The “Broken Clock” Fallacy & The Art Of Contrarianism

Authored by Lance Roberts via RealInvestmentAdvice.com,

Some state that “bears are like a ‘broken clock,’ they are right twice a day.” While it may seem true during a rising bull market, the reality is that both “bulls” and “bears” are owned by the “broken clock syndrome.”

The statement exposes the ignorance or bias of those making such a claim. If you invert the logic, such things become more evident.

“If ‘bears’ are right twice a day, then ‘bulls’ must be wrong twice a day.”

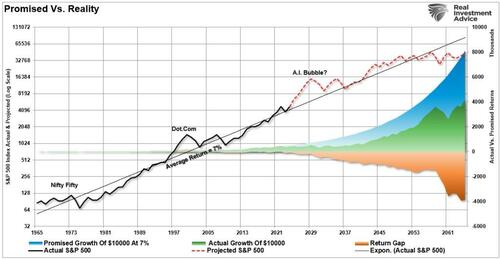

In the investing game, the timing of being “wrong” is critical to your long-term goals. As discussed in “The Best Way To Invest,”

“There is a massive difference between AVERAGE and ACTUAL returns on invested capital. Thus, in any given year, the impact of losses destroys the annualized ‘compounding’ effect of money.”

Throughout history, bull market cycles are only one-half of the “full market cycle.” That is because, during every “bull market cycle,” the markets and economy build up excesses that are then “reversed” during the following “bear market.” In other words, as Sir Issac Newton once stated:

“What goes up, must come down.”

Bulls Are Wrong At The Worst Time

During rising bull markets, the bears become an easy target for ridicule. While the bears have logical arguments for why the markets should reverse, markets can often remain “illogical longer than you can remain solvent,” to quote John M. Keynes. Such is an important point because, as Howard Marks once quipped:

“Being early is the same as being wrong.”

The problem for perennially bearish people is that while they may eventually be deemed correct, they were so early to the call that they became the “boy who cried wolf.”

Robert Kiyosaki, who has long called for a market crash, is a good case study.

“But the real tragedy here is that one day he will be right. One day a crash will come and Kiyosaki will take a victory lap for all to see.

Will his prior incorrect calls matter? Not at all. You can try to point out his flawed track record, but it won’t make a difference. Most people aren’t going to see your reply. But what they will see is his tweet. They will feel the pain from the crash after it happens and then they will think, ‘Kiyosaki knew it all along.’”

Oh he got it wrong eight times before? Who cares? He is right now, isn’t he?” – NIck Mugulli

Nick is correct. No one will remember the “bears” wrong calls when the crash eventually comes. However, Nick is also incorrect because the same applies to the “bulls.”

For example, few remember Jim Cramer’s Top 10 Picks in March 2000 or the bullish media analysts who said “buy” through the entire 2008 crisis? But they remember the eventual “buy” recommendations that were eventually right. Unfortunately, few investors had capital left at that point.

We give Nick a pass because he is young and has not lived through an actual bear market. As anyone who has will tell you, it is not an adventure they care to repeat.

The problem with being “bullish all the time” is that when you are eventually wrong, it comes at the worst possible cost: the destruction of investment capital. However, being “bearish all the time” also has a price, such as failing to grow investment capital to reach financial goals. While some investors left the market to avoid a 50% crash in 2008, they never returned for the subsequent 500% return. What was worse?

While the “bulls” seem to have their way during rising markets, the always-bullish media overlooks a problem. Over the past 120 years, the market has indeed risen. However, 85% of that time was spent making up previous losses, and only 15% making new highs.

The importance of this point should not be overlooked. Most investors’ “time horizon” only covers one market cycle. Suppose you are starting at or near all-time highs. In that case, there is a relatively significant possibility you may wind up spending a significant chunk of your time horizon “getting back to even.”

The “rt Of Being A Contrarian

The biggest problem for investors, and the “broken clock syndrome,” is the emotional biases by being either “bullish” or “bearish.” Effectively, when individuals pick a side, they become oblivious to the risks. One of the most significant factors is “confirmation bias,” where individuals seek confirmation and ignore non-confirming data.

As investors, we should avoid such a view and be neither bullish nor bearish. We should be open to all the data, weigh incoming data accordingly, and assess the risk inherent in our portfolios. That risk assessment should be an open analysis of our current positioning relative to the market environment. Being underweight equities in a rising bull market can be as harmful as being overweight in a bear market.

As a portfolio manager, I invest money in a way that creates short-term returns but reduces the possibility of catastrophic losses that wipe out years of growth.

We believe you should not be “bullish” or “bearish.” While being “right” during the first half of the cycle is essential, it is far more critical not to be “wrong” during the second half.

Howard Marks once stated that being a “contrarian” is tough, lonely, and generally right. To wit:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

The problem with being a contrarian is determining where you are during a market cycle. The collective wisdom of market participants is generally “right” during the middle of a market advance but “wrong” at market peaks and troughs.

As an individual, you can avoid the “broken clock“ syndrome.

Avoid the “herd mentality” of paying increasingly higher prices without sound reasoning.

Do your research and avoid “confirmation bias.”

Dev”lop a sound long-term investment strategy that includes “risk management” protocols.

Diversify your portfolio allocation model to include “safer assets.”

Control your “greed” and resist the temptation to “get rich quick” in speculative investments.

Resist getting caught up in “what could have been” or “anchoring” to a past value. Such leads to emotional mistakes.

Realize that price inflation does not last forever. The larger the deviation from the mean, the greater the eventual reversion. Invest accordingly.

Being a contrarian does not mean always going against the grain regardless of market dynamics. However, it does mean that when “everyone agrees,” it is often better to look at what “the crowd” may be overlooking.

Tyler Durden

Fri, 07/12/2024 – 12:45