Psychology Has Shifted And Confidence Has Broken

Submitted by QTR’s Fringe Finance

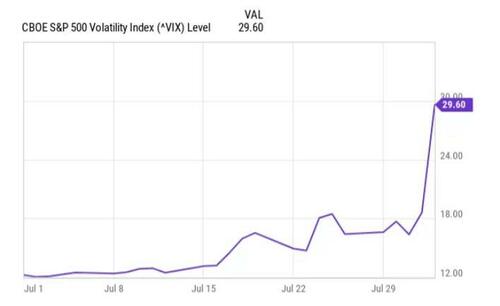

Just about two weeks after I wrote an article called “We Are On The Edge”, discussing how, if I had to pick only one trade to put on at the time, it would have been getting long volatility, we saw a massive spike in the VIX to end the week on Friday. Here’s how things looked early afternoon on Friday.

In my opinion, Friday’s trading session marks the beginning of a scenario that I have been predicting would unfold for the better part of the last two years. Here’s what I think is playing out.

Friday, we finally saw serious signs of an economy deep in recession emerge in the macroeconomic data, as hiring slowed significantly and the unemployment rate jumped to 4.3%.

Normally over the last two years, this would have been shrugged off by the market.

However, the tech and AI bubble had already started to burst about three weeks ago, and momentum into the numbers today was bearish instead of bullish.

The news also came after a horrific overnight session in Japan, where stocks plummeted 6% on the back of the BOJ raising rates. Ken Cheung, director of foreign exchange strategy at Mizuho Securities, told CNN:

“The BOJ made a hawkish shift after its surprising 15 (basis point) rate hike. Importantly, the BOJ flagged the inflation upside risks … and left the door open for further rate hikes. ”

And both the jobs number and Japan’s market taking a shit came after a week of escalating tensions in the Middle East, with a direct conflict between Israel and Iran looking more likely.

Source: AP

And now we’re waiting on promised action from Iran and they don’t work during market hours. Which means the 72 hour “break” from trading over the weekend sure seems like a long time.

But the biggest deal about Friday’s trading wasn’t the volatility in stocks; it was that, for the first time in the last two years, it feels like psychology has shifted and confidence has broken. Hell, Friday morning, Elizabeth Warren even took to X and, in a move that does far more harm than good, begged Jerome Powell to cut interest rates.

You don’t need to take Game Theory or Human Psychology 101 at Wharton to know that pleading publicly for rate cuts isn’t a tactical solution; instead, it is taking a megaphone and telling the entire world that you are starting to panic.

And panic, as Japan taught us overnight, is contagious.

Think of all the weeks that have gone by with proclamations of a soft landing and a miraculous defeat of inflation while sparing the economy. They look like this:

On this blog, we have long thought these proclamations were nonsense, but now we’re seeing proof. As I have been saying for two years, 5.5% rates on top of the largest debt bubble in history is nothing more than a ticking time bomb making its way through the economy’s plumbing.

And now, at the worst possible time, that bomb is about to blow.

It isn’t just Friday’s move in the market that is making me say this. Macro data related to housing, loan delinquencies, commercial real estate, and personal savings that I have been pointing out all year has continued to support the argument that the American consumer is broke and liquidity has run dry.

And, as I have written in numerous articles over the last year, by the time the Fed moves to cut now, it isn’t going to matter. I’ve said that as we get closer and closer to the first rate cut, I continue to believe that this could be the ultimate “sell the news” event and could mark the beginning of a large correction in equity markets, depending on the Fed’s appetite for massive QE.

🔥 70% OFF, THIS WEEKEND ONLY: Using the coupon entitles you to 70% off an annual subscription to Fringe Finance for as long as you wish to remain a subscriber: Get 70% off forever

Moving rates from 5.5% to 4.5% in the middle of a market crash — as JP Morgan hurriedly publicly declared would now happen in the middle of the trading day on Friday — when everybody was already expecting those moves to begin with, does nothing. A good way to think about it is this: the market is crashing today with the expectations of rate cuts already baked into the cake.

Now we have officially realized the rock and hard place we have been stuck between for the last two years. In one direction, the Fed has to make massive, decisive, easing moves that will see things like gold and Bitcoin move higher exponentially and will reopen the door to all of the inflationary forces we’ve been fighting over the last two years, like when Walter Peck shut down the power grid in Ghostbusters and released all the spirits back into New York City.

On the other hand, the Fed can clench its teeth and go with the “planned” cut or leave rates where they are, and we can continue to watch Japan’s deflationary shockwave make its way through the U.S. and eventually into our bond market, where something exceptionally large will break — as James Lavish detailed recently on my podcast — potentially creating systemic risk or currency risk.

Either way, there is no going back to the soft landing narrative now. With unemployment at 4.3% and the market in turmoil, the grim reality of needing to pay the piper is starting to rear its ugly head.

As far as my portfolio allocation, nothing really changes too much because this is the scenario that I’ve expected for a while, right down to the fact that gold was rising Friday morning, ostensibly as a hedge against the volatility, and then quickly crashed as it became clear over-leveraged investors needed to raise cash. This sell-off that I predicted would come represents a buying opportunity in gold and miners because, as I have stated repeatedly, the next step from here is likely the Fed trying to jawbone and overshoot the mark with quantitative easing.

The likely scenario short-term, in my opinion, is that the Fed will reiterate its already expected cuts and perhaps move them up timewise. In my opinion, this will not be enough to appease the market since cuts are already expected, and we will see this scenario of a further market drawdown into the Fed rate cut that I’ve been expecting and writing about for a year.

Naturally, as stocks start to sell off, I look for “boring” names to continue to add: namely, defense stocks, consumer staples, utilities, commodities, and things of that nature.

I’ve been saying for two years that you simply can’t raise rates the most in recent history at the fastest pace in recent history on the most debt outstanding in history and not face consequences. With Friday’s action in markets, it has become clear we have started to walk down the path of finding out what those consequences are going to be.

It’s weekends like these that I’m glad my economic education comes from the Austrian school, and I’m not an intern working at Goldman Sachs or doing wealth management for AXA Equitable Advisors. Sometimes it feels like you’re pushing a rock up a hill, but every once in a blue moon, things make a little sense.

Now read:

Fearless: Trump Survives 🔥 43,000 views

Gold Allocations Still “Very Low”, Silver A “Very Special Metal” 🔥 22,500 reads

Market Moves Like These “Have Not Ended Well” 🔥 22,300 reads

The Next Worst Thing 🔥 25,200 views

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Sat, 08/03/2024 – 12:50