Irrational Exuberance Then And Now

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Over the past few months, we have seen the same term, irrational exuberance, used to describe the current state of the stock market. To gain perspective on the future, let’s compare the market environment that prompted Greenspan’s comments to today.

Irrational Exuberance

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy? We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability. Indeed, the sharp stock market break of 1987 had few negative consequences for the economy. But we should not underestimate or become complacent about the complexity of the interactions of asset markets and the economy. Thus, evaluating shifts in balance sheets generally, and in asset prices particularly, must be an integral part of the development of monetary policy. –Alan Greenspan December 1996

The simple translation: Greenspan was apprehensive due to high stock valuations; therefore, a correction of stock prices could damage the economy. He didn’t want to be “complacent about the complexity of the interactions of asset markets and the economy.”

Let’s review a few graphs to appreciate Greenspan’s point of view.

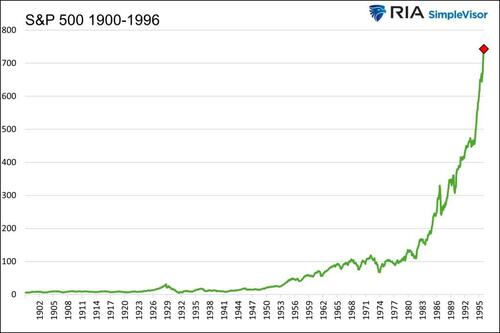

In just two years, between 1994 and the day Greenspan uttered irrational exuberance, the S&P 500 had risen nearly 60%. Furthermore, from the 1990 recession trough to his speech, the S&P had climbed almost 250%.

The economic recovery from the recession of 1990 kicked off the bull market. Further fueling the run were fabulous projections of how the budding World Wide Web, computers, and the powers of modern technology would result in outsized corporate profits and economic growth. Sound familiar?

With such lofty projections came immense speculation. Investors were willing to pay more for corporate sales and earnings due to higher growth prospects. In other words, valuations rose.

The first graph below shows the Shiller CAPE10 valuation stood at levels last seen in 1929 and were moderately higher than those at the peak of the Nifty Fifty Bubble. For more on the Nifty Fifty, check out our article Are The Magnificent Seven In A Bubble? Ask The Nifty Fifty.

Another valuation metric, Tobin’s Q ratio, uses a company’s assets’ market value and replacement value to determine if a stock is over or undervalued. A ratio greater than one means the market values the company more than the value of its assets. Therefore, a high reading implies expectations for above-average earnings growth. As shown, in 1996, the ratio was slightly higher than the Nifty Fifty Bubble peak but below the 1929 peak.

Was Greenspan Prescient?

Greenspan had ample reason to worry with higher stock prices and valuations at levels seen near the tops of the last two stock booms. His warning caused the market to stutter for a few weeks before continuing its climb higher. Between December 5, 1996, and the bull market peak three years later, in 2000, the S&P more than doubled, and its valuations far exceeded the lofty levels of 1996.

Keep in mind that despite Greenspan’s weariness of market conditions, he cut rates by 75 basis points in late 1998 over concerns related to the Long Term Capital Hedge Fund bankruptcy. His actions further fueled the market significantly higher.

From the market peak in August of 2000 to its low in 2003, the S&P 500 erased a big chunk of the post “irrational exuberance” gains. Those highs would not be seen again until 2013.

Today’s Exuberance

The recent performance of the S&P 500 is like that of the mid to late 1990s. Similarly, current valuation metrics are at or above those Greenspan feared in 1996.

Today’s AI narrative mirrors the enthusiasm for the internet and technology forecasts of the mid- to late 1990s. Investors seem assured that AI will make the economy much more productive. Therefore, corporate profits will boom, and the economy will flourish. Those companies at the heart of AI, like Nvidia, Google, and Microsoft, will experience growth that dwarfs market averages. Or so we are told.

While the AI narrative sounds excellent, reality and narratives are often quite different. Despite the internet and technology boom of the late 1990s and beyond, the economic and corporate earnings growth rate did not increase. In fact, as shown below, the economy grew at an average rate of nearly 3% from 1975 to 1999. Since then, the average growth rate has been closer to 2%.

Corporate earnings have followed a similar path despite the internet’s benefits.

Lessons From An Irrational Market

The market will likely correct meaningfully, and valuations will normalize. This time is not different.

However, the timing of a correction is far from known. Mr. Market doesn’t care what you, we, or the Fed Chairman think of valuations and prices. The market is bigger than all of us and can have a mind of its own. High valuations, even if in already record territory, can go higher.

The market can stay irrational longer than you can stay solvent. John Maynard Keynes

Some in the bearish camp advise taking our chips off the table and not trying to pick the top. That may be prescient. However, it may be years too early, like Greenspan’s irrational exuberance advice.

Walking the tightrope between irrational exuberance and reality is complex. Therefore, appreciate the market for what it is. This bull market has no known expiration date. Active management, using technical and fundamental analysis along with macroeconomic forecasting, is crucial to managing the potential risks and rewards that lie ahead.

Summary

We leave you with a contrarian thought. What if we are experiencing rational exuberance and AI is an economic game changer? What if current valuations aptly reflect enhanced economic growth? Such profits and wealth formation may allow us to service unproductive debts better. Accordingly, today’s haunting macroeconomic issues may fade into a glorious future.

No one knows what the future holds. But, there are tools allowing us to maximize the upside better and limit the downside. With such potential returns and drawdowns lurking on the horizon, active management may likely prove to be the best way to manage your investments.

Tyler Durden

Wed, 07/17/2024 – 08:28