Top Tech Trio Melts Up To Record High As Rest Of Market, Europe Burns

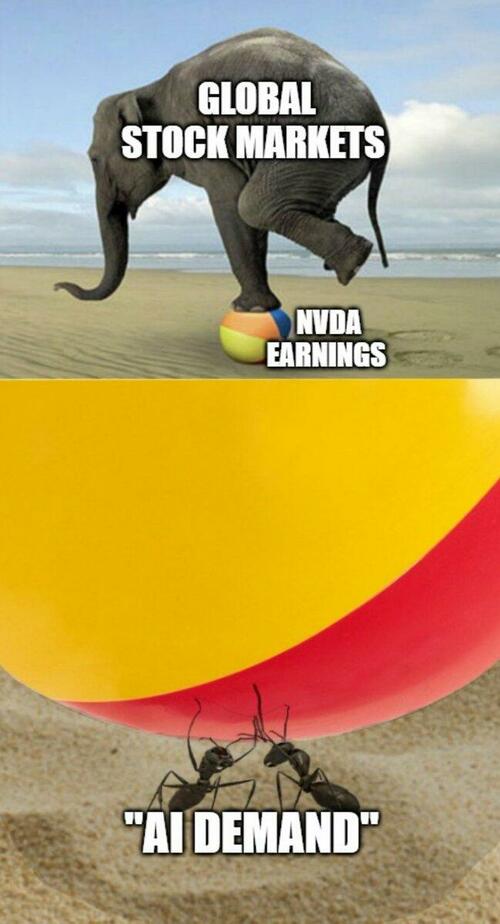

Another day, another tech-led meltup, which managed to reverse the early slump in the stock “market”, and push the S&P to just shy of closing green, and the 41st record high of 2024, on the back of just one idea: this one.

Frankly, the whole AI meltup has become stupid: with the Mag 7 concept now dead and buried, all that matters are the Top 3 Tech Trio – Apple, Microsoft, and Nvidia – which all have the almost same market cap, just around $3.2 trillion, and which as reported yesterday, are just “Taking Turns Going On Runs To All Time Highs“, with Nvidia overtaking Apple again today yet both just behind Microsoft…

… as traders expect that somehow the rest of the world will plow trillions into these three companies in perpetuity to justify their market cap, which of course will never happen (especially with the stagflationary recession that is looming according to pretty much any other industry) and instead these top AI-linked companies have so far disclosed relatively modest backlogs and cloud/data center RPO datapoints. According to Goldman, revenue allocated to RPOs for the cloud/data center segment was a paltry $242 billion as of March 31.

That doesn’t matter however, because once in momentum, the party must go on, and until the buyback blackout period begins after the close today, the party is in full swing.

Indeed, take Apple, which first saw its most disappointing WWDC performance in a decade – and with good reason: an AI-enabled Siri where all your queries are intercepted by the NSA tool that is ChatGPT, is still just as useless as Siri – only to explode higher the very next day as Tim Cook unleashed a massive buyback spree to create the impression that Apple’s official foray into AI wasn’t actually a total dud, and which in this extremely illiquid market sent the AAPL RSI to 80 making it the most overbought stock in three years…

… as the buyback was promptly joined by what may have appears to be the world’s biggest gamma squeeze!

And so, with the daily stock buyback-cum-gamma squeeze chase rotating among the Top Three Techs, the resulting action has pushed the S&P to record highs on 30 days this year, and four consecutive ATHs this week (Friday will be a wash) while the equal-weighted S&P has not moved in the past 4 months!

But it’s not just tech vs non-tech. Even within tech there is a staggering divergence – Nasdaq hit a new record high despite 72% of the index close lower on the session and more than twice as many new lows as new highs...

… and with the equal-weighted Nasdaq now underperforming 9 of the past 10 days!

And here is the chart of the week: Nasdaq vs Nasdaq advance/decline line. Absolutely crazy.

So while all the buying now focuses on just a handful of stocks, this is what the S&P looked at the close: 2 sectors green and 9 red….

… and yet, that epic imbalance didn’t stop spoos from closing unchanged!

Literally, literally, nothing but those 3 companies matters any more, certainly not the Russell 2000 index which is down three days in a row.

But while algos and traders are staring in fascination at the daily chase to new record highs among the “Top 3” and ignoring the rest of the S&P, things outside the US are turning ugly. No, not China, which as everyone knows is a basket case, and where the recent bounce is now over and done as the CSI slides from the mid-May highs…

… we are talking about Europe, and specifically France, where as noted earlier, the upcoming elections called so unexpectedly by president Macron, are now setting up to be a disaster for the French president, who is looking at a catastrophic loss following the snap formation of a leftist alliance, and which sent the French CAC40 plunging the most this week since early 2022, driven by plunging banks (SocGen down 12%, BNP Paribas down 10%)…

… but it wasn’t France’s stocks that were the highlight: instead it was the plunge in French bonds and the record blow out in the French-German yield spread…

… which widened 29bps this week to 77bps, the highest since 2017…

… that should be truly spooking markets as nobody, and we mean nobody, is prepared for another European debt crisis right now…. although this may be just the “crisis”, similar to Covid, the world needs to shock central banks into aggressively easing over the coming months and ahead of the US presidential election. To this point, the 10Y clearly knows which was the wind is blowing and ignoring the meltup in tech, TSY yields tumbled to the lowest level since early May.

And speaking of tightening, in the biggest news overnight, the BOJ once again kicked the can on actually tightening financial conditions and trimming its bond buying, and even as Japan reels under staggering inflation, the idiots that pass for its central bankers somehow managed to spark another yen rout, and only the imminent arrival of the next European sovereign bond crisis managed to push the yen modestly higher.

Yet while the coming central bank deluge was noted by gold and silver, both of which closed at session highs…

… crypto remains in an algo-driven world of its own, and tumbled all session since the European close for no reason even as ETFs now own 1 million of the 21 million bitcoins that will ever be mined.

Tyler Durden

Fri, 06/14/2024 – 18:11