“Too Complacent” – Back To Mag-7 Earnings & The AI Story

Authored by Peter Tchir via Academy Securities,

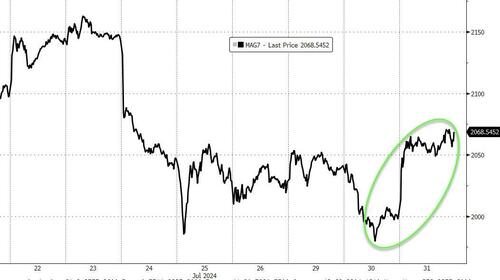

It is difficult to tell how much of today’s rally was:

AMD related which was up more than 10% and presumably helped rally almost 15% adding more than $300 billion of market cap

MSFT, gaining traction from the immediate post earnings reaction as their conference call did a lot to soothe investors – a nice turnaround in a market that has been punishing “misses”

The Fed. Yields moved down across the curve, even though the Fed didn’t cut rates, and only signaled that September was a possibility, not a done deal.

Relief rally from what has been a few tough weeks for stocks, buy the dippers being enticed back in, and some chatter about money on the sidelines moving in from money funds now that rate cuts are in sight.

Not only are we getting buyback announcements, but as companies make it through their earnings, they are able to enter back into discretionary buybacks and may view recent dips as great buying opportunities.

In terms of the Fed:

Powell didn’t commit to September, but with the market likely to be pricing in close to 100% certainty it would take some unusually strong numbers on either inflation or employment to have them not cut.

I don’t see 50 on the table.

The Fed seems more comfortable with the employment situation than many in the market. This remains my biggest area of fear – that employment deteriorates more rapidly than the Fed is expecting (or is priced into the market), but the Fed feels handcuffed and cannot commit to easing quickly in response to employment data (they are still afraid of inflation retuning).

Both stocks and bonds seem a little too complacent about the Fed, earnings and other factors.

The Japanese Yen, has broken below 150 for the first time since the middle of March. Improving 7% versus the dollar in 3 weeks could have some repercussions for anyone funding positions with Yen. That was listed as a reason for stocks declining a few weeks ago, and is worth paying some attention to.

While events in the Middle East didn’t affect markets overnight, there is once again increased risk of an escalation directly between Iran and Israel (Today’s SITREP).

We have some more earnings to get through, and it really does seem like “get through” is the watchword, as opposed to being an excuse to rally like they have been in some prior earnings cycles.

Jobs. That is my biggest concern for markets, but falls into an overall view that we will be going from no/soft landing to some form of bumpy landing in the coming weeks as data comes in.

Back to Mag 7 Earnings and the AI Story

I still expect that stocks will be lower in August than they were yesterday, but it won’t be a one way street and today likely helped to reset some “for a trade” longs, and squeeze out shorts, smoothing the path to more downside on any disappointment.

I am somewhat surprised the rate rally is continuing, but there has been less corporate new issuance and the “month end index extension” trade is well known and likely helping support rates here (which in turn are helping stocks). I don’t see that continuing.

Energy related stocks remain my favorite position, as they will act as a hedge in the event of geopolitical escalation.

Tyler Durden

Wed, 07/31/2024 – 16:15