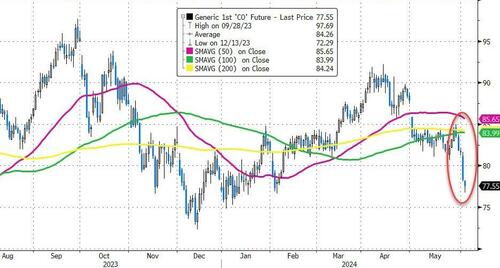

WTI Tests 4-Month Lows As API Reports Across The Board Inventory Builds

Oil prices plunged to four-month lows (WTI with a $72 handle, Brent below $80), smashing through all key technical levels, as algos were shocked into full-send mode as OPEC+ unexpectedly signaled plans to return some supplies to the market later in the year.

CTAs have flipped to a net short position in Brent, compared with a net long position at the end of last week, according to data from Bridgeton Research Group.

“CTAs are just hammering away the market with massive selling seen yesterday,” said Scott Shelton, an energy specialist at TP ICAP Group Plc.

Oil prices have slumped about 5% over just the last two days after OPEC+ agreed to allow some supply curbs to start unwinding as early as October. The move has added to the gloomy sentiment in pockets of the physical market around the world that are flashing signs of weakness.

Non-technical traders will be focused on tonight’s API data ahead of tomorrow’s official inventory and production data, with last week’s big draws in crude and Cushing stockpiles on bulls’ minds.

API

Crude +4.05mm (-1.9mm exp)

Cushing +983k

Gasoline +4.03mm

Distillates +1.98mm

After last week’s draws, API reports across the board inventory builds – wit a big rise in crude and gasoline stocks – adding pressure to crude prices…

Source: Bloomberg

WTI was hovering around $73.25 ahead of the API print

With crude price tumbling, perhaps it is clear why Blinken has visited the MidEast so much recently..

“The Biden administration has clearly gotten a big dollop of relief here,” said Bob McNally, president of consultant Rapidan Energy Group and a former White House official.

In a May Bloomberg News/Morning Consult monthly tracking poll in the seven key swing states that will decide the 2024 election, 30% of voters said gas prices were the most important economic factor to them. Voters in those states trusted Trump more than Biden to handle the issue by a margin of 49% to 32%.

Tyler Durden

Tue, 06/04/2024 – 16:40