisingly, Siemiatkowski has become one of the most outspoken European tech bosses about the benefits of AI, even if it leads to lower employment, arguing that is an issue for governments to worry about. Translation: UBI is coming, and with its massive stimulus, QE, YCC and so on, because over the next decade hundreds of millions of well-paid services jobs will quietly go into that good night.

There is another reason behind Klarna’s impetus to push for massive cost-savings. The Stockholm-based group is lining up financial advisers for its long-anticipated initial public offering due as early as the first half of next year, with Morgan Stanley, JPMorgan Chase and Goldman Sachs in lead positions to secure top roles, the FT reported.

Siemiatkowski said that Klarna had boosted its average annual revenue per employee from about $400,000 a year 12 months ago to $700,000 now, due to cutting its workforce and reducing expenses through AI.

The benefits of AI are likely to be a key selling point for any Klarna IPO. Once the darling of the European tech scene valued at $46bn in 2021, the Swedish group saw its valuation plummet as low as $6.7bn a year later because of rising interest rates and falling stock prices. Bankers and investors in Klarna now believe it may be able to achieve a valuation of between $15bn and $20bn when it lists, assuming it manages to fire many more employees.

Then again, Klarna has other problems: credit losses at Klarna increased 22% to SKr1.1bn in the second quarter compared with a year earlier, even as revenues increased 25% to SKr6.9bn.

Klarna had been consistently profitable from its founding in 2005 until 2019 when its rapid expansion in the US caused it to make huge losses. Last year, it made its first quarterly net profit in more than four years, and Siemiatkowski said it would not go back to making losses, arguing that AI was boosting its gross margins.

“If I can get to a superior revenue per employee that will allow us to pay top class for the best talent, the people who are currently deep-diving and learning AI . . . The very strong message to our employees is: less total labour cost, higher cost per individual. I’m very happy about seeing that this is paying off,” Siemiatkowski said.

Here the punchline: if Klarna is successful at keeping its productivity and output with 50% fewer workers, other service companies will immediately take the plunge and do the same. And if X/Twitter is any indication, with the company successfully dumping up to 80% of its pre-Musk acquisition bloat, the next decade will see a veritable carnage of layoffs across every single industry, putting Goldman’s forecast of “only” 300 million layoffs in the dust.

Tyler Durden

Wed, 08/28/2024 – 15:45