Bye, Then

By Stefan Koopman, Senior Macro Strategist of Rabobank

In a move reminiscent of a failing bank, President Biden belatedly terminated his reelection bid over the weekend, succumbing to unrelenting pressure from Democrats who feared he was too frail to defeat Trump. But the campaign had effectively collapsed following the June 27 debate, when it became glaringly apparent to each and everyone that he was no longer fit to be President for four more years. Like a ship taking on water, he continued to sail for a few more weeks, but it was only a matter of time before it sank.

A national address from President Biden will follow this week, but he already endorsed his Vice President Kamala Harris as the new candidate, with the Clintons and California Governor Newsom also boarding the Harris train. However, former President Barack Obama and former House Speaker Nancy Pelosi are still undecided on whether to hop on. The presidential candidate will be officially nominated in a month, with the Democratic National Convention slated to take place August 19 through August 22. In the meantime, other candidates, such as Senator Joe Manchin, may still emerge.

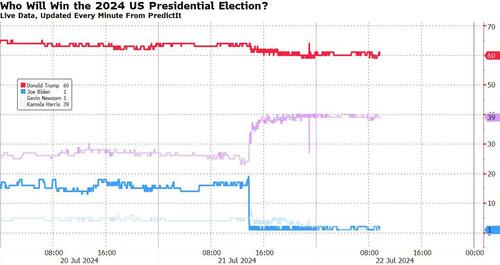

There has been significant confidence in the markets in Trump winning. It is also our base scenario, if only for ‘risk management’ purposes. Biden’s unprecedented decision does introduce a wild card into the campaign, possibly leading to market volatility. There have already been many nationwide Harris vs. Trump polls, and her numbers against Trump were very similar to Biden’s in several recent ones, but new polls that incorporate Biden’s absence could change this. If Harris can quickly rally widespread party support to challenge Trump, especially in some swing states, the momentum could be hers and the race would be wide open. If so, election-related volatility should increase.

Yet if Trump continues to lead in the polls and investors remain viewing his win as inevitable, the “Trump trade”, which implies deregulation, tax cuts, and increased fiscal spending, and should then lead to a steeper yield curve, a firmer USD and a boost for bitcoin, will dominate.

This morning’s market opening does not reflect a strong investor conviction in any particular direction. The dollar remains virtually unchanged against several currencies, including the euro, yuan, and Mexican peso. The 10-year Treasury yield fell by 3 basis points at the opening, now standing at 4.21%. Bitcoin fell right after the announcement but has since returned to levels seen earlier on Sunday. Even though the VIX has been creeping higher in recent days, with investors rotating out of tech, FX and rates markets remain relatively quiet. Yet with 106 days to go until the US election, recent events suggest that if you’re yearning for ‘precedented times’, you’re likely to be disappointed.

Tyler Durden

Mon, 07/22/2024 – 11:40