Catastrophic JOLTS: Private Sector Job Openings Plunge Offset By Bizarre Surge In Government “Openings”, As Hiring, Quits Crater

Heading into today’s JOLTS number we were expecting much of last month’s unexpected surge – which as we noted last month was the result of a bizarre spike in government job openings – to be revised away, and for the June print to drop from the revised May print.

Expect big drop in JOLTS job openings as last month’s surge in government job openings is revised away https://t.co/0SkQxgdckL

— zerohedge (@zerohedge) July 30, 2024

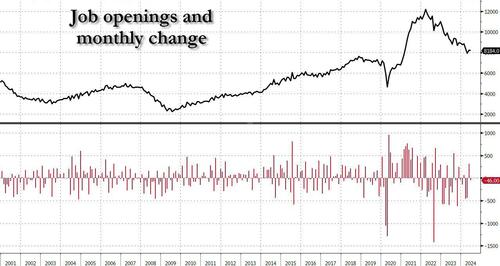

In retrospect, that’s what happened if perhaps not to the extent we had expected. As shown in the chart below, according to the BLS, in June the total number of job openings did drop by 46K from an upward revised 8.230 million to 8.184 million, where the number of government workers was indeed revised lower, however, the ultimate drop was not as big as we, or the street, had expected and it printed above the consensus estimate of 8.00 million.

A quick look at the breakdown shows that while private jobs saw another broad drop in openings across private sectors…

… it was almost fully offset by the relentless surge in government job openings. Yes, while May was indeed revised lower, June saw another jump in government job openings, surging to a near record 1.094 million, driven by a 118K spike in State and Local job openings.

Putting it all together, while private sector job openings plunged to a level seen back in late 2018, government job openings are just shy of a record high!

Ignoring the data manipulation, in the context of the broader jobs report, in June the number of job openings was 1.373 million more than the number of unemployed workers (which the BLS reported was 6.811 million), down from last month’s 1.581 million and the lowest since the summer of 2021.

Said otherwise, in April the number of job openings to unemployed dropped to just 1.24, a sharp slide from the March print of 1.30, the lowest level since June 2021 and now officially back to pre-covid levels.

But wait there’s more: confirming that if one ignores the clearly manipulated jump in government job openings (“quick, let’s hire a ton more TSA agents and deep state apparatchiks to make it seems that Kamalanomics is working”), a quick look at the number of quits – an indicator closely associated with labor market strength as it shows workers are confident they can find a better wage elsewhere – showed a plunge in June, dropping by 121K, the most since July 2023, to just 3.282 million, the lowest since August 2020!

Finally, the piece de resistance was the number of actual hires, which in June also tumbled to just 5341, down a massive 314K in one month, the biggest monthly drop since February 2023…

… dragging the total to just 5.3 million, the lowest level since the depts of the covid lockdowns.

Finally, no matter what the “data” shows, let’s not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it – or some 70% to be specific – is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 33%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden, pardon Kamala, to still maintain the illusion that at least the labor market remains strong when everything else in the economy is crashing and burning, we’ll let readers decide if the near record number of government job openings at a time when hiring and quitting are both crashing, is an accurate reflection of a strong labor market, or is merely a reflection of a debt-funded deep state gone full tilt. We’ll know the answer on Friday.

Tyler Durden

Tue, 07/30/2024 – 10:52