European Leaders Might Renew Contract To Keep Russia-Ukraine Gas Pipeline Flowing Despite War

It is somewhat surprising (but also not surprising given energy scarcity fears) that after two-and-a-half years of war, hundreds of thousands of lives tragically lost, and brutal grinding warfare which has also killed many civilians on both sides… that the oldest and biggest economic link between Russia and Europe is still in place: the transit of Russian gas through Ukrainian territory.

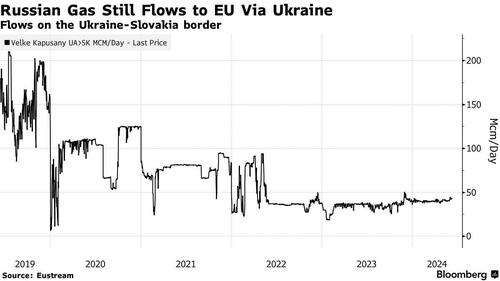

A five-year agreement which is set to expire by the end of 2024 has remained uninterrupted, though the share of Russia’s pipeline gas in EU imports has steadily diminished. Yet the reality is that if Europe hopes to diversify away from dependency on Russian LNG, establishing the necessary alternate infrastructure is a costly and lengthy process.

Bloomberg reported Monday that European officials are currently discussing plans to keep the gas flowing through a key Russia-Ukraine pipeline, and that Ukraine – which has hit desperation given its dire wartime energy needs and situation – favors it.

At this point from Kiev’s perspective there are equally bad options which requires pragmatically seeking the least worst-case scenario.

Bloomberg acknowledges that Ukraine’s “transit revenue amounted to about $1 billion in 2021 — providing crucial funding for the war-ravaged economy.” If pipelines and supporting infrastructure aren’t used then they are likely to fall derelict or also can more easily become military targets for Russia.

Oleksiy Chernyshov, chief executive of Ukraine’s state-run Naftogaz, was quoted in the report as saying it must be remembered that “Ukraine has incredible infrastructure of transit and storage gas, which should be used, and Ukraine is predisposed to use this infrastructure because it brings a lot of advantages.”

Main buyers of Russian gas continue to be Hungary, Austria, Slovakia and Italy — all of which have continued to put ideological questions related to the war in the back-seat compared to the pressing and vital energy needs of the population and of industry.

On the Russian side too, Gazprom has taken deep hits due to the war. “Gazprom is unlikely to recover gas sales lost as a result of Vladimir Putin’s full-scale invasion of Ukraine for at least a decade, according to a report commissioned for the Russian energy group’s leaders,” a recent FT report has indicated. “The company’s exports to Europe will average 50bn-75bn cubic metres a year by 2035, barely a third of prewar levels, the research predicted.”

Ukraine national media reports earlier in the conflict strongly hinted that the contract for Russian gas would not be renewed. “The position of the Ukrainian side is clear: the transportation contract ends at the end of this year, we are not going to negotiate with the Russians and renew the contract. This is what the Prime Minister of Ukraine informed his Slovak counterpart,” RBC-Ukraine said in January [machine translation].

But even upon that announcement, there were key caveats and exceptions given: “To extend transit, an option is possible when the Slovak company itself leases the capacity of the Ukrainian gas transportation system. In this case, gas transit can be continued after 2024. But this is still only an assumption,” the publication said at the time. As Bloomberg is now subsequently reporting, this leaves things open for significant wiggle room, ‘discussion’ and compromise.

Tyler Durden

Tue, 06/11/2024 – 02:45