Futures Flat In Cautious Trade Ahead Of CPI As Gold Nears Record High

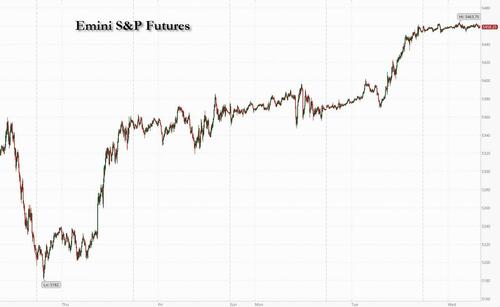

Futures are flat, after trading in a narrow range overnight which saw Asian stocks gain and European bourses trade mostly higher, with tech down small and small-caps/Russell leading with bond yields up 1bps in the front of the yield curve. As of 7:45am, S&P futures are unchanged at 5,459 after soaring 1.7% on Tuesday, fueled by cooler-than-forecast PPI data while Nasdaq futures are down 0.1% with the Mag7 mixed as NVDA boosts Semis. 10Y yields are down again, sliding to 3.83%, and pushing the USD lower. Commodities are mixed with Energy/Precious higher and Base lower; China’s largest steelmaker warns of 2008-like downturn given the slump in domestic consumption. The macro focus is on CPI (our full preview is here) and Retail Sales tomorrow.

Alphabet shares dropped 1% in US premarket trading after Bloomberg News reported that the Justice Department is considering a push to break up Google. Kellanova rallied as Mars agreed to buy the Pringles chips maker for nearly $36 billion. Victoria’s Secret soared 15% as the company is poaching the top executive from Rihanna’s lingerie brand to lead the retailer’s turnaround. Here are some other notable premarket movers:

Acelyrin falls 11% after the company said it’s making a strategic shift to focus on the development of lonigutamab.

Brinker International slides 15% after the owner of Chili’s and Maggiano’s Little Italy reported fiscal fourth-quarter adjusted earnings per share that missed Wall Street expectations.

Cardinal Health rises 6% after the health-care distributor lifted its adjusted earnings per share forecast for 2025.

Flutter Entertainment jumps 7% after the operator of FanDuel online sportsbook reported second-quarter sales and profit that beat analyst expectations.

Global-e Online sinks 14% after the application software company cut its full-year forecasts.

Kellanova gains 7% as Mars Inc. agreed to buy the company for nearly $36 billion.

Mercury Systems climbs 11% after the defense company reported fiscal fourth-quarter revenue and adjusted earnings per share that topped Wall Street expectations.

Ouster drops 15% after the lidar technology company gave a revenue outlook that’s weaker than expected.

Turning to the main event, it’s CPI day in the US and, after three consecutive misses, forecasters expect a modest 0.2% increase in both the consumer price index and the core gauge excluding food and energy which would mark the smallest three-month rise for the latter since early 2021. That would leave the headline rate unchanged at 3%. Our full preview is here.

The easing of price pressures in the US has bolstered confidence that officials can start lowering borrowing costs and refocus on supporting the labor market.

“We think inflation is no longer going to be an issue for the Fed and they will be able to cut,” said Lilian Chovin, head of asset allocation at Coutts. “Growth is shifting down a gear after a very strong first half of the year, but that’s what the Fed wanted, and they’re about to achieve it. That is very positive news for market participants.”

The latest gains on Wall Street have pushed the S&P 500 closer to a key technical level, with the index just notching its biggest four-day rally this year.

“Earnings season has been quite good in the US and decent in Europe,” said Chovin at Coutts. “Revisions from analysts are turning positive across most regions which should support equities going forward.”

Europe’s Stoxx 600 Index was 0.2% higher, advancing for a second day as investors awaited US CPI data for clues on the health of the economy, and after UK inflation rose less than expected. Travel and leisure gains the most as Flutter surges. UBS rose after the bank’s second-quarter profit beat estimates. Basic resources lag and miners dropped as iron ore slumped to the lowest since May 2023 amid worries over demand in China. Here are the most notable European movers:

Flutter shares jump as much as 13% in London trading after the operator of the FanDuel online sportsbook reported second-quarter revenue that topped Wall Street expectations and boosted its full-year projections for revenue and adjusted Ebitda.

UBS rose as much as 3%, the best-performing stock in the Stoxx 600 Financial Services Index, after second-quarter profit at the Swiss lender beat expectations. Analysts say investment banking results offset weaker wealth management.

Straumann shares jump as much as 15%, the most since July 2002, after the Swiss dental equipment company reported better-than-expected results in the second quarter and lifted its outlook for the year.

JDE Peet’s gains as much as 8.5% after Jefferies upgrades to buy from hold and sets a Street-high price target, saying in note the Dutch coffee seller is making encouraging progress.

TUI shares advance as much as 6.1% after the travel and tourism firm reported third-quarter underlying Ebit that came ahead of estimates. Additionally, the company sees fares and bookings up this summer compared to last year.

Carlsberg shares rise as much as 3.5% after the Danish brewer upgraded its profit guidance, which Citi attributed to cost control and a strong third-quarter start in Europe. Gains were capped, however, by weaker-than-expected first-half growth, as poor weather in China and Europe undermined sales.

Talanx shares rise as much as 5.2%, the most since May 2023, after the insurance and financial services firm’s earnings surpassed estimates in the first half, according to Morgan Stanley, with management still confident the company can beat its full year net income target.

K+S shares rise as much as 2.3% after 2Q earnings as analysts flag higher volumes in German chemicals company’s Agriculture segment. They also expect relatively stable prices for company’s key product, potash, in rest of 2024.

Rio Tinto shares fall as much as 2.3% in London, with European mining stocks the worst-performing sector in the Stoxx 600 index, as iron ore extended its slump into a third day, after the world’s largest steel company flagged an industry-wide crisis in China, intensifying concerns about demand.

Thyssenkrupp shares fall as much as 4.7%, an intraday record-low level, after the German steel producer reported third-quarter results that showed a significant decline in new orders and sales after three forecast cuts in past months. Analysts highlight potential for further negative revisions from consensus.

RWE shares fall as much as 2% after the German energy firm’s first-half earnings dropped by almost a third due to a decline in power prices. Metzler says now that consensus has moved down, there could be scope for more positive surprises ahead.

Glanbia falls as much as 3.4%, the most since January 2023, as its half-year results offered a mixed picture, with strong performance in the optimum nutrition category offset by weakness in other divisions.

Earlier in the session, Asian stocks climbed for a fourth straight day, on track for its longest string of gains in over a month, ahead of a key US consumer price report. The MSCI Asia Pacific Index climbed 0.7%, with Toyota, TSMC and Samsung among the top contributors to the advance. Japanese stocks climbed to the highest since early August, after Prime Minister Fumio Kishida said he won’t run for a second term as leader of his party.

In FX, a Bloomberg gauge of the dollar slipped, trading around a four-month low. The pound fell against the dollar and UK government bonds jumped as British inflation data came in below forecasts. Consumer prices rose 2.2% in July against economists’ expectations of 2.3%. Traders fully priced a half-point of further Bank of England rate cuts by year-end for the first time since Aug. 5. The yen and Japanese stocks fluctuated as traders digested news that Prime Minister Fumio Kishida won’t run for a second term as leader of the long-ruling Liberal Democratic Party in September. The kiwi fell by over 1% after New Zealand’s central bank cut rates by 25 basis points, embarking on an easing cycle much sooner than previously indicated.

In rates, treasuries gained again supported by wider gains seen in gilts, where the UK curve bull steepens after headline, core and service CPI all rose less than expected in July and front-end BOE swaps subsequently added to the pricing of rate cut premium. Treasury yields slightly richer across the curve and near lows of the day heading into early US session. US 10-year yields around 3.83% and 1bp richer vs. Tuesday close with bunds lagging by 2.5bp in the sector and gilts outperforming by 3bp. US session focus switches to the July CPI print expected at 8:30am New York. July US CPI data is expected to be soft, driven by housing rents, user-car prices and discounts in discretionary services; bond market remains long heading into the data, as traders look for an aggressive pricing of Fed easing to be maintained. Fed-dated OIS is pricing in around 107bp of rate cuts for the year with roughly 37bp of easing priced into the September policy decision.

In commodities, oil first rose as an industry report pointed to a sizable drop in US crude stockpiles and tensions simmered in the Middle East, but then dipped ahead of the CPI report. Gold climbed toward a record high approaching $2500/oz. The weakness in iron ore deepened after the world’s biggest steel producer warned that China’s steel industry is facing a crisis more serious than the downturns of 2008 and 2015, likening conditions to a “severe winter.”

In crypto, Bitcoin continues to edge higher and now back above $61k.

US data slate includes only July CPI at 8:30am and no Fed speakers scheduled for the session

Market Snapshot

S&P 500 futures little changed at 5,459.00

STOXX Europe 600 up 0.4% to 503.78

MXAP up 0.7% to 179.00

MXAPJ up 0.5% to 559.67

Nikkei up 0.6% to 36,442.43

Topix up 1.1% to 2,581.90

Hang Seng Index down 0.4% to 17,113.36

Shanghai Composite down 0.6% to 2,850.65

Sensex up 0.2% to 79,131.58

Australia S&P/ASX 200 up 0.3% to 7,850.70

Kospi up 0.9% to 2,644.50

German 10Y yield little changed at 2.20%

Euro up 0.1% to $1.1009

Brent Futures up 0.6% to $81.17/bbl

Gold spot up 0.3% to $2,472.35

US Dollar Index little changed at 102.57

Top Overnight News

European stocks tracked an advance in Asian peers on bets that Wednesday’s US consumer price report will allow the Federal Reserve to start reducing interest rates in September.

Japanese Prime Minister Fumio Kishida won’t run for a second term as leader of the long-ruling Liberal Democratic Party in September, opening the way for a race to succeed him as premier.

Forecasters expect a monthly report on US consumer prices to show another modest increase last month, reinforcing widespread expectations for a Federal Reserve interest-rate cut in September.

Investors who’ve positioned for even more gains in the Treasury market are looking for US inflation data that reinforces the case for a faster pace of Federal Reserve interest-rate cuts.

UK inflation increased less than economists and the Bank of England had expected, prompting traders to bring forward bets on the pace of interest-rate cuts in the coming months.

Russia is withdrawing some of its military forces from Ukraine to respond to a Ukrainian offensive into Russian territory, U.S. officials said, the first sign that Kyiv’s incursion is forcing Moscow to rejigger its invasion force.

China’s economy probably failed to turn the corner on its worst stretch in five quarters, with an uneven recovery in July held back by consumer spending still lagging industrial activity and investment.

Central Bank Decisions: RBNZ

RBNZ cut the OCR by 25bps to 5.25% (vs. mixed views between a cut and a hold), while its projections point to a further reduction this year. RBNZ said inflation is declining and is returning to the target band, while it noted that the pace of further easing will depend on the committee’s confidence that pricing behaviour remains consistent with a low inflation environment. Members noted that monetary policy will need to remain restrictive for some time to ensure that domestic inflationary pressures continue to dissipate and the pace of further easing will thus be conditional on the committee’s confidence that pricing behaviour is continuing to adapt to a low-inflation environment. Furthermore, the committee agreed there was scope to temper the extent of monetary policy restraint, while it sees the OCR at 4.92% in December 2024 (previously 5.65%), 4.1% in September 2025 (previously 5.4%) and at 3.85% in December 2025 (previously 5.14%).

RBNZ Governor Orr noted confidence inflation back in its target band can commence re-normalising rates and said they considered a range of moves including 50bps but consensus was for 25bps, while he added that a 25bps rate cut is a relatively low-risk start and it is a reasonable first step for monetary easing with the central bank in a strong position to move calmly.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks only partially sustained the momentum from Wall St where risk sentiment was underpinned by softer-than-expected PPI data, while the region digested the RBNZ rate cut and PM Kishida’s decision to not join the LDP leadership race. ASX 200 advanced amid a slew of earnings including from index heavyweight and largest bank CBA. Nikkei 225 wiped out initial gains with trade driven by currency moves and after PM Kishida announced to step down. Hang Seng and Shanghai Comp. were subdued ahead of key earnings from Alibaba and Tencent, while participants also digested weaker-than-expected Chinese new loans and aggregate financing data.

Top Asian News

Japanese PM Kishida said it is important to show a new face of the LDP in the leadership race and the first step to do so is for him to step down, while he confirmed he won’t run for re-election as LDP leader and will fully support the new leader.

Hon Hai/Foxconn (2317 TT) Q2 (TWD) Net Income 35bln (exp. 34.5bln). EPS 2.53 (exp. 2.56). Operating Profit 44.6bln (exp. 41.06bln); expects Q3 and 2024 revenue to grow significantly Y/Y.

Foxconn (2317 TT) says visibility in FY business is better than in May; strong demand for AI server will continue. Business is to grow in Q4 Y/Y. Wil start delivery for Nvidia’s (NVDA) GB200 in Q4 in small volumes and further increase deliveries in Q1. AI server business will grow Q/Q this year and could beat Co’s own expectations. Co.’s leading position in AI servers will not be challenged easily due to production capacity and technology. Talks with potential EV customers in Japan are on track.

Tencent (700 HK): Q2 (CNY) Revenue 161.12bln (exp. 161.35bln), Adj. Net 57.31bln (exp. 48.67bln), Domestic Games Revenue 34.6bln (exp. 33.6bln), International Games Revenue 13.9bln (exp. 14.14bln). As of June 30th, combined MAU of Weixin and WeChat at 1.371bln. Did not declare dividend for 6-month period. Will continue to invest in AI.

European bourses, Stoxx 600 (+0.4%) are entirely in the green, continuing the optimism seen on Wall St in the prior session. European sectors hold a strong positive bias; Travel & Leisure takes the top spot, propped up by significant post-earning gains in Flutter. Financial Services is also towards the top of the pile, after UBS reported strong Q2 earnings. Basic Resources lags given the weakness in the metals complex. Futures are mixed, and price action has been rangebound ahead of today’s key risk event, US CPI.

Top European News

AstraZeneca’s Market Value Soars Past £200 Billion

Polish GDP Growth Tops Forecasts, Reducing Rate Cut Pressure

European Gas Prices Rise on Supply Concern in Fragile Market

Orsted Announces Debt Redemption

Turkey Cenbank Begins Buying Liras at Takasbank Money Market

UBS Profit Beats Estimates in Boost to Ermotti’s Buyback Plans

FX

USD is mixed vs peers with the DXY slipping below 102.50 in the run up to US CPI data. Fed pricing currently prices in circa 37bps of loosening for next month’s meeting with a total of 106bps of cuts priced by year-end.

EUR/USD is back on a 1.10 handle and eclipsing the 1.1008 peak printed on 5th August. In terms of levels to the upside, the YTD peak from Jan 2nd kicks in at 1.1038.

GBP is on the backfoot following softer-than-expected inflation metrics. The decline in services inflation will be welcomed by the MPC. Pricing for the September BoE meeting has moved in a dovish direction with a cut now seen at 42% vs. circa 36% pre-release. Cable maintains the 1.28 handle.

JPY is losing ground to the USD with the main macro update coming via PM Kishida’s decision to step down. Overall, the pair is tucked within yesterday’s 145.43-147.94 range with today’s CPI release likely to offer the next inflection point.

NZD is the laggard across the majors as the RBNZ delivered a 25bps cut (Governor Orr even suggested that 50bps was discussed), with market expectations mixed between a cut and a hold heading into the event. AUD/USD also pressured but to a lesser extent alongside downside in iron ore prices.

PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1493 (prev. 7.1479).

Fixed Income

USTs are unchanged ahead of US CPI. The 113-22 peak printed alongside the release of UK CPI before the benchmark then eased a touch, alongside EGBs, to the 113-19 mark where it remains.

Gilts are the relative outperformer, though off 100.57 best by around 20 ticks as fixed benchmarks generally ease a touch. Outperformance which was driven by the latest UK inflation data, which saw the headline pick-up by less than forecast and crucially the Services metric come in markedly cooler than expected.

Bunds drift lower. In the morning it experienced two-way action on UK CPI, but ultimately dipped below the 135.00 mark and then slipped further on a modest upward revision to French Final CPI.

France sells EUR 9bln vs exp. EUR 7.5-9bln 0.00% 2027, 2.75% 2029, 2.75% 2030, 0.00% 2031 OAT.

Germany sell EUR 0.803bln vs exp. EUR 1bln 2.50% 2054 Bund & EUR 0.798mln vs exp. 1bln 0.00% 2050 Bund.

Commodities

Crude gains thus far following yesterday’s lower settlement, following reports Iran’s attack may be limited and potentially delayed contingent on the Gaza ceasefire talks slated for tomorrow. Brent Oct sits in a 80.89-81.40/bbl range after dipping back under USD 82/bbl.

Firmer trade in the precious metals space despite a relatively steady Dollar, but amidst heightened geopolitics after Russia said issues regarding Ukrainian peace talks have been put on a long pause, meanwhile, sources suggested Hamas will not attend tomorrow’s ceasefire discussions in Doha.

Mixed trade across base metals awaiting US inflation data, with a performance contract seen between Western and Eastern futures. Dalian and SGX iron ore overnight fell to the lowest in over a year.

US Private Inventory data (bbls): Crude -5.2mln (exp. -2.2mln), Distillate +0.6mln (exp. -0.6mln), Gasoline -3.7mln (exp. -1.4mln), Cushing -2.3mln.

Union at BHP (BHP AT) Escondida mine said management is illegally replacing workers during the strike and said it is willing to hold talks with management to end the strike, while BHP said the union at the Escondida mine declined to restart talks after a new invitation.

Russia extends ban on gasoline exports until end of 2024, via Interfax.

India’s July Gold imports at USD 3.13bln (prev. 3.06bln M/M)

Geopolitics – Middle East

“Hamas will not participate in Doha’s ceasefire talks tomorrow, according to a senior official in the Palestinian factions, who was cited by Al-Mayadeen”, according to Walla’s Elster

Israeli media reported a rocket attack from southern Lebanon on Meron in the Upper Galilee with 40 rockets fired from southern Lebanon towards Jabal al-Jarmaq, according to Al Arabiya. Furthermore, Hezbollah announced the targeting of the base of Mount Neria in northern Israel in response to the raid on the town of Barashit in southern Lebanon, according to Sky News Arabia.

Support is reportedly increasing in Israel for an offensive against Hezbollah, according to WSJ.

Sources reported an Iran proxy attack on US troops at the Conoco base in eastern Syria with impacts outside its perimeter, while a US official said projectiles aimed in the direction of the US base in Syria did not impact the base and the attack was unsuccessful.

Iran is reportedly planning to resume testing nuclear bomb detonators and is actively working on the development of its clandestine nuclear weapons program, getting closer than ever to building a nuclear bomb, according to Iran International.

Geopolitics – Ukraine

Russia’s border region of Belgorod declares regional emergency because of attacks by Ukrainian forces, according to the regional governor.

Ukraine plans to hold its first follow-up international conference after the peace summit online in August in which the conference is to focus on energy security, according to the presidential office.

It was separately reported that a US official said the objective of Ukraine’s Kursk invasion appears to be to force Russia to pull troops out of Ukraine to defend Russian territory against this invasion.

IAEA said evidence continues to indicate that the fire at the Russia-controlled Zaporizhzhia nuclear plant in Ukraine did not start at the base of the cooling tower and no foreign objects were visible in the tower, while it added the impact of the fire on the structural integrity of the cooling tower needs to be assessed and there may be a need to dismantle it.

US Event Calendar

07:00: Aug. MBA Mortgage Applications, prior 6.9%

08:30: July Real Avg Hourly Earning YoY, prior 0.8%

08:30: July CPI Index NSA, est. 314.765, prior 314.175

08:30: July CPI YoY, est. 3.0%, prior 3.0%

08:30: July CPI Ex Food and Energy MoM, est. 0.2%, prior 0.1%

08:30: July CPI Ex Food and Energy YoY, est. 3.2%, prior 3.3%

08:30: July CPI Core Index SA, est. 318.958, prior 318.346

08:30: July Real Avg Weekly Earnings YoY, prior 0.6%, revised 0.5%

08:30: July CPI MoM, est. 0.2%, prior -0.1%

Tyler Durden

Wed, 08/14/2024 – 08:14