How US College Students Feel About Their Finances

Student debt in the U.S. has ballooned to over $1.7 trillion, burdening millions of Americans with financial stress. Rising tuition costs and stagnating wages are considered to be the major drivers of this issue.

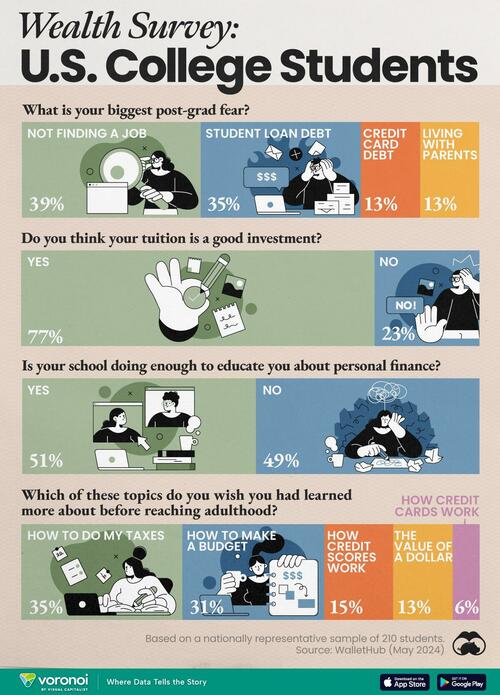

To gain insight into how this is affecting students, Visual Capitalist’s Marcus Lu visualized the results of WalletHub’s Student Money Survey.

This survey was conducted in 2024 with a nationally representative sample of 210 students. Results were normalized by gender and income.

Data and Key Findings

Student wealth surveys can provide unique insights into the financial preparedness of younger Americans.

Starting with post-grad fears, it appears that the majority of students are afraid of either not finding a job, or paying off their debt.

Some of these worries could subside in the future, as the federal government appears committed to cancelling federal student debt.

The latest news came on May 22, 2024, when the Education Department announced it would cancel $7.7 billion for borrowers who received Public Service Loan Forgiveness, which includes professions like teachers and nurses.

Regardless, 77% of students surveyed believed that their tuition was a good investment.

Not Learning Enough

Another highlight from this study was that nearly half (49%) of students feel that their school does not do enough to teach them about personal finance.

When survey respondents were asked to choose which topic they wished they had learned more about, the most common answer was “How to do my taxes”.

If you enjoy posts like these, check out Mapped: Personal Finance Requirements by State, which visualizes where high school students are required to take a personal finance course.

Tyler Durden

Mon, 06/03/2024 – 22:10