Apple Pumps And Dumps As iPad Sales Help Topline Beat, But China Revenues Tumble

With most of the megatechs having already released earnings – with most disappointing and seeing their shares slide – all eyes were on the last Mag7 to report during the heart of earnings season (there is still Nvidia, but due to a calendar quirk that’s not for a month) which is also the company which recently regained (from Microsoft) the title of the world’s most valuable company: Apple.

Having failed to enjoy the same AI-driven euphoria as some of its gigacap peers, Apple stock had languished for months and was in fact relegated by Goldman a few months ago to the Meh 3 (AAPL, GOOGL, TSLA) and away from the Fab 4 (META, NVDA, MSFT, AMZN). But then after the company’s developer day, an initial meh reaction ended up being a major tailwind which pushed the company’s stock price to new all time high (according to many analysts, undeservedly so, since its only claim to fame is an upgrade version of Siri on deck, meant to push an iphone replacement cycle), which is why many were wondering if today’s earnings would validate and justify much of the recent euphoria.

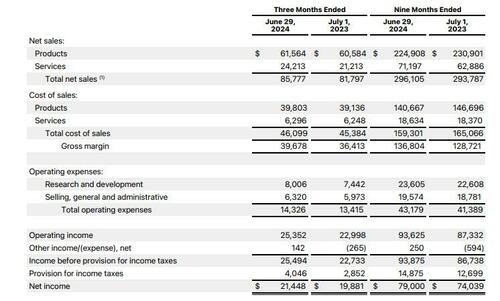

With that in mind, here is what AAPL just reported for the third fiscal quarter ended June 30:

EPS $1.40 vs. $1.26, up 11% y/y, beating estimates of $1.35

Revenue $85.78 billion, +4.9% y/y, beating estimates of $84.46 billion (Bloomberg Consensus)

Products revenue $61.56 billion, +1.6% y/y, beating estimates of $60.63 billion

IPhone revenue $39.30 billion, -0.9% y/y, beating estimates of $38.95 billion

Mac revenue $7.01 billion, +2.5% y/y, beating estimates of $6.98 billion

IPad revenue $7.16 billion, +24% y/y, beating estimates of $6.63 billion

Wearables, home and accessories $8.10 billion, -2.3% y/y, beating estimates of $7.79 billion

Service revenue $24.21 billion, +14% y/y, beating estimates of $23.96 billion

The one – very big – fly in the ointment was the usual suspect: China, where revenues unexpectedly tumbled 6.5% yoY:

Greater China rev. $14.73 billion, -6.5% y/y, missing estimates of $15.26 billion

Going down the line:

Cost of sales $46.10 billion, +1.6% y/y, higher than estimates of $45.43 billion

Total operating expenses $14.33 billion, +6.8% y/y, below the estimate $14.39 billion

Gross margin $39.68 billion, +9% y/y, beating the estimate $39.06 billion

Cash and cash equivalents $25.57 billion, below estimates of $28.98 billion

And so on:

Looking at a breakdown of sales by product category we find that, as expected, iphone sales dropped in a quarter which most knew would be uneventful for the iphone maker, yet at $39.3bn (and down from $39.7bn YoY) they still beat expectations of $39.0billion. The rest of the product suite was solid with Macs surprisingly beating estimates while both iPads and wearables coming stronger than expected. Worth noting that the iPad is a big leap in response to the new iPad Pro and iPad Air. Apple says, as it usually does, that half of iPad buyers in the quarter were new to the product. In any case the trend is clear: while sales may not be plunging, they have certainly topped out and the only ting that is still rising is Services.

For those asking, there wasn’t a single mention of the Vision Pro in Apple’s earnings release. Let’s not forget: this $3,500 headset is Apple’s first major new product in nearly a decade, and it has been an epic, overpriced if pretty cool, dud. Additionally, there’s not a ton left in the cupboard in terms of innovation with the company canceling its self-driving car in February. Of course, there is SiriGPT, although we can assure Tim Cook that nobody will upgrade their iPhone just to talk to a woke, censored chatbot.

What is remarkable about the chart above is that revenue from Apple’s product suite is flat – at best – over the past decade. The only growth is in the company’s services division, which in Q3 beat again, rising to $24.2 billion, up 14% from $21.2 billion, and beating estimates of $24.0 billion.

Looking at a geographic breakdown we find that while sales improved across almost every region, with the notable exception of China, where sales dropped by 6.5% YoY to $14.7BN, sharply below the estimate of $15.3BN.

Still, the long run chart shows that revenues across most regions are flat at best, even ignoring the ongoing China weakness which will only get worse if Trump becomes president.

As Bloomberg notes, “it was a good beat on 3Q iPhone revenues but overall sales for the Greater China region missed estimates by a few hundred million dollars. A lot of folks will try do the math here but ultimately we need to hear from Cook and Maestri on how they feel iPhone did in that market. Other factors at play?”

Commenting on the quarter, Tim Cook said that “during the quarter, we were excited to announce incredible updates to our software platforms at our Worldwide Developers Conference, including Apple Intelligence, a breakthrough personal intelligence system that puts powerful, private generative AI models at the core of iPhone, iPad, and Mac. We very much look forward to sharing these tools with our users, and we continue to invest significantly in the innovations that will enrich our customers’ lives, while leading with the values that drive our work.”

CFO Luca Maestri also chimed in:

Statement from Luca Maestri:

“During the quarter, our record business performance generated EPS growth of 11 percent and nearly $29 billion in operating cash flow, allowing us to return over $32 billion to shareholders. We are also very pleased that our installed base of active devices reached a new all-time high in all geographic segments, thanks to very high levels of customer satisfaction and loyalty.”

While Apple doesn’t give guidance in its earnings announcements anymore, but we should expect some sort of directional color from the CFO on the earnings call itself.

Commenting on the quarter, Bloomberg’s Mark Gurman had a scathing, and accurate, assessment:

My big picture takeaway is that, financially, everything is *fine* at Apple. But this is a company that has dramatically lost its pace of innovation and has probably missed on its latest major new product, while canceling future sources of growth like in-house screen technology and cars. I am seeing nothing in the Apple product roadmap in the next 2-3 years that is a game-changer. Anything new and meaningful is not coming until around 2027 in my view.

If then… The stock, which dumped for much of the session, initially spiked on the company’s top and bottom line beat, but has since retraced all gains and was trading at session lows as attention turns to the surprising China weakness.

The earnings call is starting as we hit save, but the following exchang was notable: a member of the media asked the $6.4 trillion question, whether Apple Intelligence push investors to buy new generation iPhones?

The answer with CFO Luca Maestri on the call with Bloomberg: “We are very excited with the kinds of features we are offering users: They are very personal, relevant and people will really enjoy them. Apple Intelligence provides yet another reason to upgrade.”

Yeah, good luck with that.

Tyler Durden

Thu, 08/01/2024 – 17:16