‘Kohllapse’: Retailer Routed As Consumer Turnaround Stalls

Shares of Kohl’s Corp. crashed during the early morning cash session following a dismal earnings report. Or better yet, let’s call it what it is: a ‘Kohllapse’…

Kohl’s slashed guidance for the full year after reporting first-quarter results that missed about every metric.

Comparable sales, which measure the performance of stores open for more than one year, dropped 4.4% in the quarter ended May 4 — the ninth consecutive decline. Analysts tracked by Bloomberg were expecting a 1.74% decline.

Here’s a snapshot of the first quarter (courtesy of Bloomberg):

Comparable sales -4.4%, estimate -1.74% (Bloomberg Consensus)

Adjusted loss per share 24c vs. EPS 13c y/y, estimate EPS 6.7c

Gross margin 39.5% vs. 39% y/y, estimate 39.5%

Net sales $3.18 billion, -5.3% y/y, estimate $3.34 billion

Merchandise inventories $3.08 billion, -13% y/y, estimate $3.24 billion (2 estimates)

The midmarket department store chain also slashed its full-year forecast to $1.25 to $1.85 a share, well below the Bloomberg consensus estimate of $2.39 a share.

Here’s a snapshot of the full-year forecast (courtesy of Bloomberg):

Sees adjusted EPS $1.25 to $1.85, saw $2.10 to $2.70, estimate $2.39

Sees net sales -2% to -4%, saw -1% to +1%

Sees operating margin 3% to 3.5%, saw 3.6% to 4.1%, estimate 3.89%

“Regular price sales increased year-over-year, with early success in underpenetrated categories, positive trends in our Women’s business, and continued strong growth in Sephora. However, lower clearance sales versus last year represented a more than 600 basis point drag on comparable sales,” CEO Tom Kingsbury wrote in a statement.

Kingsbury continued, “We are approaching our financial outlook for the year more conservatively given the first quarter underperformance and the ongoing uncertainty in the consumer environment.”

Here’s how Wall Street analysts responded to the earnings report:

Vital Knowledge

“This very ugly KSS report/guide reflects how big box retailers without 1) a powerful consumables anchor and/or 2) aggressive pricing are being squeezed hard in the present environment,” analyst Adam Crisafulli writes

Citi (neutral)

“Although gross margin and SG&A were both better than consensus, the issue with KSS has been (and continues to be) the top-line,” analyst Paul Lejuez writes

The department store operator has several merchandising initiatives this year to help drive sales, including baby, gifting and impulse, but they “have yet to provide any sales boost,” he says

Bloomberg Intelligence

Kohl’s “weak” 1Q results delays company turnaround, writes analyst Mary Ross Gilbert

“Strong Sephora sales — up 60% in 1Q with comp sales up 20% — are masked by lower revenue in adjacent categories, postponing prospects to restore growth,” she says

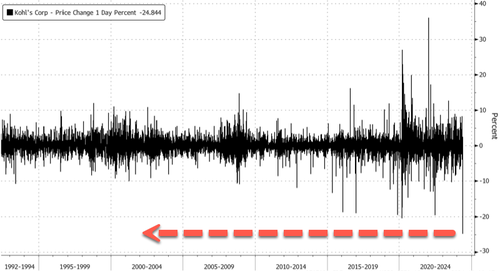

If Kohl’s intraday plunge of 25% holds until close, it would mark the largest single-day crash in the company’s history.

Shares are crashing to Covid lows.

Elsewhere, Foot Locker Inc. soared as much as 27%, the highest in years, after better-than-expected comparable sales provided insight into CEO Mary Dillon’s turnaround plan, which showed some signs of working.

Still, Dillon warned about consumers: “There’s still pressure on the consumer for us—exposure to inflation, interest rates and reduced savings,” adding, “But it’s discretionary for a reason. They decide where to spend it.”

More headlines this AM from retailers (courtesy of Bloomberg):

Dollar General Inc., in the midst of turnaround efforts under two-time CEO Todd Vasos, said Thursday that gains in traffic and market share drove sales growth, though shoppers are spending less per transaction on average. Consumable products are growing, but more discretionary items such as apparel, seasonal and home products are declining.

Best Buy Co., the last big US electronics chain, is all about discretionary items — and comparable sales slumped 6.1% in its most recent quarter, missing estimates. Still, the company outperformed on profit thanks to membership and service offerings.

Discount chain Burlington Stores Inc. surged as much as 16% in premarket trading after reporting comparable sales and earnings that topped estimates. The company also raised its full-year guidance. “The quarter got off to a slow start in February, likely due to disruptive weather and delayed tax refunds, but then our sales trend picked up,” CEO Michael O’Sullivan said in a statement.

The overall theme about the working poor, recently laid out by Goldman analysts, has been an ominous one:

Goldman Warns Consumers Are Cracking As Stagflation Threats Emerge

Goldman’s Commentary On Consumer Health Is An Ominous One

Wall Street Is Suddenly Freaking Out About “Low-Income Consumers”

This week’s news from retailers continues to reinforce Goldman’s theme about deteriorating working poor consumers.

Tyler Durden

Thu, 05/30/2024 – 13:05