JPM Reports Record Quarterly Income After Surge In One-Time Items, Unexpectedly Boosts Loan Loss Reserves

And we’re off: Q2 earnings season has officially open after two of the largest US banks – JPM and Wells – reported results moments ago, with what was a bit of a mixed bag. We will cover Wells elsewhere, but here are the highlights for the largest US commercial bank, JPMorgan.

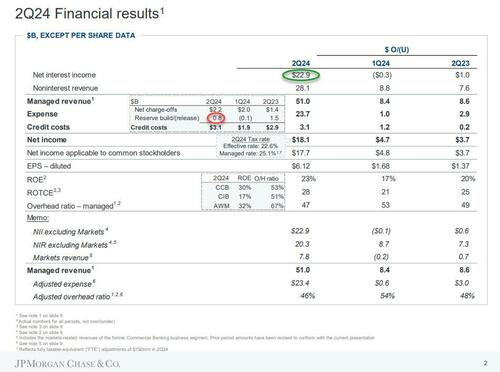

Here is a summary of what JPM just reported for Q2:

Adjusted Revenue $50.99BN, up $8.6BN from a year ago, but not comparable to estimates for reasons outlined below

Investment banking revenue $2.46 billion, +46% y/y, beating estimates of $2.13 billion

FICC sales & trading revenue $4.82 billion, +4.6% y/y, missing estimates of $4.85 billion

Equities sales & trading revenue $2.97 billion, +21% y/y, beating estimates of $2.66 billion

Advisory revenue $785 million, +45% y/y, beating estimates of $640.5 million

Equity underwriting rev. $495 million, +56% y/y, beating estimates of $387.6 million

Debt underwriting rev. $1.08 billion, +51% y/y, beating estimates of $905.9 million

EPS $6.12, up $1.37 from a year ago and includes significant one-time items

EPS excluding significant items was $4.40

Compensation expenses $12.95 billion, beating estimates of $12.72 billion

Overall, a strong showing except that miss by FIC (more on that below). What is notable is that for yet another quarter JPM reported record quarterly profit of $18.1 billion, up $3.7 billion YoY, thanks to revenue beats by the company’s equity traders and investment bankers, while Net Interest Income printed at $22.86BN, just above the $22.82BN expected (the “unmanaged” number came in just below estimates) even though the net yield on interest-earning assets was 2.62% below the estimate of 2.65%. That said, much of the bottom-line surge was one-time as JPM took a multibillion-dollar gain ($7.9BN pretax) tied to a Visa share exchange.

The bank also recorded $546 million in net investment securities losses: it will be interesting to find out what this is and if JPM has quietly been cultivating yet another CIO “whale”. Strip those away and JPM’s net income was only $13.1 billion, down from both a quarter ago and from a year ago. Also of note, JPM’s return on equity hit 23%, and that’s up to 28% if you follow the bank’s ROTCE stat. As for the bank’s CET1 capital ratios, the standard came in at 15.3% and advanced hit 15.5%. This means that the bank’s total loss-absorbing capacity is now $534 billion.

Something else worth noting: JPM revealed that its Q2 stock buybacks jumped to $4.9 billion from $2.8 billion last quarter. This took place even before the Fed greenlighted more shareholder returns on June 28 – the last day of the quarter – which means Jamie Dimon frontran the “successful” stress test results.

What we also find notable is that in a reversal from last quarter, the bank actually built reserves by $821 million (vs a $72 million release in Q1): this was the biggest reserve build since the bank crash quarter in Q2 2023 when the bank added $1.5 billion in reserves. This meant that provision for credit losses rose to $3.05 billion, above the $2.83 billion expected even as total charge-offs came in at $2.23 billion, just below the $2.26 billion expected.

Looking at the bank’s balance sheet and consumer banking division, there were no major surprises here, with total deposits down 1% YoY to $2.40TN (vs est $2.43TN), and flat QoQ, while total loans (including First Republic) were up 6% YoY to $1.32TN, and also flat QoQ.

“There has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world,” Jamie Dimon said in a statement Friday. “Therefore, inflation and interest rates may stay higher than the market expects.”

Dimon was somewhat modest when citing investment banking fees rising 50%: “albeit against a low base.” He does however brag that the bank opened 450,000 net new checking accounts (“our 50th consecutive quarter of net new account growth”), and that results included “a record number of first-time investors.”

Dimon also said that market valuations and credit spreads “seem to reflect a rather benign economic outlook,” yet the bank is “vigilant about potential tail risks.” Those are the same ones we’ve been hearing about, from geopolitics that are “potentially the most dangerous since World War II,” to “multiple inflationary forces,” the prospect that “interest rates may stay higher than the market expects,” and the unknown effects of “quantitative tightening on this scale.”

But if the world’s future is ambiguous, Dimon suggests the bank’s isn’t. Its 15.3% CET1 ratio provides the bank “with excess capital even after the uncertainty created by Basel III endgame,” he writes, and the board is going to boost its dividend for the second time (“a 19% cumulative increase compared with the fourth quarter of 2023”). Dimon’s bottom line: “Our priorities remain unchanged.”

That said, a closer read of the Consumer Bank reveals continued weakness in the bank’s Card services group, where charge offs are rising fast, culminating in credit costs of $2.6 billion. Some more details:

NCOs of $2.1B, up $813mm YoY, predominantly driven by Card Services as newer vintages season and credit normalization continues

Net reserve build of $579mm was primarily in Card Services, predominantly driven by loan growth and updates to certain macroeconomic variables

Turning to the Commercial and Investment Bank (including markets), it is here that JPM reported solid Investment Banking and Equity Trading numbers, offset by a miss in FICC:

IB revenue was $2.46 billion, up 46% YoY, and beating the estimate of $2.13 billion; this was “driven by higher fees across all products”

Equity trading almost rose to the “vaunted” $3 billion mark ($2.97 billion), beating estimates of $2.66 billion driven by strong performance in Equity Derivatives and Prime.

However, FICC revenue was $4.82B, up 4.6% YoY, and missing estimates of $4.85; the number was largely driven by Securitized Products.

Merger advisory came in at $785 million, which was the best quarter since Q3 2022, even as Dimon continues to maintain a cautious stance on the possibility of risks around the corner.

Finally, Securities Services revenue of $1.3B, up 3% YoY, driven by higher volumes and market levels, largely offset by deposit margin compression.

Two other notable highlights:

JPM is paying a lot to retain traders: total expense for the group jumped 12% YoY to $9.2B, “driven by higher compensation, including revenue-related compensation, higher legal expense and higher volumerelated non-compensation expense”

Credit costs were $384mm as a results of i) Net reserve build of $220mm, “driven by incorporating the First Republic portfolio into the Firm’s modeled approach, as well as net downgrade activity, primarily in Real Estate, largely offset by the impact of net lending activity”, and ii) NCOs of $164mm, of which approximately half was in Office.

Finally, a 17% ROE in the unit was a very healthy number, even if it is down from the 20% in Q1.

Going down the investor presentation, JPM’s asset and wealth management business now holds $3.7 trillion in assets, up15% YoY, lifted by the surge in markets in the last three months. For the quarter, AUM had long-term net inflows of $52B and liquidity net inflows of $16B.

Of course, JPMorgan’s assets aren’t the only thing that make this bank big. Its headcount is now up to 313,206, up 4% from 300,066 a year ago.

Looking ahead, the bank said that it sexpect a net interest income this year of about $91 billion which is just under the expected adjusted expense of $92 billion — which includes the boost to the first quarter’s FDIC special assessment and a contribution to the bank’s foundation (but excludes legal costs). The bank adds that expected net charge-off rates for its card services unit will be about 3.4%. Here is a summary:

Still Sees Full Year Net Interest Income About $91B, Est. $91.33B

Still Sees Full Year NII Ex-CIB Markets About $91B

Still Sees FY Adj. Expense About $92B

Expects 2024 Card Services NCO Rate of ~3.4%

After all that, the market reaction was mixed: the stock initially pumped, then dumped, and at last check was flat as markets try to make some sense of what the earnings mean for the bank going forward. That said, don’t cry for Jamie: the largest US banks — with the exception of Morgan Stanley — are up more than 20% this year.

The full Q2 investor presentation is below (pdf link).

Tyler Durden

Fri, 07/12/2024 – 08:18