“Continued Deterioration”: Goldman Sees “Surplus Market” In Copper, Pushing Prices Lower In “Short-Term”

Copper futures in New York are 15% below their May all-time high and have hit a two-week low. Goldman analyst Adam Gillard suggests that a “surplus market” could pressure prices of the base metal lower in the “short term.”

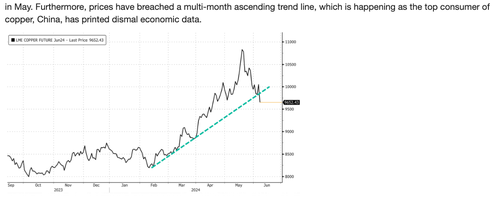

In recent weeks, copper has been stuck in a narrow range and is down about 15% from the record in May. The surge in prices was driven by global supply fears, a squeeze in the market, and energy transition demand.

In May, Jeff Currie, who led commodities research at Goldman Sachs for nearly three decades and now serves as the chief strategy officer of the energy pathways team at Carlyle Group, appeared on Bloomberg’s Odd Lots and said:

“You know, it is the most compelling trade I have ever seen in my 30 plus years of doing this. You look at the demand story, it’s got green CapEx, it’s got AI, remember AI can’t happen without the energy demand and the constraint on the electricity grid is going to be copper.”

By early June, following the peak in prices, we quoted Trafigura Chief Economist Saad Rahim, who told investors, “Prices of non-ferrous metals have moved much higher than fundamentals in the physical spot market might indicate or justify, especially for copper.”

We also noted that the all-important multi-month ascending trend line was broken in early June.

Since then, China’s unwrought copper and copper product exports hit a record last month, as fears of soaring demand in the world’s second-largest economy have shifted the market into a surplus, pressuring prices lower.

For more on the copper market and where prices are headed, Goldman’s Gillard published a note Thursday morning explaining, “Continued deterioration—it’s a surplus market, and I think price goes lower in the short term.”

Here’s Gillard’s chart pack:

Trade flows: Chinese cathode exports reached a new ATH during June due to tolling (export) arb strength.

LME inventory: Elevated China exports are currently being delivered to Asian LME warehouses; we think another 30k MT is due to become visible in Asia into month end from legacy Chinese exports

Chinese (cathode) demand: What’s striking is that Chinese inventory has built (seasonally adjusted) despite record exports, resulting in a 6% apparent demand contraction during June

Downstream de-stocking: Locally the bull thesis is in part predicated on a price related downstream de-stock, which is temporary, thus if end demand (grid) returns, cathode demand will return in force due to a lean supply chain. Whilst we concede the data is sketchy (at best), a/o June month end downstream inventory remains elevated at +8% y/y whilst wire & cable operating rates (grid ?) are still down 12pts y/y

Scrap: Negative spot smelter margins (weighted remains positive) have resulted in Chinese smelters diversifying feed away from expensive concentrate towards scrap (which explains 7% YTD growth in Chinese refined supply despite negative TCRCs). Whilst we concede that scrap is opaque and Monday’s BBG headline around tax quotas could limit 2H supply growth, during 1H Chinese blister production from scrap increased by 12% y/y (92k MT), which explains anode RC strength. This supply creep can quickly erode a deficit.

Africa: Think DRC + Zambia supply growth is under appreciated given significant Chinese investment which is hard for consultants to track (modelling 40k MT ish artisanal mines isn’t easy). Think IVN + CMOC et al will continue to surprise which will result in persistent Chinese SXEW import strength (which won’t be ARB sensitive), which we are starting to see in the official trade data; China’s refined imports from DRC, Zambia and South Africa is now 42%, an ATH

Chile: Whilst we’re not disputing the medium term supply challenges (it’s getting harder not easier to build a new mine, outside of Africa at least), note that copper supply from Chile increased by 12% y/y Jan – May, because exports outperformed production, presumably on TC related mine level concentrate destocking (although we are surprised they held this amount of inventory in a high rate environment). At some point this ends, but locally Chilean supply growth is healthy.

Positioning: Whilst specs are still long, albeit from good levels (a lot was put on sub 9k LME)

Gillard’s takeaway of the current market environment for the base metal:

“All in: Think market is trying to look through 2024 surplus because thinks negative treatment charges means a 2025 deficit is difficult to avoid. Think that thesis is going to be challenged given African supply creep, Chinese demand headwinds, and mechanical balance shift (into surplus, it’s not just deficits that carry! ), and price should go lower as a result given positioning.”

The analyst did not specify how much further prices could drop in the short term. However, many top Wall Street analysts maintain long-term views of a global copper shortage.

Tyler Durden

Fri, 07/19/2024 – 11:45