Key Events This Holiday-Shortened Week: Jobs, JOLTS, ISM, Fed Minutes And Powell Speaks

As DB’s Jim Reid writes this morning, tongue-firmly-planted-in-cheek, the biggest shock in Europe on Sunday after a hugely anticipated battle, was that England football team managed to find a way of winning through to the last 16 in what was one of the most woeful and undeserved victories of all time. As this was unfolding the first round of the French elections perhaps delivered a slightly less convincing victory for the far-right than final polls suggested and with other parties now seemingly open to form alliances in the second round, this is likely to further reduce the far-right’s chance of an overall majority in parliament. This has helped the Euro to move +0.40% higher overnight to trade at 1.0757 against the dollar, with Euro Stoxx futures climbing +1.2%.

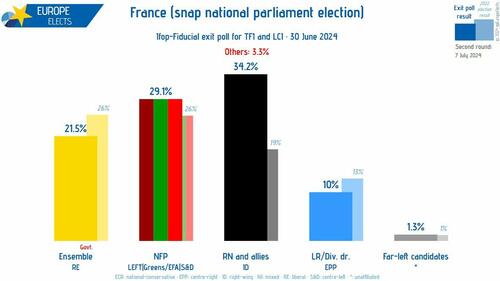

To recap, Le Pen’s National Rally look set to win around 34.2% of the vote, slightly underperforming the final poll of polls which had them at 36.2%. The left-wing NPF coalition are expected to be at around 29% slightly outperforming their final poll of polls of 28.3%. Macron’s party is on track for around 21% also a bit above the final poll of polls of 20.4%.

In terms of what happens next, all those candidates that have an absolute majority of votes and a vote greater than 25% of the electorate are elected. For those not crossing the threshold, the second round this coming Sunday is a run-off between the top two candidates plus any other candidates who polled more than 12.5% of registered voters. Then the one with the most votes is elected.

The left alliance has said it will remove candidates that are in third place which will be problematic to the Far Right’s chances of a majority. Over half the 577 parliamentary seats, a historically very high number, are expected to go to the second round with lots of tactical voting now likely. The deadline for filing papers to accept the opportunity to be on Sunday’s second round is at 6pm tomorrow. So we’ll have a good idea of tactical alliances then.

Moving on and as it’s the start Q3 today, we’ll shortly be releasing our performance review for the quarter just gone. On the plus side, Q2 saw equities continue to advance, and the S&P 500 hit many more fresh new highs thanks to further gains for the Magnificent 7. But the gains remained narrow, with the equal-weighted S&P 500 actually losing ground in Q2. Meanwhile, sovereign bonds struggled in Q2 as investors generally priced in slower rate cuts, even as the ECB cut for the first time since the pandemic in a June that saw a more dovish pricing for rate expectations. Politics and geopolitics were also back in focus, not least in France where there was a notable selloff after the snap election announcement. See the full report in your inboxes shortly.

In terms of this week, it will be quite a busy one considering there is a US holiday. Thursday is Independence Day which means Friday will likely see a skeleton staffing for the latest employment report with the all-important payrolls number.

Elsewhere on a day-by-day basis the main highlights are as follows. Today brings the US ISM and German CPI and the start of the annual ECB Sintra central bank conference with Lagarde speaking for the first amongst many appearances this week. Tomorrow brings the US JOLTS report, Eurozone CPI and both Powell and Lagarde on a panel at Sintra. Wednesday brings US services ISM, the ADP report, initial jobless claims a day earlier than usual and the trade balance data. The FOMC minutes are also released. We’ll also see China’s Caixin services PMI and the Eurozone PPI. Thursday sees the UK election and Swiss CPI with Friday seeing German and French IP, Eurozone and Italian retail sales and the Canadian job report to go alongside the US equivalent.

Previewing the US employment report on Friday, DB economists expect headline (+225k forecast vs. +272k previously) and private (+195k vs. +229k) payrolls to be above the +190k and +163k expected by the consensus. The three-month averages are +249k and +206k, respectively. Consensus expects unemployment to stay at 4%. Remember as ever that the JOLTS data (tomorrow) should be a better gauge of how tight the labor market is but as always is a month behind the employment report.

Courtesy of DB, here is a day-by-day calendar of events

Monday July 1

Data : US June ISM index, May construction spending, China June Caixin Manufacturing PMI, UK May net consumer credit, M4, Japan Q2 Tankan index, June consumer confidence index, Germany June CPI, Italy June manufacturing PMI, new car registrations, budget balance

Central banks : ECB forum on central banking in Sintra, Lagarde, Nagel speak

Tuesday July 2

Data : US May JOLTS report, June total vehicle sales, Japan June monetary base, Italy May unemployment rate, Q1 deficit to GDP, Eurozone June CPI, May unemployment rate, Canada June manufacturing PMI

Central banks : Fed’s Powell speaks, ECB’s Lagarde, Elderson, Guindos and Schnabel speak

Wednesday July 3

Data : US June ADP report, ISM services, May trade balance, factory orders, initial jobless claims, China June Caixin services PMI, UK June official reserves changes, France May budget balance, Italy June services PMI, Eurozone May PPI, Canada May international merchandise trade

Central banks : FOMC June meeting minutes, Fed’s Williams speaks, ECB’s Lagarde, Knot, Lane, Cipollone and Guindos speak

Thursday July 4

Data : UK June new car registrations, construction PMI, Germany June construction PMI, May factory orders, Canada June services PMI, Switzerland June CPI

Central banks : ECB account of the June meeting, Cipollone speaks, BoE credit conditions, bank liabilities, DMP surveys

Other : UK election

Friday July 5

Data : US June jobs report, Japan May household spending, leading index, coincident index, Germany May industrial production, France May industrial production, current account balance, trade balance, Eurozone and Italy May retail sales, Canada June jobs report

Central banks : Fed’s Williams speaks, ECB’s Lagarde and Nagel speak

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the JOLTS job openings report on Tuesday, and the employment report on Friday. The minutes from the June FOMC meeting will be released on Wednesday. There are a few speaking engagements from Fed officials this week, including Fed Chair Powell on Tuesday and New York Fed President Williams on Wednesday and Friday.

Monday, July 1

09:45 AM S&P Global US manufacturing PMI, June final (consensus 51.7, last 51.7)

10:00 AM Construction spending, May (GS +0.2%, consensus +0.2%, last -0.1%)

10:00 AM ISM manufacturing index, June (GS 49.5, consensus 49.1, last 48.7): We estimate the ISM manufacturing index rebounded 0.8pt to 49.5 in June, reflecting the continued rebound in global manufacturing activity. Our manufacturing tracker rose 0.5pt to 49.3.

Tuesday, July 2

09:30 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will participate in a panel discussion with the President of European Central Bank Christine Lagarde and the President of Brazilian Central Bank Roberto Campos Neto at the ECB Forum on Central Banking in Sintra, Portugal. A moderated Q&A is expected. The event will be live streamed.

10:00 AM JOLTS job openings, May (GS 7,750k, consensus 7,864k, last 8,059k): We estimate that JOLTS job openings fell by 0.3mn to 7.75mn in May, reflecting a further pullback in online job postings and a possible drag from seasonality.

05:00 PM Lightweight motor vehicle sales, June (GS 14.9mn, consensus 15.8mn, last 15.9mn): We estimate a 1.0mn decline in lightweight motor vehicle sales in June to 14.9mn (saar), reflecting continuing disruptions to dealer software systems.

Wednesday, July 3

07:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a panel discussion on the Drivers of Equilibrium Interest Rates at the ECB Forum on Central Banking in Sintra, Portugal. Speech text and Q&A are expected. On May 30, Williams said “I see the current stance of monetary policy as being well positioned to continue the progress we’ve made toward achieving our objectives” and “I expect overall PCE inflation to moderate to about 2-2.5% this year, before moving closer to 2% next year.”

08:15 AM ADP employment change, June (GS +175k, consensus +158k, last +152k): We estimate a 175k rise in ADP payroll employment in June, reflecting a below-normal pace of spring hiring but positive residual seasonality.

08:30 AM Initial jobless claims, week ended June 29 (GS 235k, consensus 235k, last 233k): Continuing jobless claims, week ended June 22 (last 1,839k)

08:30 AM Trade balance, May (GS -$75.0bn, consensus -$76.0bn, last -$74.6bn)

09:45 AM S&P Global US services PMI, June final (consensus 52.3, last 55.1)

10:00 AM Factory orders, May (GS +0.2%, consensus +0.3%, last +0.7%); Durable goods orders, May final (last +0.1%); Durable goods orders ex-transportation, May final (last -0.1%); Core capital goods orders, May final (last -0.6%); Core capital goods shipments, May final (last -0.5%); 10:00 AM ISM services index, June (GS 52.5, consensus 52.5, last 53.8): We estimate that the ISM services index fell 1.3pt to 52.5 in June. Our non-manufacturing survey tracker was unchanged at 52.5, and we note the possibility that software system disruptions at auto dealers weighed on survey responses in the retail and wholesale industries.

02:00 PM Minutes from the June 11-12 FOMC meeting: The June dot plot delivered a hawkish surprise with a median projection of one cut in 2024 instead of the two cuts that we and consensus had expected. Four FOMC participants projected no cuts this year, seven projected one cut, and eight projected two cuts. But Chair Powell emphasized in his press conference that many participants saw the decision between one cut and two this year as a very close call and that both are still plausible outcomes. He also noted that “these projections are not a committee plan or any kind of a decision.” We have left our forecast unchanged and continue to expect two rate cuts this year in September and December.

Thursday, July 4

US Independence Day holiday. NYSE will be closed, SIFMA recommends bond markets remain closed, and there are no major economic data releases scheduled.

Friday, July 5

05:40 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks at an event organized by the Reserve Bank of India in Mumbai, India. Speech text and Q&A are expected.

08:30 AM Nonfarm payroll employment, June (GS +140k, consensus +190k, last +272k); Private payroll employment, June (GS +115k, consensus +163k, last +229k); Average hourly earnings (mom), June (GS +0.35%, consensus +0.3%, last +0.4%); Average hourly earnings (yoy), June (GS +3.95%, consensus +3.9%, last +4.1%); Unemployment rate, June (GS 4.0%, consensus 4.0%, last 4.0%); Labor force participation rate, June (GS 62.6%, consensus 62.6%, last 62.5%): We estimate nonfarm payrolls rose by 140k in June (mom sa). Big Data measures continue to indicate a below-normal pace of job creation during the spring hiring season, and our layoff tracker is also edging higher from low levels. We also assume a 50k drag from payback effects, because the longer-than-usual May payroll month likely pulled forward reported job growth into last month’s report. We estimate that the unemployment rate was unchanged at 4.0%, reflecting higher household employment offsetting a 0.1pp rebound in labor force participation to 62.6%. We estimate average hourly earnings rose 0.35% (mom sa), which would lower the year-on-year rate by 13bps to 3.95%. Our forecast reflects waning wage pressures but a 10bp monthly boost from calendar effects.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 07/01/2024 – 09:57