Tesla Earnings Preview: Financials, Robotaxis, Cybertruck, Musk’s Pay Plan In Focus

Tesla is set to report earnings after the bell today, with the street expecting a hefty EPS drop and 2% revenue decline. Sellside consensus expects Tesla’s Q2 earnings per share to drop 33% to 61 cents, with sales dipping to $24.38 billion. Here are the expectations on other metrics:

Gross profit margin (exp. 17.7%).

Free cash flow (exp. 1.2bln).

CapEx (exp. 2.5bln).

Average selling price (exp. 42,736).

Q3 2024 GUIDANCE:

EPS exp. 0.55.

Revenue exp. 25.4bln.

FY24 GUIDANCE:

EPS exp. 2.02.

Revenue exp. 98.6bln.

As we noted this morning, with valuations among technology firms still high after last week’s retreat, investors are looking for more evidence that their businesses are on track and the euphoria around artificial intelligence is justified.

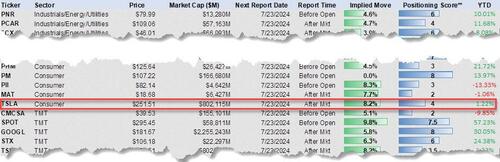

That said, unlike other Mag7 stocks, TSLA has largely missed the meltup in the past year, with the stock only enjoying a sharp move higher in recent weeks. Even with that though, Goldman calculates that TSLA’s positioning score among hedge funds is only 3.5, meaning this name is extremely shorted and there is major risk of a continued squeeze (just as we correctly warned 2 months ago).

Robotaxis In Focus

Analysts and investors eagerly await details on Tesla’s robotaxi reveal, initially set for August 8 but now delayed to October. Investors will also look for information on new affordable models, the Optimus humanoid robot, and spending on AI and autonomous driving.

Tesla’s 11-day winning streak earlier this month, that saw the stock rise about 50% from its YTD lows, abruptly ended on July 11 after a Bloomberg News report revealed that the EV maker plans to delay the unveiling event of the highly anticipated ‘robotaxi’ from August 8 to sometime in October.

In early June, we told readers, “TSLA remains one of the most shorted names in the hedge fund space and is one of the biggest mutual fund underweights.”

Shares soared nearly 62% from June 10 to July 11 in a massive short squeeze. We penned this note: “Tesla’s Furious Rally Is Another Massive Short Squeeze.”

But the tide could be changing unless the company unexpectedly beats expectations after the bell today. As a reminder, here is GLJ Research’s take on the Robotaxi disappointment for Tesla earlier this month:

A lot of investors trade around these TSLA days/events, many of which have turned out to be sizeable disappointments (i.e., Battery Day + Cybertruck Unveil + AI Day 1.0 + Optimus Day 1.0 + etc.); and now that “Robotaxi Day 8/8” its not happening as originally scheduled, the folks trading TSLA’s stock into this event are likely now sellers (welcome to investing in 2024). Furthermore, given the run-up in TSLA’s shares the past 11 days (the 74-day RSI is a whopping 74.6), the selling could be quite material.

JPMorgan analyst Ryan Brinkman penned a note after the JPMorgan European Automotive Conference in London last month explaining that robot taxis are “years” away.

Deliveries And Cybertruck

Yet Tesla surprised investors at the beginning of July with better-than-expected deliveries for the second quarter despite a global electric vehicle market downturn.

It delivered 443,956 vehicles in the second quarter, better than the 439,302 average analyst estimate.

The Austin-based carmaker delivered 422,405 of its top-selling Model 3 and Model Y vehicles in the second quarter, down from 446,915 a year ago.

The company produced 410,831 vehicles during the quarter.

While sales were down 4.8% from a year ago, Tesla improved on a sequential basis from the 386,810 vehicles delivered in the first three months of the year.

New estimates from Fred Lambert, the editor-in-chief and main writer at Electrek, speculated that after parsing through the delivery report, “Tesla Cybertruck might have become the best-selling electric pickup truck in the US.”

Lambert’s extended take on Cybertruck is that it will likely become (if not already) the best-selling EV truck in the world’s largest economy:

I predicted that despite the Cybertruck coming a long time after the F150 Lightning and Rivian R1T, it would likely achieve higher volume than those quickly after its launch for the simple fact that Tesla is second to none when it comes to ramping up EV programs.

We can’t confirm it because of the lack of transparency in Tesla’s sale disclosure, but I think it’s likely true that Cybertruck has become the best-selling electric pickup in the US right now.

Regarding demand, a ZH reader contacted us last week. They said their Cybertruck delivery date was moved up from the estimated second half of 2025 to August.

For some context, the reader paid $100 for the Cybertruck reservation in late 2022. Recall that reservations first opened in November 2019.

Tesla and AI

As far as Tesla and AI, in July Morgan Stanley’s Adam Jonas suggested that Tesla could be poised for the powering up America theme with its solar energy and storage business.

This comes as artificial intelligence data centers are being constructed across the country, and once completed, demand a whole heck of a lot more power than traditional data centers, which means power grids must be upgraded to handle the new load capacity.

“At first glance, the rapid growth in AI and its impact on electricity demand may not seem to have relevance to Tesla or the broader auto industry,” Jonas wrote in a note to clients in late June.

Titled “Tesla Energy Storage: Can GenAI Electrify This $130bn Business?” Jonas continued, “We recently published an analysis showing how US data center power usage may be equivalent to the power used by 150 million electric cars by 2030; the forecasted increase in US data center power from 2023 through 2027 is the electrical energy equivalent to adding 59 million EVs to US roads, or a 21% increase in total vehicles in service.”

Jonas seemed to embrace ‘The Next AI Trade,’ a theme we introduced to our pro subscribers in early April. We outlined how the AI revolution will drive a significant increase in electricity demand from AI data centers, reshoring trends, and other electrification trends, necessitating an upgrade of the nation’s grid.

Musk’s Pay Package

Investors will also be looking for any new updates on Tesla’s move to Texas. Tesla investors voted for CEO Elon Musk’s compensation package and moving the company’s state of incorporation to Texas, signaling confidence in his leadership, in early June.

Tesla is banking on the reapproval aiding in its effort to overturn Delaware Chancery Court Judge Kathaleen St. Jude McCormick’s ruling, which means a likely appeal to the state’s Supreme Court.

Still, the outcome is uncertain, with Tesla stating in its proxy statement that it “cannot predict with certainty how a vote to ratify Musk’s compensation would be treated under Delaware law in these novel circumstances.”

Tesla Stock: Most, If Not All Good News, Appears To Be Priced In

As we said in our note earlier this month, with the stock price surging 50% in just a few days, one can make the argument that most if not all good news for the foreseeable future was promptly priced in.

Meanwhile, there is a growing sense of uncertainty around how to treat the wider EV market, amid a sea of conflicting dynamics. The industry benefits from generous tax credits. Yet it’s also contending with significant hurdles in the form of tariff wars and even identity politics, with some consumers rejecting EVs as a form of “woke” transport.

In the US, Donald Trump has said that if he becomes president again after November’s election, he’ll undo existing laws supporting battery-powered vehicles, calling them “crazy.” That said, Trump is a “huge fan” of Tesla’s Cybertruck, according to Elon Musk, who recently told staff to brace for major job cuts, with sales roles among those affected. And the Cybertruck, Tesla’s first new consumer model in years, has been slow to ramp up.

For that reason, some hedge fund managers have decided the stock is off bounds altogether. Tesla is “very difficult for us to position,” said Fabio Pecce, chief investment officer at Ambienta where he oversees $700 million, including managing the Ambienta x Alpha hedge fund.

Basically, it’s not clear whether investors are dealing with “a top company with a great management team” or whether it’s “a challenged franchise with deficient corporate governance,” he said.

However, “if Trump wins, it is truly going to be very positive” for Tesla, though “obviously not amazing for EVs and renewables in general,” he said. That’s because Trump is expected to impose “massive tariffs towards the Chinese players,” which would be “beneficial” to Tesla, Pecce said; this is also wrong since there is virtually no Chinese EV penetration in the US, and if anything it would force even more dumping of Chinese EVs in Europe which is also a huge market for Tesla.

And as usual, skeptics will also be looking into the company’s accompanying 10-Q when it is released for potential updates on the company’s numerous legal liabilities.

Tyler Durden

Tue, 07/23/2024 – 14:05