Import Volumes Surge At Nation’s Busiest West Coast Ports Amid Strike & Global Trade War Fears

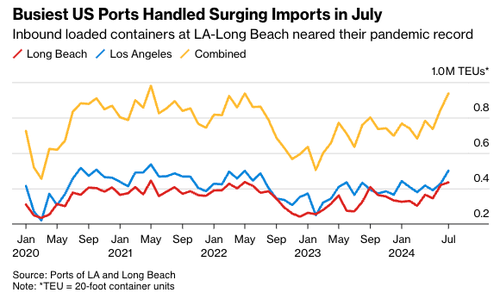

The ports of Los Angeles and Long Beach, which handle about a third of all US container imports, recorded the third-strongest month ever in July. This surge comes as companies rush to import goods ahead of potential tariffs on Chinese products and the looming threat of dockworker strikes that could roil supply chains.

Bloomberg reports that Los Angeles and Long Beach Ports recorded import volumes in July that nearly eclipsed an all-time high reached in May 2021. Back then, government helicopter money dished out to consumers through stimulus checks caused an explosion in consumer buying of goods primarily produced in China and Asia. In return, import volumes on West Coast ports soared, unleashing some of the worst-ever supply chain snarls.

Demand is now driven by importers trying to avoid potential US tariffs on Chinese goods and potential dockworker strikes that could erupt as early as October.

“We’re in a strong position heading into the peak shipping season as consumers purchase back-to-school supplies and shippers move goods ahead of potential tariff increases,” Port of Long Beach CEO Mario Cordero wrote in a statement, adding, “We have plenty of capacity across our terminals and cargo continues to move efficiently and sustainably.”

“If we get a two-week strike, then realistically, the ports would not be back to normal operations until we are into 2025,” Sea-Intelligence CEO Alan Murphy told clients last week in a note.

Companies are also increasing imports into the US from China as former President Trump has signaled that he will likely implement significant tariffs if reelected.

Goldman’s Jan Hatzius recently told clients that Trump has signaled to reshape US trade policy, which could result in “substantial uncertainty”…

As described in our US economics team’s recent discussion of potential trade policy changes under Trump (Exhibit 1), we assign high probability to targeted (but still sizable) tariffs on US imports from China (90% odds), including a 60pp increase in tariff rates on lists 1-2 from the 2018-2019 trade war, a 35pp tariff increase on list 3, a 10pp tariff increase on list 4a, and a 5pp tariff increase on list 4b, which combined would raise the effective tariff rate on US imports from China by 18.9pp. We also place high odds on tariffs on US auto imports from Mexico (70%; largely aiming to address the reexport of Chinese goods) but see other proposals as less likely to be implemented. That said, we view a 10pp surcharge on all US imports as a serious proposal that has a clear chance of implementation (40% odds), but we do not view it as the base case.

Rising container imports …

This is happening while corporate America warned about weakening consumer trends.

Tyler Durden

Mon, 08/19/2024 – 14:25