Treasury Estimates $1.3 Trillion In Borrowing Needs For The Remainder Of 2024

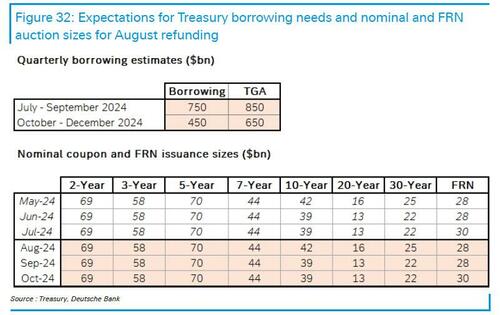

Ahead of today’s big event – the Treasury borrowing estimates publication – we said not to expect any fireworks and also that unlike recent spikes, the most likely range of calendar Q3 and Q4 borrowing estimates is $750BN for the July-September quarter and $450BN for the October-December quarter (which assumes a year-end cash balance of $650 billion).

And at exactly 3:00pm the Treasury published the anticipated numbers, which came close to our estimates for Q3, but well above our forecast for Q4, specifically:

Q3 funding needs were revised lower to $740 billion (just below our forecast of $750 billion) from $847 billion projected last quarter. According to the Treasury, the borrowing estimate was “is $106 billion lower than announced in April 2024, largely due to lower Federal Reserve System Open Market Account (SOMA) redemptions and a higher beginning-of-quarter cash balance.” In other words, the QT taper is primarily responsible for the lower funding needs. As a reminder, the Fed’s plan hadn’t been in place when the Treasury released its previous borrowing estimate. The Treasury also kept its quarter-end cash balance estimate unchanged at $850 billion.

Q4 funding needs (released for the first time) are estimated at $565 billion, $115 billion above our estimate of $450 billion, which is quite a bit higher obviously than expected, but which is also due in part to the higher TGA estimate of $700 billion vs our assumption of $650 billion.

In summary, the Treasury expects to borrow just over $1.3 trillion by year-end (although this number will end up being much higher if Trump becomes president and the US “unexpectedly” collapses into recession in the first days of the new presidency).

The Treasury’s cash balance at the end of June, at about $778 billion, was also above the $750 billion level Treasury had targeted at the end of April. The holdings of the Treasury General Account stood at about $768 billion as of last Thursday.

There’s more, because while the Treasury projects $850BN cash balance at end of Q3, this number then drops to $700BN at end of Q4 (which is above our estimate of $650 billion) and since the streetwide estimate for Q3 end of quarter cash was ~$650BN, this suggests that the real funding needs (on an apples to apples basis) is actually $515BN, which is modestly above the median Wall Street estimate. For context, JPMorgan expected a Q4 marketable debt borrowing need of $496BN, while Wrightson was on the high end at $670 billion. Of note, Societe Generale had forecast a year-end cash buffer of $550 billion, $150 billion below the Treasury’s own forecast. On the other end, TD Securities predicted the Treasury would project a far more generous year-end cash balance of $850 billion (perhaps anticipating the prefunding of a much more drawn out debt ceiling battle).

“Treasury’s year-end cash balance was around the middle of the expected range and indicates a moderate decline relative to an elevated level of cash expected at the end of the third quarter,” said Zachary Griffiths, a senior fixed-income strategist at CreditSights.

Keep a close eye on the $700BN year-end cash balance, as it has potential implications for the next debt-limit battle: that cash stockpile would be rapidly drawn down after the debt ceiling by law kicks back in at the start of next year — unless Congress passes an increase or new suspension, which is unlikely if Congress is once again split.

The law doesn’t dictate a precise amount of cash that the Treasury is allowed to have on hand when the debt limit kicks in. Some dealers – such as DB – had anticipated the department would provide a smaller estimate for its cash balance target for the end of December, just before the debt limit’s reinstatement in January. But that view wasn’t universal. A smaller cash pile would imply slightly less bill issuance at the end of the year, and therefore a higher Reverse Repo balance.

The targeted end-of-December cash balance level “is also its assumed cash balance upon the expiration of the debt limit suspension on January 1, 2025,” according to a footnote in the Treasury statement. “This assumption is based on expected cash flows under Treasury’s cash management policies and is consistent with its authorities and obligations, including those under the Fiscal Responsibility Act of 2023.”

Bottom line: contrary to its activist tactics to boost the market and to front-load debt needs, this quarter the Treasury reported numbers that came in line with expectations for Q3, and slightly above blended estimates for Q4.

Then again, the real question should be not what the Treasury projects for Q3 and Q4, but Q1 which is when as we now know Biden will finally leave the White House forever, and be replaced by either Trump or Kamala (or Big Mike) and when all the lipstick on this pig will finally wash off.

Tyler Durden

Mon, 07/29/2024 – 15:24